Real Estate Income Without Owning Real Estate

Investors often understand the value of a real estate investment. Property values tend to rise over time and can deliver steady income as they appreciate. Of course, real estate prices can fall, and they have fallen in the past, but investors can diversify to reduce the risk of price declines.

Diversified real estate investment portfolios might include a mix of rental properties scattered in several regions of the country along with exposure to undeveloped land and construction projects. Or, it could include a mix of residential and commercial properties.

No matter what it includes, a diversified real estate investment portfolio designed to generate passive income can be expensive and is, in all honestly, perceived to be beyond the reach of many individual investors.

Solutions to This Problem Are Available

Peer to peer real estate crowdfunding is s potential solution to some of the problems with real estate investing. In simple terms, these are “crowd investing” platforms that allow individual investors to fund part of a mortgage, land acquisition or construction loan or become a part equity owner.

This is perhaps not as well known an investment as stocks or bonds but it is a growing and there are a steady inflow of new competitors in this sector. That means you have the ability to select the platform that best meets your needs.

The exact structure of the platforms vary and we will look at just two of the options available to smaller investors to provide an overview of the sector. We will explore other options in this sector in future articles.

A Do It Yourself REIT

Many individual investors are familiar with real estate investment trusts or REITs. These are companies that own, operate or finance income-producing real estate. REITs often trade on major exchanges alongside stocks and exchange traded funds and provide investors with a liquid stake in real estate.

The advantages of REITs include diversification and liquidity. But, investors often pay steep fees for that liquidity. A crowd funding site like Fundrise is an alternative to this type of investment.

Fundrise allows individuals to invest online in commercial real estate via eREITs and eFunds. Individuals can gain access to real estate deals without the high dollar commitment typically needed, without being an accredited investor and without paying the high front-end load fees.

However, it is important to remember that these are illiquid investments which means that your investment capital could be tied up for years in a Fundrise account.

Investors can participate in real estate deals through Fundrise with as little as $500 of capital and they can receive monthly income through this platform. It is possible on many deals to reinvest dividends if you choose to in order to compound wealth.

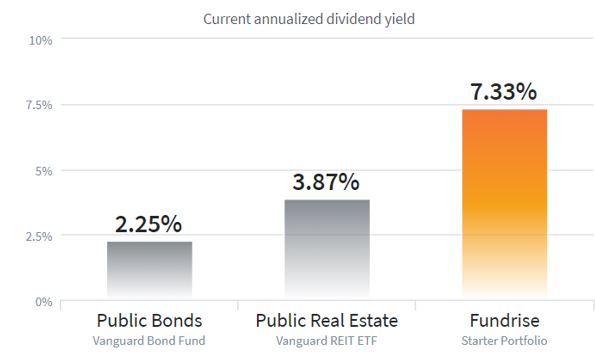

Returns can be higher for illiquid investments and this is true for a recent deal that Fundrise was offering. Investors with as little as $500 were able to obtain passive income at an annualized rate of 7.33% per year.

Source: Fundrise

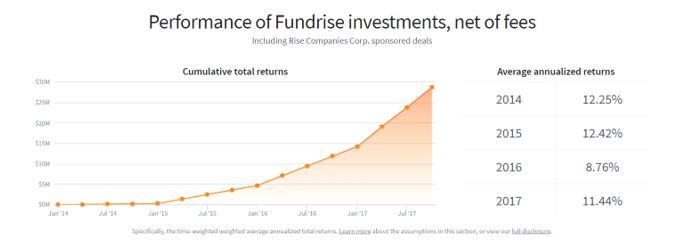

The company reports historic returns that exceed these projected amounts.

Source: Fundrise

Be A Hands On Real Estate Investors Without the Hassle of Owning Property

Groundfloor is a an online platform specializing in lending for single-family or small multi-family home rehab and renovation loans. The firm provides access to short-term, high-yield returns with a minimum investment of as little as $10. Typical loans return 6% to 14% annually and loans generally carry a term of six to twelve months.

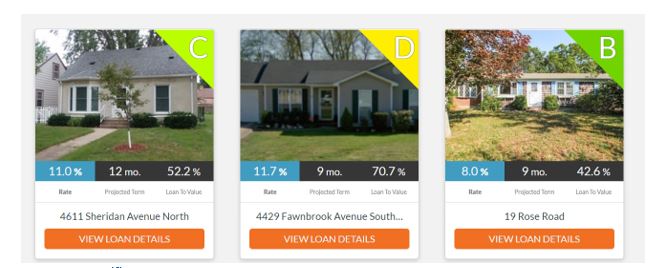

A real estate investor secures a loan through Groundfloor rather than a traditional bank or a hard money lender to finance a residential real estate project. That borrower submits a loan application and after review, the loan is assigned a loan Grade A through G and a corresponding rate where Grade A loans are the least risky, with the lowest rate of return and Grade G loans are most risky.

Grade A loans generally offer returns of 5.5% and Grade G loans generally offer returns of 26% with each letter grade offering a rate within that range.

As an investor, you can browse the summary view of loans funding on the Groundfloor web site or view more information on the loan detail page for each loan. You decide when, how much, and where to invest money. Investing is simple and efficient.

With Groundfloor you are, in effect, allowed to create your own REIT. When you invest your money with a REIT, the REIT manages your risk and reward. With Groundfloor you choose how much, when, and in which projects to invest. You are in control of your money and you manage your own risk and reward.

To select investments, investors browse the web site which shows detailed information on properties and borrowers.

Source: Groundfloor

A Different Source of Passive Income

Using Groundfloor’s reported performance, we can compare this do it yourself REIT investment to multiple alternatives. On average, Groundfloor’s returns beat the stock market trading and fixed income investments.

However, individuals will be able to determine how much risk they are willing to accept and that will have a large impact on their potential returns. While the 2017 average rate of return was 12.83%, it is important to remember that some loans earned more than that and others earned less than that.

This is obvious and is, in fact, how averages work, but it is a point that must be stressed. When making any investment, including investments for passive income through real estate, risks must be considered.

Company data provides information on loan performance in 2017. The data shows that 127 loans were current in their obligations or repaid in full. There were 31 identified as “subject to workout” and 1 identified as “subject to fundamental default.”

The precise meaning of these terms is available at the company’s web site and are of interest to potential investors, but our purpose is to highlight the risks associated with these investments.

Just one of the 159 loans in this sample was in the worst category, and that is a statistically admirable feat demonstrating that Groundfloor is performing due diligence on its loans and delivering extraordinary results for its investors.

However, we urge investors to consider what it would mean if that one loan was the loan they had invested in.

Crowd funding real estate is an investment opportunities that investors should be aware of and is something income investors should consider as a source of passive income. However, the risks should not be ignored and illiquidity should be considered when making the investment.

As always, consider both the potential gains and risks when making any investment.