Potential Stock Market Winners Under the Green New Deal

Recently, New York Democratic Rep. Alexandria Ocasio-Cortez and Massachusetts Democratic Sen. Ed Markey introduced a nonbinding resolution that calls for the U.S. to generate 100% of its electricity from zero-emission sources in 10 years.

According to MarketWatch, “The wide-ranging measure also backs investment in “smart” power grids and zero-emission vehicles, along with the elimination of greenhouse gases and the cleanup of hazardous-waste sites.

There is not a lot of detail on particular technologies or how to pay for the proposed changes, but long-term investors nonetheless may want to pay attention to the Green New Deal,” said Josh Price, an energy analyst at Height Capital Markets.

“If you start to see some more of these ground shifts in politics — veering toward renewables, veering toward addressing climate change — it’s definitely bullish for these renewable energy companies and power providers,” Price told MarketWatch.

“This isn’t a near-term catalyst for us by any means, but for some of those slow-money, long-time-horizon guys, the biofuels space and the renewables space are definitely interesting places to look,” he also said.

Specific Trades to Consider

NRG Energy, AES, Xcel Energy and other “more-forward-looking utilities” that are shifting away from fossil fuels could be winners if there is a continued focus on limiting climate change, according to the Height analyst.

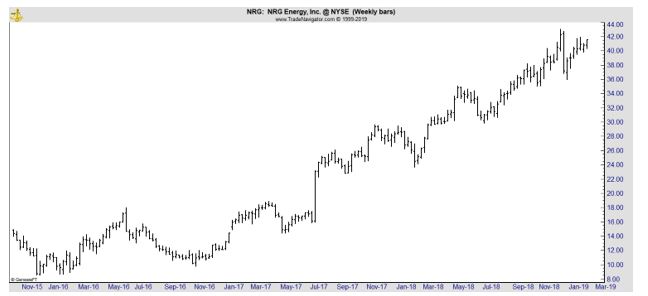

NRG Energy, Inc. (NYSE: NRG) is an integrated power company. The company is engaged in producing, selling and delivering electricity and related products and services in various markets in the United States.

The stock has been in an uptrend for some time and this news could push the stock to even more gains.

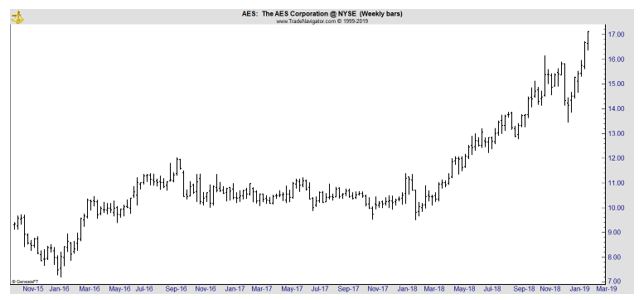

The AES Corporation (NYSE: AES) is a holding company that, through its subsidiaries and affiliates, operates a diversified portfolio of electricity generation and distribution businesses.

It is organized into six strategic business units (SBUs): the United States; Andes; Brazil; Mexico, Central America and the Caribbean (MCAC); Europe, and Asia. According to recent regulatory filings, its United States SBU had 18 generation facilities and two integrated utilities in the United States.

The Andes SBU had generation facilities in three countries. Its Brazil SBU has generation and distribution businesses, Eletropaulo and Tiete. The MCAC SBU had a portfolio of distribution businesses and generation facilities, including renewable energy, in five countries.

The Europe SBU also had generation facilities in five countries and the Asia SBU had generation facilities in three countries.

The stock has been in an up trend for most of the past year.

Xcel Energy Inc. (Nasdaq: XEL) is a public utility holding company whose operations include the activity of four utility subsidiaries that serve electric and natural gas customers in eight states.

The company’s segments include regulated electric utility, regulated natural gas utility and other activities. Its utility subsidiaries include NSP-Minnesota, NSP-Wisconsin, Public Service Company of Colorado (PSCo) and Southwestern Public Service Co. (SPS), which serve customers in portions of Colorado, Michigan, Minnesota, New Mexico, North Dakota, South Dakota, Texas and Wisconsin.

Other operations include WYCO Development LLC (WYCO), a joint venture formed with Colorado Interstate Gas Company, LLC (CIG) to develop and lease natural gas pipelines storage and compression facilities, and WestGas InterState, Inc. (WGI), an interstate natural gas pipeline company.

This stock has been in a consolidation after a rapid up move.

Additional Opportunities

Action at the state level is key, Price told MarketWatch. The Green New Deal is likely to influence California, New York and other blue states, especially those that already have aggressive targets for their use of renewable energy.

California, for example, aims to get 60% of its electricity from renewable sources by 2030. So investors in companies tied to renewable energy could feel increasingly bullish because it could help ensure state action and then eventually lead to future nationwide legislation.

The resolution’s backers want to ensure that climate-change issues remain a priority as Democratic presidential candidates ramp up their 2020 campaigns, Price also said.

Contenders for the Democratic nomination who are co-sponsors include Cory Booker, Kamala Harris, Elizabeth Warren and Kirsten Gillibrand. Investors should be aware that there could be a political imperative to act on climate change if a Democrat wins the White House race next year, Price said.

While the resolution didn’t mention biofuels specifically, companies focused on these alternative fuels for cars appear set to benefit from the Green New Deal and related efforts, according to the Height analyst. Players in this area include Renewable Energy Group (REGI), Darling Ingredients (DAR), and Finland-based Neste.

“Between full electrification and what we have now, there’s space for these biofuels with low-carbon intensities to gain ground,” Price said.

Nuclear power initially looked like a Green New Deal loser, as a fact sheet for the plan that was circulated by Ocasio-Cortez’s office reportedly called for transitioning away from such plants.

Among those expressing concerns was Matthew Wald, a senior communications adviser for the Nuclear Energy Institute, an industry group whose board includes executives from American Electric Power (AEP), Duke Energy (DUK) and other companies with nuclear power plants.

“Is the #GreenNewDeal meant to stop #climatechange, or simply support natural gas and renewables?” Wald said in a tweet. “We need to use every tool that works, including #nuclear, our largest source of #carbon-free energy.”

But unlike the fact sheet, the Green New Deal resolution didn’t single out nuclear power. “The resolution is silent on any individual technology,” Markey said at a press conference, when asked about that particular industry.

The Green New Deal is far from legislation, but it could provide traders with opportunities. If it does nothing else, it could increase the attention of analysts and investors in the utility sector. That could be bullish for a conservative sector that, at times, garners little attention.

While there will be opportunities related to this news, there will also be risks.

This news could also add to the boom and bust tendency of emerging companies in the alternative energy space. This could mean biofuel stocks, for example, could become momentum trades and quickly lose their luster if news becomes less promising.

Whether investors agree or disagree with the politics of the Green New Deal, they should consider the investment implications of the news.

Did you know that dividends have rewarded investors for at least 100 years, at least since John D. Rockefeller said, “Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.”

We have prepared a special report about dividends that you can access right here.