The Next Big Thing In Investing

Many investors spend time looking for the next big thing. The next Apple, or the next marijuana sector. They often look into the details of individual stocks but there are times when the next big thing is a change in the tax law that creates unexpected investment opportunities.

A recent article in Barron’s, “Why “Qualified Opportunity Zones” May Be the Next Hot Thing in Investing” highlighted a new type of investment that individuals should be aware of.

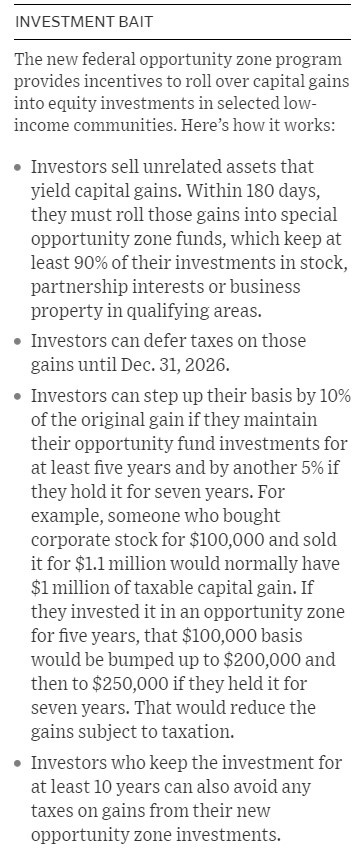

Defining Qualified Opportunity Funds

The tax reform law created the opportunity for investors to “roll the capital gains from the sale of anything—your home, shares of Amazon.com , a Modigliani—into a “qualified opportunity fund,” and hold for 10 years, you get to defer paying capital-gains tax until the end.

Then you’re taxed on just 85% of the original investment, and 0% on any money generated by that initial money.”

The program, which was championed by Sens. Cory Booker (D-NJ) and Tim Scott (R-SC), provides tax benefits and breaks to specifically defined census tracks, based on designations by governors.

Investors can claim breaks on capital gains taxes, depending on how long they invest in an area designated as an Opportunity Zone, and receive a deferment on taxes owed.

In particular, the exclusion of capital gains can be a “extremely meaningful investment” in both city and rural areas in need of an economic boost, according to Brett Theodos, a researcher at the Urban Institute.

The program essentially works by giving wealthy investors an incentive to target distressed areas.

Source: The Wall Street Journal

One analyst, Lisa Knee, a lawyer and tax partner at accounting firm EisnerAmper, told Barron’s, “The reason there’s so much hype is because it’s really something new; it’s got bipartisan support, which is amazing; and if carefully structured and planned for, it could really serve a lot of greater good for the communities.”

At the highest level of description: investor can put that money into a qualified opportunity fund—a partnership or corporation investing at least 90% of its assets in “property” in designated qualified opportunity zones.

Property can mean stock, partnership interests, or business property, like a building, which you have to have purchased after 2017, or that you substantially improve.

Say an investor sells stock today for a $1 million gain and puts it in a qualified opportunity fund. She would have nothing due now, but in 2026, she would have to pay taxes on 85% of the original $1 million. Then, if she sells the fund interest in 2028 for, say, $10 million, she would pay no taxes on the $9 million gain.

“Any gain you have during the hold period of the fund, that’s tax-free, which is pretty remarkable,” says Marla Miller, tax managing director in BDO’s National Tax Office. “The 10-year hold is very enticing for a lot of investors.”

Finding the Next Big Opportunity

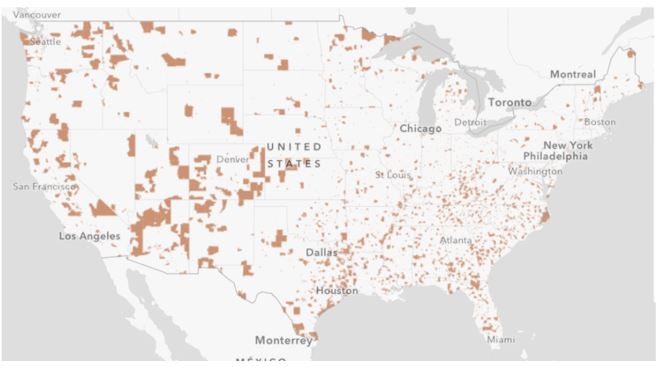

These opportunity zones exist all around the country.

Source: Economic Innovation Group

The total number of qualified census tracts to more than 8,700 across all states, territories, and the District of Columbia.

Now, the Economic Innovation Group, a think tank founded by Napster’s Sean Parker, estimates that there are $6 trillion of capital gains.

“You’re enticing a lot of money off the sidelines into opportunity zone areas,” says Neal Wilson, a co-founder of EJF Capital, a $10 billion asset manager. “If you can realize some of those gains; if even a small percentage of that goes into opportunity zones, it will have an impact.”

There are already a few funds available to investors. RXR Realty is exploring raising money, and EJF Capital is looking to raise $500 million for an opportunity zone strategy, according to people familiar with their strategies.

There is also interest among venture capitalists including AOLF Founder Stephen Case’s Revolution, along with Hypothesis Ventures and Mucker Capital.

But there are concerns that venture capital may not work. “Depending on how many hoops there are to jump through, it just may not be practicable for venture investments the way it will be for real estate investments,” Mucker’s Erik Rannala says.

Of course, the tax benefits are important to consider and there are strict rules related to those.

Effectively all of the use of the property has to be within the zone during the holding period. And a business in a qualified zone has to derive at least 50% of its gross income from active business in a qualified opportunity zone.

And the investment cannot be in a “sin business,” like a country club or golf course, liquor store, massage parlor, racetrack, or any gambling venue. Nor can it be a facility that furthers the use of hot tubs or tanning.

A Long-Term Investment

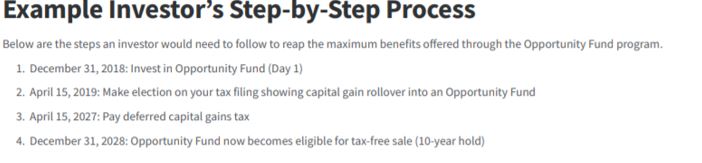

This is not a strategy that is suitable for short-term traders. It requires a significant period of time to realize the tax benefits. The Fundrise Opportunity Fund presents the following example of how long the investment must be held:

Source: Fundrise

Virtua Partners, is a global private equity firm specializing in commercial real estate, is also providing access to this opportunity. The firm currently sponsors a variety of investment funds and commercial real estate projects across the United States and currently have 16 million square feet of assets under management or development.

Virtua has assembled a collection of informational webinars on the topic that are available on their web site.

And that raises perhaps the most important point related to these investments. Before investing in opportunity zines, individuals should educate themselves on the investments, the firm they are working with and the potential risks of the investment.

Tax advantaged investments, can, at times, be appealing to investors. New companies offering these strategies could be taking advantage of that aspect but unable to deliver results in the long run. For that reason, it could be best to research a firm’s track record.

If a firm doesn’t have a track record of success in the investment field, that could be a warning sign that additional research is required. But, this opportunity is worth researching for many investors.