This Could Be the Biggest News Investors Are Ignoring Today

The story appears to be straightforward.

“SoftBank is planning to invest $2 billion in WeWork, the leading co-working company according to The Wall Street Journal. The money comes from the conglomerate itself, not from its nearly $100 billion Vision Fund.

It values WeWork at $47 billion and brings SoftBank’s total investment in the company to about $10.5 billion.”

This looks like an investment in a fast growing company by a leading investment fund. SoftBank Group Corp is a Japanese multinational holding conglomerate.

The company owns stakes in Softbank Corp., Softbank Vision Fund, Arm Holdings, Fortress Investment Group, Boston Dynamics, Sprint (85%), Alibaba (29.5%), Yahoo Japan (48%), Brightstar (87%), Uber (15%), Didi Chuxing (20%), Nvidia (5%), Slack Technologies (5%), WeWork (22%), and other companies.

It also runs Vision Fund, the world’s largest technology fund.

SoftBank was ranked in the Forbes Global 2000 list as the 39th largest public company in the world,[8] and the 4th largest publicly traded company in Japan after Toyota.

But, There’s More to the Story

Recently, The New York Times reported that “Softbank dropped plans for a $16 billion investment in shared-office space provider WeWork Cos., opting instead for a smaller deal of about $2 billion amid market turbulence and opposition from investment partners, according to people familiar with the matter.

SoftBank is already a major investor in WeWork having committed more than $8 billion, partly from the Japanese company’s giant tech-investment fund.

The earlier plan to acquire a majority stake in WeWork would have been one of the largest ever investments in a private tech startup, calling for SoftBank to spend $10 billion to buy out existing investors and provide an additional $6 billion in new capital over the next three years, these people said.

Executives at both companies had been in advanced discussions, and as of late last month they had planned to announce the landmark deal Tuesday, these people said.

The exact reason for the pared-back investment is unclear, though the deal faced significant hurdles.

The Wall Street Journal reported in December that SoftBank faced opposition from the two main investors in its nearly $100 billion Vision Fund, which it used in 2017 to buy a $4.4 billion stake in WeWork.

Those investors—sovereign wealth funds connected to the governments of Saudi Arabia and Abu Dhabi—expressed concerns about investing so much, particularly at the $36 billion valuation that was being discussed, people familiar with the discussions have said.

Within SoftBank, the strong support for WeWork has been controversial. Several executives questioned the lofty valuation of a company primarily focused on real estate.

WeWork’s chief executive and founder, Adam Neumann, has marketed it like a tech company, though the vast majority of its business is akin to an office leasing company. It rents long-term space, renovates it, then divides the offices and subleases them on a short-term basis to other companies.”

The report noted that SoftBank’s investors also reacted poorly to a potential deal. When the Journal first reported on the talks in October, SoftBank’s shares fell 5.4% the next day.

The shares are down sharply from their late September peak, though that may be partly due to the broader downturn in technology stocks.

The tech rout likely would have made it harder for SoftBank to raise outside money for the deal as it planned.

The Times noted, “The scaled-back investment shows the limits of SoftBank’s financial ambitions and its eccentric leader, Masayoshi Son.

The 61-year-old executive is making massive bets on the future of technology, typically making investments as he pleases and often basing those decisions on instinct than traditional financial analysis.

Mr. Son has been a steadfast supporter of WeWork. The bet, Mr. Son has said, is that WeWork will grab a sizable chunk of global office space in the coming years, as companies gravitate to its hip, flexible workspaces.

He said on an investor call this summer he is considering moving all of SoftBank’s offices to WeWork locations.

With the larger planned deal, Mr. Son had hoped the sovereign wealth funds would let the Vision Fund pay for some of the deal, a person familiar with the matter has said. SoftBank considered other ways to fund the deal, including using its own cash, raising debt or bringing in outside investors, the person said.

That bigger deal called for all existing investors to be bought out at a roughly $22 billion valuation, less than half the $45 billion valuation set by SoftBank in a November investment.

WeWork had been intending to put off an initial public offering indefinitely. The smaller investment will mean WeWork will need to find cash in future years if it wishes to keep expanding at its current pace.

WeWork has been doubling its revenue every year for the past few years. But the costly renovations associated with expansion have led to heavy losses.

The company spent twice as much as it made in the first nine months of 2018, posting revenue of $1.2 billion and a net loss of about $1.2 billion. Revenue doubled over the same period in 2017, while losses nearly quadrupled.

WeWork has said the rising losses reflect its heavy investment in growth, and that its individual locations are profitable once they are leased.”

Bloomberg’s Matt Levine explained the deal in his usual interesting way, comparing it to a similar deal with SoftBank completed with Uber:

“SoftBank bought a bunch of shares directly from Uber at a high valuation, and more-or-less simultaneously bought a bunch of shares from existing Uber investors at a much lower valuation. It was weird!”

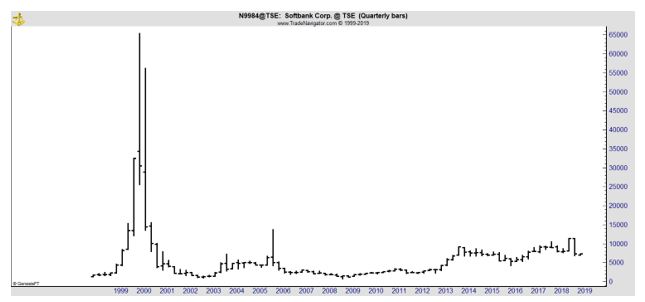

Investors tend to be wary of what Levine calls “weird” deals. The stock price of SoftBank shows this skepticism.

SoftBank was among the hottest stocks in the internet bubble in 1999. But the company has never recovered to those levels. Now, it is propping up operations in companies that are losing money.

It is possible that Uber and WeWorks will be profitable soon. It is also possible that the companies are simply subsidizing companies with investments made by SoftBank. That second possibility is frightening for investors.

This is a sign that the startup companies that are widely acclaimed could be overvalued, similar to the position SoftBank found itself and many investments in 2000. This news indicates investors should remain cautious.