Know What You Want Your Investments To Do

Successful musicians often suffer from financial problems that are similar to the problems of a typical individual investor. The similarities could be surprising given the fact that successful musicians can earn millions of dollars in their career.

Despite the fact they earn so much money, the cause of a successful musician’s problems could be the same as any other investor’s problems. They may simply fail to understand what they want their investments to do.

In this article, we are focusing on investments. There are other financial problems that affect individuals and successful musicians, like overspending or under saving, and we are not addressing those.

Know Your Goals

No matter how much money you make or how much you invest, it’s important to have clear goals. Don McLean estimates that he’s earned about $150 million in his career. Much of that could be due to the song “American Pie.” It’s ranked by many experts as one of the greatest songs of all time.

McLean recently talked to MarketWatch.com and discussed his attitude towards money. It could be important to note that McLean has a degree in finance that he earned in 1968. This could make his experience unusual since he is knowledgeable in the field.

His experience and knowledge were obvious in the interview. According to the interviewer, at one point, he said, “I want to ask you something. In a relatively short time, the stock market has gone from like 18000 to 25000. Don’t people think that’s a little strange? It’s shocking.”

His skepticism of the stock market affects his investment strategy. McClean’s goal is to earn a return of 6% a year on his money. This allows him to focus on safety and he reports that he mostly owns bonds along with just two stocks.

In addition to his own education, McClean referenced a former business agent who said, ‘Don’t ever invest in anything that you don’t like and understand.’ If you enjoy it and understand it and analytically it is a good investment, that’s a great thing. Then your money’s doing something that is pleasant for you. It’s not just a number.

That could explain the two stocks he owns, Alphabet, parent of Google (Nasdaq: GOOGL) and Amazon (Nasdaq: AMZN). McLean likes their dominant market positions, “and I plan to hold those because they are the government, as far as I can see. I’ll probably add to those as we go along.”

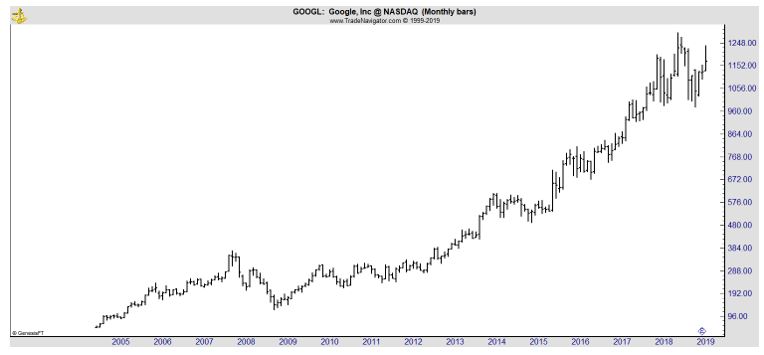

Google is an interesting stock. It is one of the rare stocks that made its all time low when it went public. The stock has delivered exceptional returns to investors since it began trading in 2004.

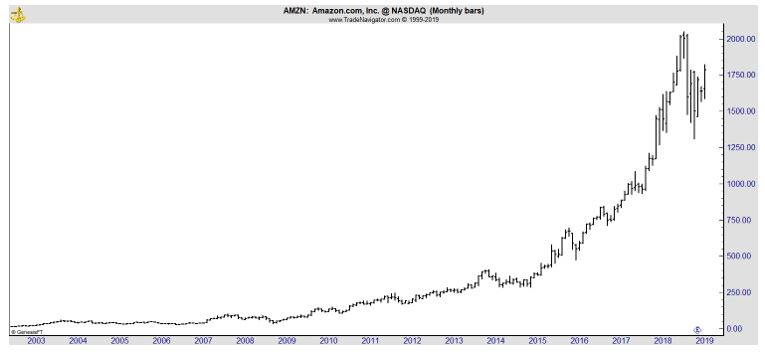

Now, it is a giant company that is one of the components of every day life for many people around the world. The same can be said for Amazon, but its stock price has been more volatile.

Amazon began trading in 1997 and survived the internet crash however investors have endured significant volatility in the more than two decades since the stock went public.

In recent years, Google and Amazon have become safer in many ways than the companies were 15 years ago.

McLean emphasized the importance of safety, “What I was trying to do was not lose the money that I had worked hard for. Back in the ‘70s I had a lot of 5 and 6 and 7% governments and of course as rates came down I made money.

Then, we hit 2008 and it was just a mess and I took everything I had out of governments and invested them all in corporate bonds. Really good companies. And that paid off like crazy.”

He is always on the look out for historic opportunities like that, offering an insight from his younger days,

“When I grew up, gold was $35 an ounce and pegged to the dollar. Everything was slow and steady. Government bonds under President Carter, if you went out 30 years you could get like 20%! Do you remember that? Imagine getting 20%, locking that in for 30 years? I’d do that in a minute.”

Now, he adds, “Some of my money is still in corporates and some is now in preferred stocks and so I get a little protection against the market and also benefits from the market. And that’s worked nicely. I try to get, like, a 6% return if I can — 5 or 6%. That’s enough for me.”

He’s not looking for quick gains, noting, “You know it’s just: slow and steady. That’s how I like it. I bought some properties — at one point I had four homes.

I sold one and I’m going to sell another and then I’ll have two — one on each coast, that are just incomparable, so I will never sell them. And they’ve gone up a lot. I don’t lend money, and I don’t borrow money. That’s another thing. I don’t have any debts.”

Lessons For Individual Investors

There are important lessons to draw from this:

- Know your goals. Individuals earning less than McLean might not be satisfied with 6% returns but know what your goal is.

- Understand the risks. McLean focuses on avoiding losses and is satisfied with lower returns since the risks outweigh the potential rewards in his mind.

- Understand what you invest in. If you are a trader, this might mean simply understanding the strategy used to select trades. As a longer term investor, it could be important to understand what the company does.

- Align your goals with your strategy. McLean is a long term investor focused on income. The goals match the investments. It is important to have a strategy that matches the goals and investments that match your temperament.

- Be prepared to act when historic opportunities come along.

You may not want to duplicate Don McLean’s strategy or portfolio and that is certainly admirable. You should create your own strategy and portfolio. But you should stick with your own strategy for the long term to achieve the benefit of the plans you make.