Passive Income From the Stock Market

Income is elusive in the current market environment. Interest rates are low as are the yields on stocks, in general. This means investors seeking income often need to accept more risks. However, income investors tend to be risk averse and that sets up a problem in this low interest rate world.

There are few absolute rules in investing, statements that are always guaranteed to be true. One of the absolute truths is that the only way to obtain a higher yield is to accept more risk. Income investors are forced to accept risk, but there are steps they can take to reduce risk.

A Reminder of the Risks of Dividend Investing

For equity investors, passive income is available in the form of dividends. However, dividends are not guaranteed. Even the dividends of companies considered to be blue chip, or very high quality investments, can be reduced or, at times, eliminated.

A recent example is in the case of General Electric (NYSE: GE). In November, the conglomerate announced that it was cutting its dividend in half. Analysts noted, the “dividend cut, only GE’s second since the Great Depression, shows the depths of the iconic company’s financial problems.”

This was important news to investors. GE is among the most widely held stocks. Many investors viewed it as a source of income. And, they learned that the income they relied on was not safe. It was a harsh reminder of the risks of investing in stock.

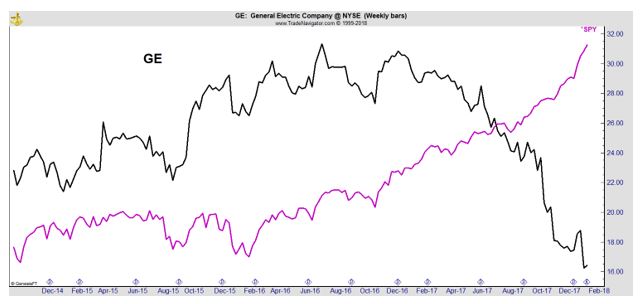

There were signs that the dividend was in trouble. The stock had been in a persistent down trend, even as the broad market had been rallying. This can be seen in the chart below where GE is shown as the solid black line and the S&P 500 is shown as the lighter colored line.

A declining stock price is one sign of a dividend that is at risk. Stock prices reflect what investors believe the future prospects of a company are like. A down trend is a signal that the majority of investors are concerned about the company’s future.

Reducing the Risks of Dividend Investing

One way to avoid the risk of a dividend cut is to sell a stock when the dream beat of bad news becomes too loud to ignore. For GE, share holders saw stories that the company was planning to reduce the size of its board of directors in an effort to save money.

That is an unusual move and any news that seems to be unusual should be investigated. GE has announced plans to reduce the size of its work force. For a company that is in trouble, that is another negative sign.

GE will also be selling off some of its businesses. This marks a reversal in the company’s strategy which has been to complete acquisitions and grow in multiple businesses.

No single piece of news is decisive by itself. It’s the accumulation of news that an investor should pay attention to and in this case, GE was sending a signal that the business was in trouble.

There are also quantitative measures an investor can follow. These include cash flow and payout ratios. But, again, there is no single indicator involved and an investor must look at the numbers in context.

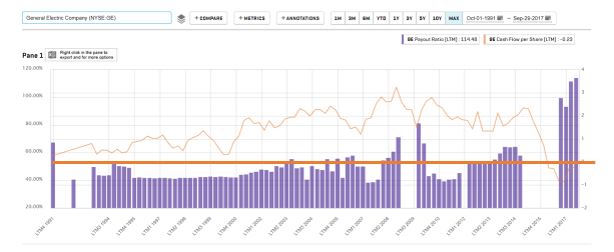

Below is a chart of GE’s cash flow per share and dividend payout ratio. Cash flow per share is shown on the right hand scale and is the solid line. The payout ratio is shown as bars and is measured with the left hand scale of the chart.

Source: S&P

Cash flow per share is the after-tax earnings plus depreciation on a per-share basis that functions as a measure of a firm’s financial strength. Many financial analysts place more emphasis on the cash-flow-per-share value than on earnings-per-share values.

While an earnings-per-share value can be easily manipulated, cash flow per share is more difficult to alter, resulting in what may be a more accurate value of the strength and sustainability of a particular business model.

Of the two indicators, the payout ratio is the most important. The payout ratio is the proportion of earnings paid out as dividends to shareholders, typically expressed as a percentage. Ideally, this ratio should be below 50%.

In the chart above, the thicker horizontal line is drawn at the 50% payout ratio. As long as the ratio is below that number, the company should have sufficient resources to continue paying the dividend and reinvest in the business so it can grow the dividend.

When it is below 50%, investors should consider whether or not the company has positive cash flow. In the chart above, the thicker horizontal line also marks the difference between positive and negative cash flow per share. Negative cash flow indicates the dividend is in danger of being cut.

Hunting for Safe, Passive Income in the Stock Market

To help you find both safety and income, we found a free stock screening tool available at FinViz.com. At this site, you could screen for a variety of fundamental factors, including high dividends and low payout ratios. Specifically, we screened for dividends yields greater than 5% and payout ratios below 20%.

The site does not offer a screen for cash flow and we wanted to provide you with a free tool so we accepted that limitation. However, in an effort to reduce risk as much as possible, we then tightened the criteria for the payout ratio to less than 20%. This should provide a margin of safety.

We also restricted our screen to companies that follow US accounting standards. This is done by limiting the search to companies headquartered in the US. The reason for this is because accounting standards differ in other countries and additional analysis is required to ensure comparability.

You can, of course, change the parameters of the tool to find stocks that are comfortable for your personal levels of risk tolerance.

Stocks to Consider

Our passive income dividend screen identified five stocks:

- BRT Apartments Corp. (NYSE: BRT) with a dividend yield of 5.1%.

- CVR Refining, LP (NYSE: CVRR) with a dividend yield of more than 20% that does seem likely to be cut despite passing our quantitative screen. This highlights that no strategy is foolproof.

- Hess Midstream Partners LP (NYSE: HESM) with a dividend yield of 5.7%.

- Park Hotels & Resorts Inc. (NYSE: PK) with a dividend yield of 7.4%.

- Taitron Components Incorporated (Nasdaq: TAIT) with a dividend yield of 6.1%.

Any of these stocks could be worth further research for investors seeking passive income in the current market environment.