This Could Be Your Valuable Bear Market Strategy

Some major Wall Street firms warn we are in a bear market.

Morgan Stanley thinks the bull market is already over — investors just don’t realize it yet, according to CNN.

“We are in a bear market,” Morgan Stanley equity strategist Michael Wilson declared in a report to clients on Monday.

Even though the American economy is strong, Wilson argued that the market is sniffing out a sharp deceleration in economic growth and a decline in corporate profits.

“While 2018 is clearly not a year of recession, the market is speaking loudly that bad news is coming,” according to Wilson, who has been skeptical about the market for months.

CNBC reported that Goldman Sachs’s bear market prediction tool is at an “elevated” level that has historically signaled a zero average return over the next 12 months and a “substantial” risk of drawdown.

Goldman’s bear market indicator — which takes into account the unemployment rate, manufacturing data, core inflation, the term structure of the yield curve and stock valuation based on the Shiller PE ratio — is at a rare 73 percent, its highest level since the late 1960s and early 1970s.

The indicator is “flashing red,” wrote Goldman chief global equity strategist Peter Oppenheimer.

“Historically, when the Indicator rises above 60 percent it is a good signal to investors to turn cautious, or at the very least recognize that a correction followed by a rally is more likely to be followed by a bear market than when these indicators are low.”

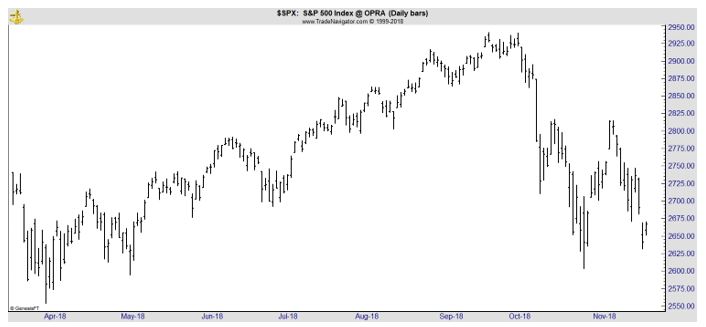

And, of course, the chart shows prices are falling. The S&P 500 remains more than 10% below its highs.

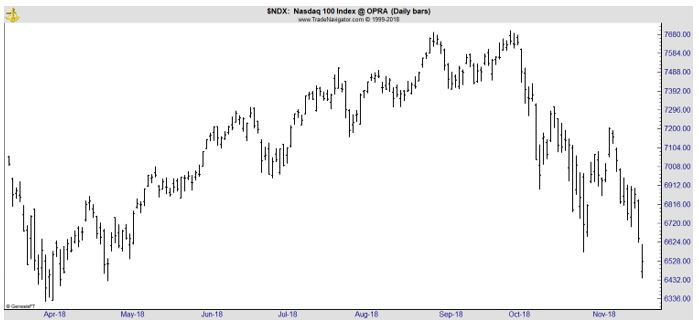

And, the tech heavy Nasdaq 100 Index is more than 15% below its high.

A Strategy for the Bear

A bear market forces an individual investor to ask, and answer, several important questions. They must decide whether they want to stay invested in stocks and risk losses. They must ask the same question for each position. And, they must consider strategies that can help meet their goals.

One strategy that could help investors in a bear market is an options strategy. Actually, there are a variety of options strategies that can help investors in a bear market. But, for some investors, options have a reputation as risky investments.

This can be true because there is an element of risk in any investment. But, the risk in options can be controlled. And, that could be of interest to investors facing uncontrollable risks in a bear market.

Among the strategies that investors can consider is the covered call, which is a popular income strategy. But they are a risky strategy and may not be the best option for many investors.

Covered calls are a strategy that involves buying and holding a stock and selling, or writing, call options on that stock. Since each options contract covers 100 shares of stock, this strategy requires owning at least 100 shares and using multiples of 100 shares when trading.

Writing a call is a strategy used to generate income. Selling the option generates immediate income from the stock. If the option expires worthless, the investor keeps the premium as the profit on the trade. The investor also collects any dividends since they own the stock.

Calls, like all options, have an expiration date and an exercise price. If the stock is trading above the exercise at expiration, the call will be exercised and the investor who wrote the contract will have to deliver the shares at the agreed upon exercise price.

When a trader writes, or sells, a call, they are obligated to sell the shares if the call option is exercised.

Let’s look at an example for a notional stock called ABC which is trading at $100 per share. The investor can buy 100 shares and then write a covered call for $3, or $300 in total income. The call might expire in 30 days and have an exercise price of $110.

If the stock is trading at $100 when the option expires, the trader keeps the premium received when the option was written and keeps the stock since it is below the exercise price of the call.

If the stock is trading at $115 when the option expires, the trader keeps the premium received when the option was written but must sell the stock at $110 per share. This generates a total return of $113 per share but misses out on the $2 per share that would be earned without the covered call.

Why Investors Use Covered Calls

This strategy works best when the stock is little changed or even falling. if there is a large up move, the strategy is not particularly useful. Continuing with the example above demonstrates why this is true.

Assume there is a buyout of the company and the stock price soars from $100 to $150 a share. Traders who sold a call with an exercise price of $110 will be obligated to sell at $110. In this case, they will not achieve the full benefit of owning the stock.

The stock could also decline sharply. Assume the company misses its earnings expectations and the stocks falls to $80 per share. The investor who wrote the covered call can still sell their stock. They will, however, simply have to consider closing the option first.

After a 20% decline, the trader who sold the call will have a loss of just 17%. The covered call will have reduced the size of the loss. It’s possible to sell the stock but the call should be closed to avoid risking exercise. This will result in extra commissions.

Investors usually consider covered call to be useful when a stock isn’t moving much or they claim it reduces the size of a loss by a small amount. These are both true but they do not really protect against large losses and they do not allow traders to reap the rewards of large gains since they give up any gains above the option exercise price.

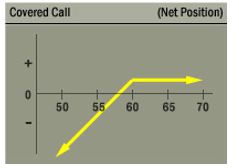

To understand the potential rewards and risks of a covered call strategy, a payoff diagram can be useful. This is shown below.

Source: The Options Industry Council

Notice that the call reduces the downside and caps the up side. That means when stocks are falling, this strategy could be useful since it will reduce losses and the up side potential is limited in a bear market.