Three Buys in a Sector that Greases the Wheels of Commerce

Retailers have been struggling over the past few years and many investors are scouting the sector in search of trading opportunities. Some of the companies in the sector will survive and do well in the long run. Others will fail. Both groups offer trading opportunities.

But, both groups also carry risk. Retail is a difficult business. It means getting consumers what they want at the right time and at the right price. Even if a retailer solves the problems associated with that problem now, they must continue meeting those objectives in the future.

That means today’s winners could be tomorrow’s loser and the companies appearing to be destined for failure at this moment could mount rapid turnarounds. The challenges for the retailers are also challenges for investors who must react to changing consumer preferences and retailer performance.

A Common Theme Among Winners and Losers

Whether a retailer wins or loses in the short run or long run, there is one aspect of the business model that appears to be destined to grow. That is the payments processing businesses. These are the companies that make it possible for consumers to pay for goods and for sellers to generate sales.

Many of these transactions are completed with credit cards.

Mastercard Incorporated (NYSE: MA) is one of the companies that makes it possible for retailers to process transactions. The company processes more than $3.5 trillion worth of payments a year. The company charges a small fee on each transaction and those fees add up quickly.

Over the past twelve months, the company reported more than $13.3 billion in revenue from its small share of the transaction costs. Although expenses for information technology equipment, communications lines and security are high, the company’s net profit margin consistently exceeds 30%.

These profit margins are appealing to investors. The chart below shows the stock’s performance since it began trading in 2006.

The total return since the initial public offering (IPO) tops 4,900%. The trend has generally been higher but there are significant risks. The stock declined more than 60% during the market crash of 2008 and 2009.

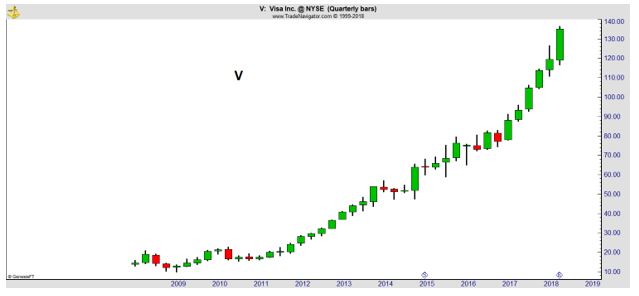

The largest credit card issuer, Visa Inc (NYSE: V), reports a net profit margin of more than 40% and generated more than $19.5 billion in revenue over the past twelve months.

This stock has also delivered significant gains since its IPO in March 2008.

The financial crisis did send the stock price down by more than 50% but since the IPO shares have delivered a total return of almost 900%.

While these companies have a majority of the market share, there are competitors. American Express and Discover have also issued millions of cards and generate significant revenue and profitability.

A Different Niche for a Payments Processing Company

PayPal (Nasdaq: PYPL) began trading as a separate company when it was spun off from online auction site eBay in 2015. The stock is up more than 180% since then.

PayPal has adopted a strategy to coexist with the larger players in the field. PayPal users can draw on a Mastercard or Visa card or their bank account to pay for purchases. Earlier this year, PayPal said users would be able to pay for purchases on Gmail, YouTube and other locations in the Google ecosphere.

Last year, the company reached an agreement with Facebook that allowed someone to send money via Facebook Messenger.

Analysts have been impressed with these moves. “That’s really helped them become much more of a partner, obviously, than a competitor with a lot of these companies,” Edward Jones analyst Josh Olson told investors.com.

He added, “I think that’s helped ease Wall Street’s concerns about whether a big tech company would just leapfrog them or make their technology obsolete.”

The company also counts Bank of America and JPMorgan Chase as partners and is trying to attract more people without bank accounts. In moves abroad, the company last year struck a deal with Chinese search giant Baidu to let Baidu Wallet holders buy things from PayPal merchants.

PayPal is also pursuing growth through acquisitions. In May, it announced the $2.2 billion purchase of iZettle, a Swedish company sometimes called the Square of Europe. The deal is intended to put PayPal’s technology into retail outlets across Europe and lead to growth in Latin America.

PayPal is significantly smaller than the larger credit card companies. Over the past twelve months, revenue was just $1.3 billion, and the net profit margin was just 14%.

Small size could result in rapid growth. Management is targeting a growth rate of about 20% a year in earnings per share over the next three to five years. Management also forecasts improving its income margins and growing sales by 17%-18% a year.

PayPal now has 218 million active users in more than 200 markets. It processes around one in every six dollars spent online, according to Edward Jones.

Analysts seem to agree that the company’s technology is good, and it works on lots of things with which you can make payments. PayPal’s One Touch technology allows customers to make online purchases without entering their password and other information.

To meet consumer demand, the company introduced its own cash back credit card last year and the company is testing a Venmo debit card. These improvements in making it easier to pay for things, attract the attention of businesses.

PayPal processes payments for about 19 million merchant accounts, most of them small to midsize businesses.

But, a large part of PayPal’s financials rely on eBay’s auction activity. EBay acquired the company in 2002 to make it easier for eBay’s buyers and sellers to pay or get paid online. Last year, PayPal drew around a fifth of its revenue from customers on eBay’s Marketplaces platform.

But this year, eBay said it would begin managing payments on its own although PayPal will remain a payment option on eBay until mid-2023. This allows time for PayPal to meet those challenges associated with the loss of that business.

Based on recent trends, it does seem that PayPal could be the next Mastercard or Visa although all three stocks should be considered as buys.