This Asset Class Could Provide Double Digit Passive Income

Every saver has come to understand the problem of low interest rates. Interest rates available on safe investments could be lower than the rate of inflation. This leads to a loss in buying power. This also leads many investors to chase yields by accepting more risk.

There is a tradeoff between risk and reward. Higher rewards will invariably carry more risks than investment options with less risk. But, there are ways to reduce risk.

Hard Money Lending Could Balance Risks With Rewards

Hard money loans are a specific type of real estate loan. These loans are always backed by assets, which means that the property serves as sole collateral for the loan. In many underwriting processes, the value of the property will be the most important factor in approving the loan.

In hard money lending, a lender can overlook some of the concerns with a borrower’s credit history or the state of the local real estate market because they have a process in place to take control of the property if that proves to be necessary.

Although these are real estate loans, they are not like mortgages. The goal of a hard money lender is to provide access to short term capital. The focus on the short term reduces risk since real estate trends are fairly steady in the short run.

These loans also carry relatively high interest rates. This is possible because the borrower is frequently focused on a highly leveraged deal and is targeting large returns. The interest paid on a hard money loan is just one small cost of the transaction.

Although the loan would be just one part of the transaction, it is possible that without the loan there would not be any type of transaction. That makes the loan worth a great deal to the borrow.

Rather than address the theory of the process, an example could be the best way to explain this type of investment.

An Example of the Rewards and Risks of Hard Money Lending

Consider an individual with above average home maintenance skills. The individual might have worked with a builder in the past but been laid off in the slowdown of the housing cycle.

This individual is shopping for a home that has been foreclosed. The home may have been worth $220,000 when the bank foreclosed. But, after several months, the bank is willing to accept an offer of $140,000.

Please remember that we are not addressing the buying or selling of real estate and are not suggesting that this type of deal is available on any particular property. We are using numbers to demonstrate the potential value of hard money lending.

This home has sat vacant and in need of some repairs. It could also use upgrades including new paint and a finished basement. The investor is capable of completing the work without the need to hire a contractor at a cost of $25,000. The home should be ready for resale in three months.

When the work is completed, the home should sell for $250,000. But, the investor has only $20,000 and banks will not lend on the property because it is not going to be owner occupied.

A local hard money lender is able to provide a loan that funds the purchase of the bank and the repairs. The total cost would be $165,000 ($140,000 to buy the home and $25,000 for repairs). The lender provides $145,000 and the buyer invests $20,000.

This loan would be for one year. The borrower would pay a 2% funding fee ($2,900) and 10% interest ($14,500). The lender receives a first mortgage on the loan which could be sold, as is, for $220,000. Paperwork is completed by local title companies.

This means the lender is protected unless the home value falls below $145,000, a 35% decline which is only seen in market crashes. The borrower is willing to pay the high rate because they stand to make much more when the work is done.

In this example, the borrower, the lender and the individual investors who fund the loans are able to profit.

Trading Hard Money Lenders

Business Development companies (BDCs) may be either be private or public finance companies that make hard money loans. These private hard money lenders typically operate within a single state and usually are focused on a specific industry, the most common of which is mortgage lending.

Borrowers typically use hard money loans when it is important to get a loan origination quickly, or when they can’t, or won’t, provide supporting documentation to obtain a lower-cost loan. These borrowers also often have ongoing relationships with BDCs, so that they can obtain fast financing when needed.

A BDC or hard money lender can typically move a loan request through to closing, before a bank-originated loan has even completed its first step of financing, or processing.

The increased interest-carrying costs are simply the cost of business for these borrowers, who find it is worth it to secure a rapid loan closing.

The publicly traded BDCs, with loan portfolios largely collateralized by real estate or other hard assets, include Hercules Capital (NYSE: HTGC) with a yield of 9.5%.

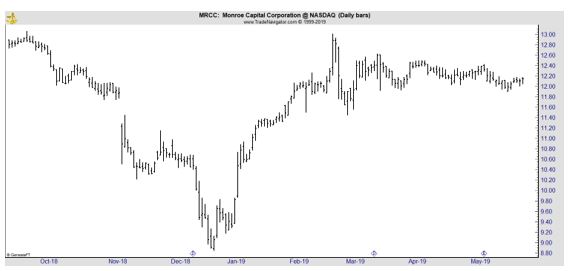

Monroe Capital (Nasdaq: MRCC) offers a yield of about 11.4%.

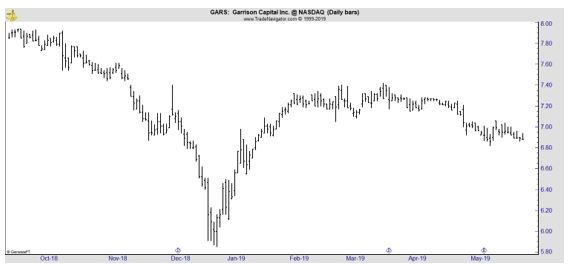

Garrison Capital (Nasdaq: GARS) provided a yield of more than 12.5% at the recent price.

Local Lenders Are in This Business

In almost every local community, there are individuals funding real estate purchases like this. The fix and flip model of real estate investing has existed for decades and will continue to serve an important role in the market. That means financing opportunities will continue to be available.

Investors like these deals because interest rates for hard money loans are typically 9.75% to 15% and origination fees can be 2% to 3%.

Low LTV rates provide security to the lender. Hard money LTV (loan-to-value) rates are typically 50% to 65%, but they can be based on the purchase price or the after-repairs appraisal value, usually whichever is higher, rather than being forced to go with the lower of the two as bank lenders are.

Borrowers typically put some money down, another factor that reduces the risk of the lender since they then face a real loss if they fail to achieve their goals.

Borrowers like these deals because the underwriting process is considerably faster than a typical mortgage. The costs are also lower than a typical mortgage.

Most hard money loans have interest-only payments during the term of the loan with the principal due at the end of the loan, but in some situations, it is possible to have money to cover the monthly interest payments included in the original loan amount.

These are short-term loans, often used to bridge between other financing options, so the typical term is between six months and two years.

Because hard money lending is an integral part of the real estate market, lenders and borrowers tend to know each other in local real estate markets. This means it is relatively easy for new investors to put cash to work in these markets.

It is possible for a new investor to find deals on their own and lend directly to real estate buyers. Or, it is almost always possible to find existing lenders and work with them to fund individual projects. Some large lenders also provide pooled investments with high yields.

Perhaps the best way to get started is to complete a web search for lenders in your area and contact them to begin earning passive income.