Losses Hurt More Than Many Investors Realize

Many investors readily adopt an attitude that they can’t beat the market. This makes sense for many since they have tried and been unable to succeed in many cases. This attitude results in a simple strategy which generally includes buying and holding index funds.

Index funds match the market. Often there are slight differences between the index’s performance and the index fund, and those differences can be explained by fees and decisions the management makes regarding dividends.

Those differences are generally immaterial to investors who take comfort from the fact that that they are not beating the market, but they are at least matching its performance.

A Potentially Hidden Goal

Ideally, if the stock market index moves up by 10%, the index fund will move up by 10%, or 9.9% after fees. This is how many investors envision their holding behaving. Of course, the opposite is true.

If a stock market index declines by 10%, the index fund should be expected to lose 10%, or maybe 10.1% after fees are included. Losses, of course, are a part of investing. But, in bear markets stock markets can and have in the past lost more than 50%. Many investors may be unprepared for that.

But that is the goal of an index fund. If an investor decides their primary objective is to track the indexes, their goal is then to lose 50% of the value of their portfolio if a bear market such as the one that began in 2000 or 2008 occurs.

Now, in reality, the investor’s goal might not actually be to lose 50% of their portfolio. But they accept that as part of their strategy because the conventional wisdom is that you can’t beat the market.

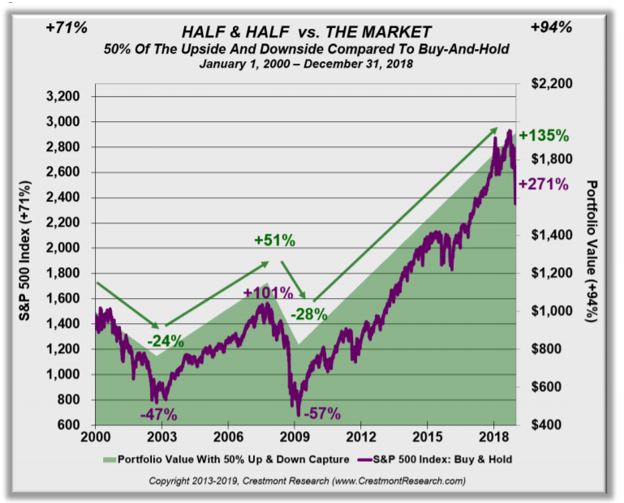

Recent research however shows that it could be possible to outperform in the long run with less risk. In fact, the research looked at a strategy that strives to capture just half the gains on the upside while avoiding half the losses on the down side. The results might be surprising, as the research noted.

Current Conditions Impact Future Returns

The buy and hold argument is based on history that demonstrates stock market indexes deliver positive returns in the long run with the long run generally being defined as twenty years or more. But investors should consider several questions besides long return.

Crestmont Research recently summarized the problem:

“This article addresses two key questions for investors today: why do secular stock market cycles matter and how can you adjust your investment approach to enhance returns?

The primary answer to the first question is that the expected secular environment should drive your investment approach. The investment approach that was successful in the 1980s and 1990s was not successful in the 1970s nor over the past 19 years. “

In other words, the past is no more than a useful guide to investors. But Crestmont raised an interesting point for investors to consider.

“Now, assume for a moment that you must pick one of two investment portfolios. The first is designed to return all of the upside—and all of the downside—of the stock market. The second is built such that it often gets one-half of the upside and one-half of the downside.

Which Would You Pick?

Without thinking, many investors pick the first. But,

“let’s assume that you have a half and half portfolio—50% down-capture and 50% up-capture. As the market falls 40%, your portfolio declines 20%—from $100 to $80. Then as the market recovers 67%, your portfolio rises by just over 33%. Your $80 increases to almost $107.

So while the market portfolio gyrated from $100 to $60 and back to $100, your portfolio progression was $100, $80, and then $107.

Even better, consider the impact across multiple short-term cycles. The typical secular bear market has multiple cyclical phases—and there will be more of these cycles before the current secular bear is over.

The effect of multiple cycles on the “rowing” portfolio is cumulatively compounding gains while the result for the “sailing” portfolio is recurring breakeven. The second cycle (using the same assumptions) drives the “rowing” portfolio from $107 to $85 and then to $114.

The score after the third cycle: Mr. Market = $100 and your portfolio = $121. Three cycles of breakeven for the market still results in breakeven—you can’t make up for it with volume.”

Since 2000, this strategy beat the market, gaining 94% while the S&P 500 gained 71%.

Source: Crestmont Research

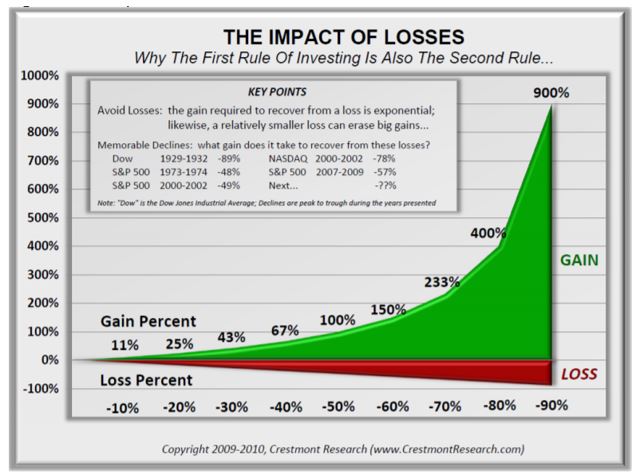

The reason this portfolio outperforms is because of the impact of losses. A loss of 50% requires a gain of 100% to get back to break-even while a loss of 25% requires a gain of just 33% to get back to break-even.

Source: Crestmont Research

The impact of two bear markets which cost market portfolios more than 50% of their capital can not be overestimated. In fact, as the data shows, it would have been better to have just half of a portfolio dedicated to stocks over that time.

This idea, what the author calls a rowing based portfolio can be implemented in a number of ways, He notes,

“…rowing based portfolios often consider and include when attractively valued—a variety of components, including but not limited to:

- specialized stock market investments (e.g., actively-managed, high dividend, covered calls, long/short equity, actively rebalanced, preferred stocks, etc.),

- specialized bond investments (e.g., actively managed, convertible bonds, inflation-protected securities, principal-protected notes, etc.),

- alternative investments (e.g., master limited partnerships, royalty trusts, REITS, commodity funds and advisors, private equity, hedge funds, timber, etc.),

- annuities,

- variable life,

- and others.”

For individual investors, it could be as simple as allocating just half their funds to the stock market and holding more cash than a traditional portfolio allocation would consider prudent. The goal is to capture just half the market move and in the long run, that could be better than fully capturing the gains and losses.

This is important to consider with valuations elevated after a ten-year bull market. Now could be an ideal to consider something different to avoid an inevitable bear market.