Trade Woes Will Drive Stocks, and These Stocks Could Be the Winners

Stocks have been rallying after fears of a trade war between the United States and China eased.

Reports noted that, “Wall Street cheered news that Chinese President Xi Jinping struck a friendlier tone on tariffs in a speech Tuesday. Xi said China will seek to boost imports and take other steps to bolster international trade and China’s financial markets.

Reports said Xi explicitly singled out the auto industry, promising “significantly lower” tariffs on auto imports this year. Automakers were one of today’s best-performing industry groups, up nearly 5%.”

Moving higher on that news were auto makers including General Motors (NYSE: GM), Ford Motor (NYSE: F) and Tesla (Nasdaq: TSLA).

Opening Access to China Could Boost Sales

Other reports indicated that Xi had simply reaffirmed plans to liberalize the auto market and lower tariffs on imported cars.

“China’s door of opening up will not be closed and will only open wider,” Xi was quoted as saying in a speech at the Boao Forum for Asia, an annual summit that has been compared to the Davos economic forum.

In addition to promising lower tariffs, Xi said China will relax foreign ownership limits on joint ventures with local car companies. Currently, China limits global automakers to owning no more than 50% of a joint venture with a Chinese partner.

However, both pledges were originally made in November, and Xi didn’t offer any new details this week. Still, Xi’s remarks soothed escalating fears of a trade war, a week after China threatened to double import tariffs on automobiles in response to President Trump’s tariff moves.

Shares of GM seemed to be rallying off of a bottom after the news.

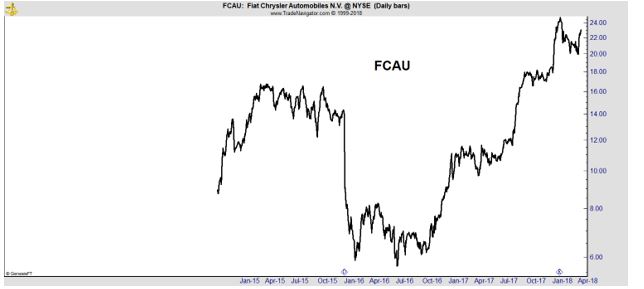

Fiat Chrysler (NYSE: FCAU) also offers a bullish chart pattern.

China’s conciliatory move follows President Trump’s tweeting that “When a car is sent to the United States from China, there is a Tariff to be paid of 2-1/2%. When a car is sent to China from the United States, there is a Tariff to be paid of 25%.”

The tweet echoed an earlier one from Tesla CEO Elon Musk, who seeks to open up a China factory but is leery of China’s foreign ownership rules. TSLA is also benefitting from the news but that stock trades at a premium to other auto makers and may not be suitable for conservative investors.

China, the world’s top auto market, is critical to global automakers. GM and its local joint ventures sold more than 4 million cars in China last year.

Boeing Also Gets a Boost From the News

Another company benefiting a lot from the thaw in trade relations was Boeing (NYSE: BA). The plane manufacturer recently received a major order from Indonesia’s Lion Air for fifty 737 MAX 10 jets with a list price of $6.24 billion. Lion Air also said it will place a provisional order for 787 widebody jets.

Lion Air co-founder Rusdi Kirana declined to say how many 787s will be ordered but he told Reuters a memorandum of understanding for the purchase would be announced in “two to three weeks.” Lion Air is one of Boeing’s largest customers. Earlier this year Lion was the first global carrier to take delivery of the smaller 737 MAX 9.

Boeing senior vice president for Asia Pacific and India sales Dinesh Keskar said the 737 MAX 10 is due to be certified by regulators in 2020. Lion Air should receive its first Max 10 jets soon after that.

A large order such as this one is often heavily discounted. But, they still provide a boost for manufacturers and establish a long term need for parts and service contracts.

Beyond China, Boeing also announced a preliminary deal with Qatar Airways for five 777 freighters worth $1.7 billion. All told, Boeing said it booked 221 net commercial aircraft orders in the first quarter of 2018, down from 414 in the fourth quarter of last year but up from 198 in the first quarter a year ago.

Deliveries were up as well. Boeing delivered 184 planes to customers in the first three months of the year, an increase of 25 compared to the same period in 2017. The company’s backlog of orders dipped by 66 to 5,835 aircraft after adopting a new revenue-accounting standard.

Also benefiting Boeing are problems as at its largest competitor. Airbus has unexpectedly shelved plans for a proposed A320neo-plus and A321neo-plus, Reuters reported.

The plan was to lengthen and modernize both models. But Airbus is struggling to increase output for the current versions. “The ramp-up is not going as well as hoped,” a person with knowledge of the supply chain told Reuters. Airbus declined to comment.

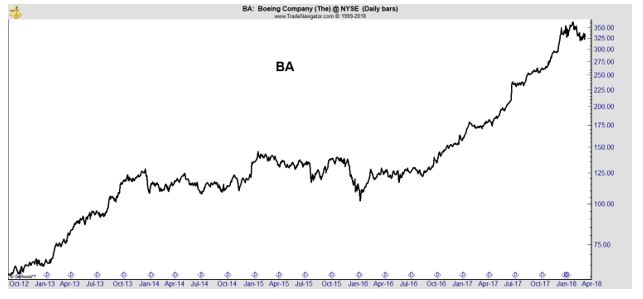

BA has been a market leader in the past year.

The strong gains have pushed the stock up to a level where investors could be best served by waiting for a pullback. BA is priced at about 24 times next year’s estimated earnings. Over the past five years, the stock has traded with an average price to earnings (P/E) ratio of about 18.

Another reason for caution is the fact that Boeing is also among the companies most at risk of a trade war. Beijing included aerospace among the 106 U.S. products targeted under China’s proposed tariffs. That was in retaliation for Trump tariffs on $50 billion in Chinese goods, mostly high-tech and telecom gear. China’s retaliatory tariffs came less than six months after Boeing received a $37 billion jet order from China.

Boeing is selling 300 planes to the China Aviation Supplies Holding Co., assuming the trade negotiations continue on a conciliatory path.

Other companies that could benefit from a thaw in the trade war rhetoric include General Electric (NYSE: GE), which makes engines with partner Safran. The GE-Safran venture, CFM International, makes engines for the 737 Max.

United Technologies (NYSE: UTX) also makes jet engines through its Pratt & Whitney unit.

This is a dynamic situation and it will challenge investors for some time. Short term traders will adapt to the news, as it breaks. Long term investors should consider creating a buy list and adding value stocks if they fall on news in the weeks ahead.