What Individual Investors Can Learn From GE’s Pension Plan

General Electric (NYSE: GE) has been in the news quite a bit recently. Analysts have been cutting price targets, some citing operational concerns while others cite pension obligations and the lack of a clear plan for a turnaround.

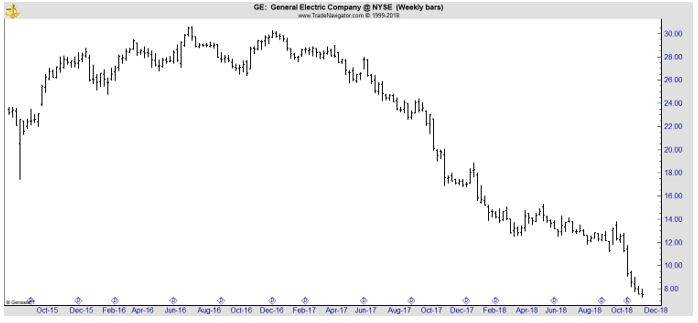

The stock has certainly been in an extended down trend.

The company’s operational shortcomings are likely to be the subject of business school case studies for several years. They are interesting. But the company’s retirement plan could be among the most important lessons for individual investors.

GE’s Plan Is Underfunded

GE (has about 430,000 retirees and active workers covered by defined benefit pension plans according to a recent report in Barron’s.

It’s important to note that defined benefit plans are increasingly unusual. These type of plans promise retirees fixed payments every month for life. This is different than an individual plan or a company’s more common fixed contribution plan where companies make regular payments to a 401(k).

Despite these differences, the problem GE faces are illustrative of the problems individuals can face in their own plans. This will be true no matter type of plan an individual is funding and relying on for retirement.

According to the Barron’s article:

“In all, GE’s workers have been promised about $100 billion in payments, but the company has only $71 billion in assets set aside to meet those obligations.

There’s no consensus among investors and analysts about the GE pension plan. Some analysts fret about the funding gap. Others argue that pension gaps are only theoretical—because a pension number isn’t like a bond with a face amount and a fixed maturity.

Those who downplay concerns also argue the funding situation is spelled out clearly for anyone willing to read the notes to the financial statements.

So is it, or isn’t it, something to worry about?”

For Your Individual Plan, Underfunding Is Something to Worry About

GE’s plan, as noted covers 430,000 retirees. The law of large numbers indicates that the plan is likely to pay out $100 billion but the amount could be more or less. That’s why some analysts aren’t worried about the plan. If the company ends up owing less, funding the plan now would waste resources.

But it is especially important to note that “pensions don’t usually become an issue for investors until the stock market declines, shrinking the value of the assets set aside to pay workers.”

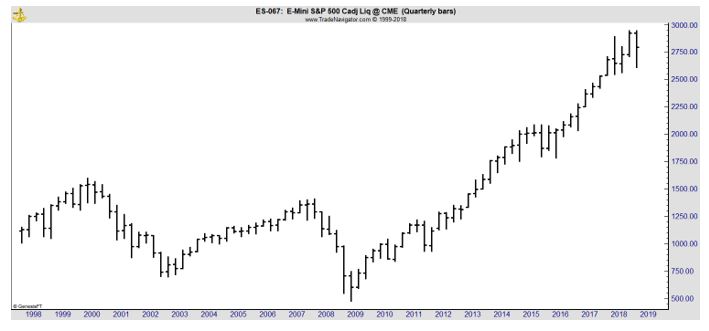

This is an example of how analysts can, at times, make overly optimistic assumptions. Notice that they usually don’t worry about pensions until the market declines. The chart below shows that markets do decline significantly at times.

This is a chart of the S&P 500. When a plan covers hundreds of thousands of individuals, there is time to recover from losses. That’s simply because some will retire and some will continue to work during the market down turn.

With an individual plan, if the individual intended to retire in 2000 or 2008 as the down turns shown above were beginning, it would have been difficult to retire. The individual could have extended their working career due to a bear market.

One way to address this problem is to overfund the retirement account. But, for an individual that isn’t usually possible. The individual investor has competing claims against their limited resources and must fund current expenses while saving for retirement. That makes adequate funding a challenge and overfunding is unlikely.

Help Could Be On the Way

GE could be bailed out by higher interest rates.

“Higher interest rates also help shrink pension liabilities, reducing the present value of open-ended obligations. Discount rates track bond yields and the 30-year bond yield is up about 0.5 percentage point this year.

GE disclosed in its 2017 annual report that a 0.25 percentage-point increase in rates would shrink the pension obligation by $2.2 billion. That’s just how the math works.”

The math could work the same way for individuals. New investments into fixed income will carry higher yields and generate more income. This could be especially helpful to a large fund but it is also at least somewhat helpful to an individual investor.

After a decade of below average interest rates, higher rates could have a significant impact on expected retirement income.

The experts noted that GE has several options. “Adding cash to the plan is one option. GE could also move a portion of its pension off the books entirely.

Steve Catone, a senior consulting actuary at Korn Ferry , told Barron’s that, “companies have been immunizing themselves from old pension obligations by purchasing annuities with insurance companies.” He added, “you can retire a pension plan for good for about 15% of the benefit obligation.”

Of course, you have to transfer the pension assets along with the liability. That could get expensive, and GE may want to hang onto its available liquidity.

But the company may be able to leverage higher rates and recent contributions to lower its obligation permanently. With the right mix of choices, GE could take the pension issue off the table for years to come.”

This could describe an approach for an individual to consider. When a company moves the pension obligations off its books entirely, it is generally selling the plan to an annuity provider.

An annuity is a contract between you and an insurance company in which you make a lump sum payment or series of payments and in return obtain regular disbursements beginning either immediately or at some point in the future.

The goal of annuities is to provide a steady stream of income during retirement. That goal is the same for company pension plans or individual retirement accounts. The steady stream of income could be combined with Social Security and other investments to meet the needs of some individuals.

Annuities are not right for everyone and even if they are the right choice for an individual, there are many products on the market that may not be suitable. Some annuities carry high costs, and some have other features that make them undesirable for many investors.

But annuities should be considered by many investors just like they are considered by large companies. Further consideration may lead to rejecting the product, but at least that will be an informed decision.