Passive Income Is Built Into These ETFs

Stock market investors often associate income with dividends. That is certainly one source of income for investors. If asked to name a second source of passive income from stocks, many investors would cite price gains. This is also correct. But, there are less well known sources of income in the stock market.

Options writing is less well known and less understood but is a potential source of income for stock market investors. These strategies can be complex or could require large amounts of capital in some cases. But, there are also ETFs that now offer these strategies, making them accessible to individuals.

An ETF is an exchange traded fund which is a product similar to a mutual fund in some ways. The manager of an ETF, like the manager of a mutual fund, pools the assets of many investors to implement a strategy.

Unlike mutual funds, ETFs are priced continuously throughout the trading day and are traded just like stocks. This make them convenient and available at low costs so ETFs have become increasingly popular among individual investors. As their popularity grew, asset managers began offering more strategies in ETFs.

Buy Write Strategies With ETFs

A best option strategy involves covered call writing. This is also called a buy write strategy and involves buying a stock or index and then selling covered call options on that position. An investor could use this strategy to generate extra income on their portfolio by collecting the premium of options.

The premium is the price of the option that an investor receives for writing or selling the option. The income can increase the return but the investor who sells the option may be required to sell the shares at a predetermined price until the option expires. This means the writer gives up some potential upside on the trade when they accept the premium.

PowerShares S&P 500 BuyWrite Portfolio (NYSE: PBP) is a $330 billion ETF that uses this strategy. The fund managers explain:

“This strategy consists of holding a long position indexed to the S&P 500 Index and selling a succession of covered-call options, each with an exercise price at or above the prevailing price level of the S&P 500 Index. Dividends paid on the component stocks underlying the S&P 500 and the dollar value of option premiums received from written options are reinvested.”

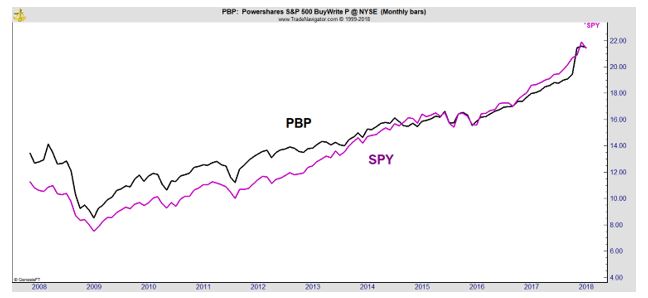

Returns of PBP are compared to the SPDR S&P 500 ETF (NYSE: SPY) in the chart below.

In general, the returns of the two appear to be similar to each other. There will be times when PBP outperforms and times when it lags. This is true of any strategy. But, PBP should lose less than SPY in a bear market since the fund generates income whether stocks go up or down.

That characteristic could make the fund appealing to many conservative investors. However, in an extended bull market, the underperformance of PBP could be significant. That’s because the income comes at the expense of limited upside. In a bull market, the limited upside hurts performance.

Put Writing With ETFs

WisdomTree CBOE S&P500 PutWriteStrat ETF (NYSE: PUTW) is an ETF with more than $300 million in assets that writes puts instead of calls.

This strategy involves selling put options to collect the premium. If the stock or index underlying the option rises, the writer collects the income. If the stock or index falls, the writer must buy at the predetermined price and could face a loss.

WisdomTree, the fund sponsor explains:

“The strategy is designed to receive a premium from the option buyer by selling a sequence of one-month, at-the-money, S&P 500 Index puts.

If, however, the value of the S&P 500 Index falls below the SPX put’s strike price, the option finishes in-the-money and the fund pays the buyer the difference between the strike price and the value of the S&P 500 Index.

The fund’s strategy of selling cash-secured SPX puts serves to partially offset a decline in the value of the S&P 500 Index to the extent of the premiums received.”

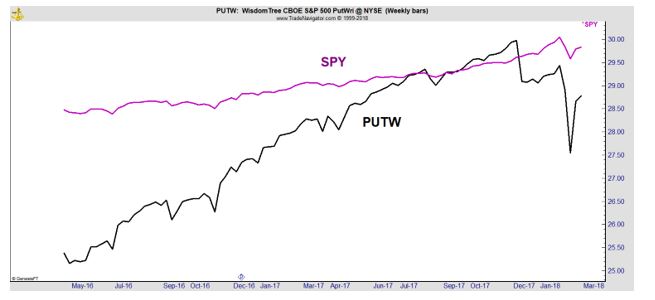

The next chart shows the performance of PUTW, again compared to SPY.

When the market is rising, and SPY is moving higher, PUTW could provide a significant degree of outperformance since the fund is collecting premiums and not facing losses. However, in a down market, losses in PUTW could come quickly.

Benefits of Options Writing In the Long Run

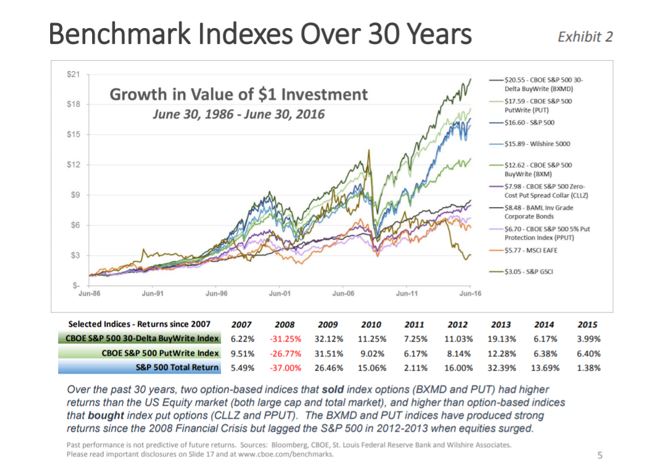

A report by the Wilshire Analytics Applied Research Group analyzed returns of these strategies over a 30 year period, from 1986 to 2016. The study compared a variety of indexes that used these type of strategies. The best performer was the put write index, a strategy similar to that used by the PBP ETF.

Source: Wilshire Analytics

The next best performer was the put write strategy, the strategy that is similar to that employed in PUTW. The study noted that the strategies also had lower volatility than the S&P 500 index.

In addition to having less volatility than the broad stock market, the research from Wilshire noted that the options writing strategies had lower drawdowns during market sell-offs. This could be seen in the chart of PBP above. Wilshire noted drawdowns were reduced by about 20 years over the 30 years.

These characteristics could make these funds attractive as a source of passive income for conservative investors. Lower volatility could mean there is a higher probability of your savings being available when you need the money. Volatility is the risk your money won’t be available when needed.

Smaller drawdowns mean that many plans could remain on track. Many investors discovered that in bear markets, such as the one that began in 2008, changes to their retirement plans were necessary. They may have planned to retire in March 2009, but a steep drawdown in their accounts forced them to work several more years.

For those planning to retire at a certain time, lower returns could be preferable to large losses that come with increased exposure to aggressive market strategies. Options writing ETFs could be a smart investment under those circumstances.