This Could Be the Best Electric Vehicle Trade

While very few things seem to be certain in the stock market, there is one statement that seems to hold a high degree of certainty. It is almost certain that Tesla (Nasdaq: TSLA) will always be in the news.

Last week, according to news reports, we learned that “Tesla’s assembly lines slowed and deliveries fell during a rocky start to the new year that is likely to magnify nagging doubts about the company’s ability to post sustained profits.

The company churned out 77,100 vehicles from January to March, well behind the pace it must sustain to fulfill CEO Elon Musk’s pledge to manufacture 500,000 cars annually.

The company only delivered 63,000 vehicles in the quarter, down 31% from 2018′s fourth quarter. It cited a big increase in vehicle deliveries to Europe and China and “many challenges encountered for the first time.”

The lower-than-expected delivery numbers and “pricing adjustments” will take a bite out of Tesla’s first-quarter net income, it said. But it said it ended the quarter with sufficient cash on hand.

Tesla said it still expects to deliver between 360,000 and 400,000 vehicles this year. The first quarter production figures lagged the 86,555 vehicles that Tesla manufactured during the final three months of last year when the company was scrambling to make more cars.

That push helped Tesla post a profit in consecutive quarters for the first time in its 15 year history.

Musk has already warned investors that the company will lose money during this year’s first quarter amid cost-cutting needed to lower the price of its Model 3, its first electric car designed for the mass market.

The company produced 62,950 Model 3s in this year’s first quarter, up 1.6% from 61,934 in the prior three months.

Musk has acknowledged that Tesla’s hopes of becoming a consistent moneymaker are riding on the success of the Model 3 and a sport utility vehicle called the Model Y scheduled to be released next year. And for those vehicles to become hits, Tesla will have to be able to produce them in high volumes.

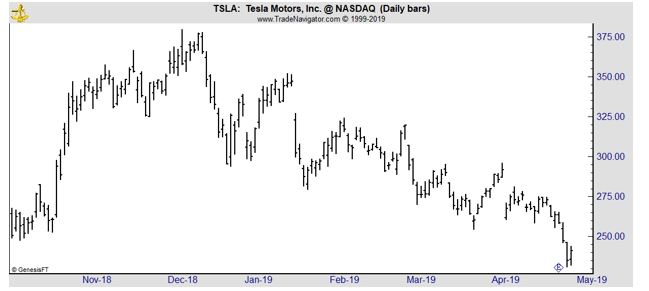

The news weighed on the stock price.

A Competitor Emerges

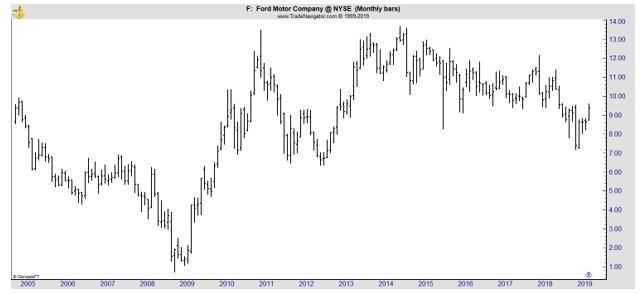

Meanwhile, another automaker reported adjusted profit hit 44 cents per share, well above the $0.27 average analysts polled by Refinitiv projected. Ford (NYSE: F) is now at an important resistance level on the chart.

CNBC noted that the company is investing heavily in electric vehicles.

“[Ford] also hopes to become more nimble by learning from some of its partners, including Rivian. Ford invested $500 million in the Detroit-based battery-electric vehicle startup this week. The alliance will let Ford use Rivian’s skateboard-like platform for at least one, and likely several, future products.

“We are learning a lot from this wonderful company and their fresh approach,” said [one analyst], especially when it comes to operating at Silicon Valley speeds.

In turn, Rivian’s CEO R.J. Scaringe expects his own team to learn about high-volume manufacturing from the company that invented the movable assembly line.

The $500 million Ford plans to invest in Rivian comes on top of another $11 billion that it last year said would be spent to begin electrifying its line-up. Ford was an early pioneer in battery propulsion but has fallen behind rivals like Tesla, as well as GM and VW. It will only launch its first long-range electric vehicle – a high-performance crossover influenced by the Mustang – next year.

Ford also has been ramping up its spending on self-driving vehicle technology. Among other things, it invested $1 billion in Argo AI. With the startup’s help, Ford’s autonomous program is now considered one of the most advanced in the industry, according to Navigant Research.

It lags behind only such leaders as Alphabet’s Waymo and GM’s Cruise Automation.

Significantly, Ford is ramping up the number of places it is testing self-driving prototypes, Farley noted during the Thursday earnings call. While places like Phoenix and Silicon Valley have become ground zero for most of those working on autonomous technology, Ford has chosen places with challenging weather and traffic conditions that push the technology to its limits.

“We are picking cities like Miami (and Washington, D.C.) that are very complex,” said [an analyst].

One of the concerns that has nagged analysts and investors has been how Ford – or any of its competitors – will turn money-losing battery car and autonomous vehicle programs into profit centers.

That’s something the recent management realignment is meant to address, [management] said in an interview. The changes will allow it to focus on what it can do to make money now while developing the businesses it will need in the future.”

Analyst caution that the automaker faces a “volatile environment with very strong competition.”

Indeed, a closer look at the first-quarter numbers reveals that while Ford performed well in its North American home – margins there climbing nearly a full point, to 8.7% – it faced significant problems in every other key market, from Europe to China.

While “there’s still some skepticism remaining,” Morningstar’s auto analyst David Whiston said, “sentiment has improved.”

Whiston, who currently rates Ford a buy, points to several positive factors, including the cuts now underway in Europe and South America, which should help profits in the future, and a broad product rollout, which could excite new buyers.

It seems investors are finally cheering the risky bets Ford is making to shift away from sedans and to invest in new technologies. And it comes at a time when the market is growing more wary of rival Tesla, which saw a sharp selloff after its earnings. The result: Ford’s market capitalization is now greater than Tesla’s for the first time since April 2017.

The long-term chart below shows Ford Motor Company (NYSE: F) is in a downtrend.

Investors should expect volatility as the company enters new markets. However, the investors in F may see better returns and less volatility than investors in TSLA while achieving exposure to the electric and autonomous vehicle markets more closely associated with Tesla.

Overall, F could simply be a safer way to trade these emerging technologies.