You Might Be Like a Professional Investor, And That’s Bad

Many professional investors spend all day deciding which stocks to buy and sell. That’s their job. Many individual investors have a job outside of the markets and dedicate just a portion of their time to making decisions about when to buy and sell.

One of the more surprising papers published recently highlights how professional managers might make their sell decision and the results are startling. It turns out there may not be as much thought behind the sell process as there is to support the buy decision process.

Data Paints an Interesting Picture

In the paper, Selling Fast and Buying Slow: Heuristics and Trading Performance of Institutional Investors, the researchers found that there may not be a strictly defined process for when to sell”

“Most research on heuristics and biases in financial decision-making has focused on non-experts, such as retail investors who hold modest portfolios. We use a unique data set to show that financial market experts – institutional investors with portfolios averaging $573 million – exhibit costly, systematic biases.

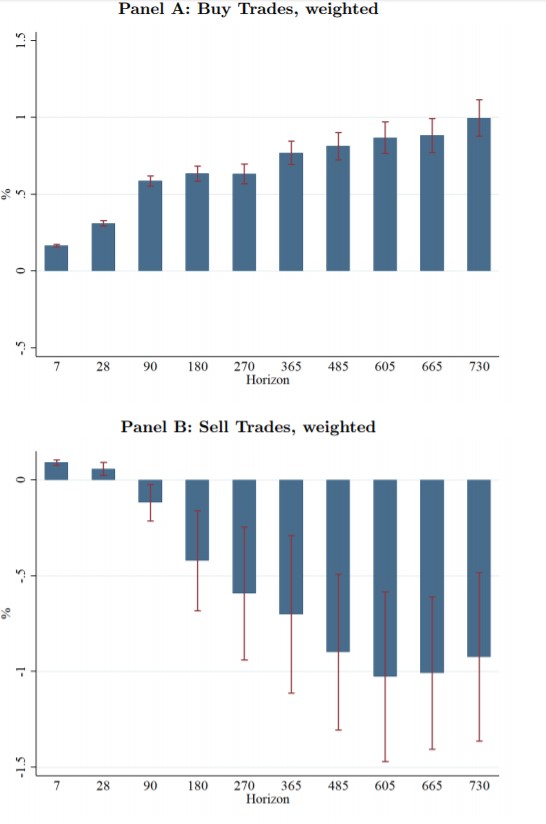

A striking finding emerges: while investors display clear skill in buying, their selling decisions underperform substantially – even relative to strategies involving no skill such as randomly selling existing positions – in terms of both benchmark-adjusted and risk-adjusted returns.

We present evidence consistent with limited attention as a key driver of this discrepancy, with investors devoting more attentional resources to buy decisions than sell decisions.

When attentional resources are more likely to be equally distributed between prospective purchases and sales, specifically around company earnings announcement days, stocks sold outperform counterfactual strategies similar to buys.

We document managers’ use of a heuristic that overweights a salient attribute of portfolio assets – past returns – when selling, whereas we do not observe similar heuristic use for buys. Assets with extreme returns are more than 50% more likely to be sold than those that just under- or over-performed.

Finally, we document that the use of the heuristic appears to a mistake and is linked empirically with substantial overall underperformance in selling.”

The authors looked at the relative performance of stocks the managers bought and sold and found that buys outperformed a random process but that sells did not. Selling a stock at random would have allowed the manager to obtain better performance.

Source: Selling Fast and Buying Slow: Heuristics and Trading Performance of Institutional Investors

Selling Might Be Based On Performance

The paper found that:

“Portfolio Managers in our sample have substantially greater propensities to sell positions with extreme returns: both the worst and best performing assets in the portfolio are sold at rates more than 50% percent higher than assets that just under or over performed.

Importantly, no such pattern is found on the buying side – unlike with selling, buying behavior correlates little with past returns and other observables.”

In simpler terms, “We conjecture that PMs in our sample focus primarily on finding the next great idea to add to their portfolio and view selling largely as a way to raise cash for purchases,” the authors write.

“In order to quickly choose between alternatives to sell, PMs look for salient reasons to unload one asset over another,” and things that have gone up or down a lot are the ones that jump out at them.

Based on the paper, managers seem to be spending a great deal of time searching for the best stocks to buy. They identify these stocks and then identify cash to buy with by reviewing their portfolio for sells. They tend to sell stocks that went up or down the most.

At Bloomberg, Matt Levine noted,

“For another thing it maps rather well onto the folk wisdom about investing.

Anecdotally, if you hang around the financial markets you will get all sorts of generic process advice about how to decide which stocks to buy, and almost all of it—buy good companies with deep moats, buy good companies well below their intrinsic value, buy companies whose business you understand, buy companies that you’ve heard of, buy companies that your teenage children like, etc.—comes down to some sort of fundamental analysis of the underlying businesses.

But you will also get—less, but some—advice about how to decide which stocks to sell, and it will often be pretty heuristic.

“Cut your losses and let your winners run,” is a thing that people say, which has nothing to do with the underlying businesses. “If you double your money, sell and take profits,” it says here, in Barron’s.

Source: Barron’s

The basic folksy rule of thumb wisdom for buying is about fundamentals, but for selling it’s usually about price action.

Not always: One classic maxim is that you should dispassionately re-analyze each position each day, and if you wouldn’t buy it now you should sell it. But just typing it like that makes me suspect that it is an ideal that no one really lives up to. It sounds like a lot of work!”

This Applies to Individual Investors

As Levine notes, sell decisions are often based on rules of thumb. The classic maxim he refers to appears to be from peter Lynch. He managed the Fidelity Magellan Fund and grew it into the largest mutual fund in the world by the time he retired.

From 1977 until his retirement in 1990, Lynch delivered average annual gains of 29.2% to investors in his fund. Lynch’s gains were more than double the average annual return for the S&P 500.

Based on this research, it appears that Lynch’s performance could be tied to his sell discipline. This would demonstrate the importance of selling and it would highlight how much work it can be to make the sell decision properly.

But selling is important. Selling locks in the gain, and that can be tempting to do when the returns are large. It also locks in a loss and that can be difficult to do when the loss is large. Therefore, it could be best to determine when you will sell before you even buy.

Knowing what will cause a sell could avoid the problems identified in the research. It could be based on fundamentals or the price action but should be defined. That could be the quickest way to improve your investment returns and put you one step ahead of at least some professional investors.