It Could Be Time To Buy Into This Big Name Turnaround Story

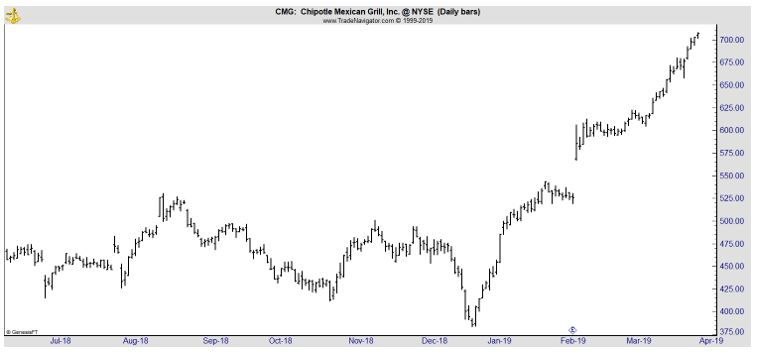

Some investors love turnarounds. That makes recent price moves in Chipotle Mexican Grill (NYSE: CMG) potentially appealing.

It’s been almost four years but many investors, and customers remember the news. Customers fell ill and the stock sold off sharply after a food poisoning outbreak in late 2015. Since then the company has taken numerous steps to restore the brand’s reputation.

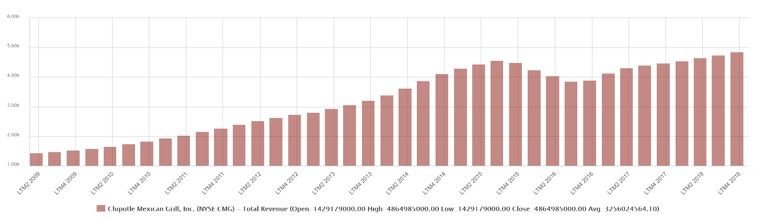

The latest quarterly results indicate the efforts could be paying off as revenue is returning to the pre-crisis levels.

Source: Standard & Poor’s

Analysts Express Caution

There was quite a bit of good news for shareholders in recent weeks. The stock price crossed above $700 for the first time since 2015. The company reported 6.1% same-restaurant sales in the quarter, with higher prices accounting for 4.1% and transaction growth accounting for 2%.

Stores have made digital ordering easier and begun designing restaurants to make it easier to pick up orders without waiting in line. For drivers, there is even a “Chipotlane,” a new kind of drive-through lane that lets people order ahead.

Chipotle expects its same-restaurant sales to rise in the mid-single digits this year.

Analysts are raising their estimates for the company, according to Barron’s. But, the news service warns. “the latest estimates show the stock trades at 39 times expected 2020 earnings, a remarkable multiple even for a company on the comeback trail.”

Reasons for caution include the fact that “the company has made it more complicated to judge its earnings, because for the past few quarters, it has given investors two different numbers—one that adheres to generally accepted accounting principles, or GAAP, and one that doesn’t.

And the sizable difference between the two is hard not to notice.

The GAAP number wasn’t quite so earthshaking—annual profits rose 2.3% to $6.31 from $6.17. But the company now gives another non-GAAP number that strips out restaurant closing costs and adjusts for items the company considers “corporate restructuring,” including things like accelerated depreciation for some restaurants expected to close.

Using the non-GAAP figures, Chipotle earned $9.06 per share in 2018, a 33% increase from 2017. That kind of growth could presumably justify a multiple of 39 times.

It isn’t unusual for companies to use non-GAAP figures. But Chipotle didn’t release non-GAAP numbers in the same period a year ago, even though it closed or relocated 25 stores in 2017 (versus 54 last year).

In an email to Barron’s, Chipotle CFO Jack Hartung wrote that the company is giving investors more information by reporting both numbers.

“To be clear and transparent, we have reported results both with and without these non-recurring charges, to provide our investors with a clear picture of our underlying results,” he wrote.

The charges “relate to transformation of the company moving the offices and closing underperforming restaurants.”

Wall Street tends to base its expectations off the non-GAAP numbers, though some analysts hope Chipotle’s use of those figures is a temporary change.

“We’re giving them a pass because of the headquarter move to Orange County and the strategic closure of a handful of units,” wrote Wedbush analyst Nick Setyan in an email to Barron’s.

“These one-time expenses should be done by the second quarter of 2019. If they are not done, then it could become a greater concern.”

The non-GAAP numbers aren’t the only reason to be skeptical over Chipotle’s valuation. The company’s restaurant-level margin was up compared with last year, but it fell on a quarter-over-quarter basis.

And some sales gains in the fourth quarter got an extra boost from unique events whose benefits may not last. At the end of the year and the start of 2019, the company offered free delivery, advertising the service on college football bowl game telecasts.

The promotion clearly generated a big response, but it isn’t clear that it will continue to pull in the same number of customers when they have to pay for delivery.

Analysts estimated that the company’s same-restaurant sales jumped about 10% in December, versus about 4% in October and November. Given that the company expects mid-single digit growth next year, it is unlikely it can keep the same momentum for 2019.”

Other Analysts Are Bullish

In a different article, Barron’s offered the bullish case.

“Piper Jaffray analyst Nicole Miller Regan reiterated an Overweight rating on the shares, along with a $725 price target that is the second highest on Wall Street. The latest run-up for the stock started in early February 2018 and has been pulled ahead by an in-process turnaround led by new management.

As upbeat as things might seem today, Wall Street analysts appear less bullish then they were at previous highs, Regan suggested, and if they come around, further share appreciation might be in the offing.

To illustrate: Today, Chipotle stock trades at about 38 times estimated 2021 EPS of $18.69. The Street’s average price target, around $568, is below current prices. Less than 30% of Wall Street ratings are at Buy or equivalents.

At the end of August 2015, when the stock hit an all-time high, the stock was trading at 29 times estimated 2017 EPS of $24.52. But the Street’s average price target was above $700, and the percentage of ratings that were at Buy was closer to half.

Regan praises the management team, which she called “highly collaborative and aligned” in her note. Fourth-quarter earnings came in better-than-expected.

“Operational excellence lays the groundwork for improving guest satisfaction, increasing intent to return and enhancing loyalty,” she wrote.

”Store level efforts are focused on retention, throughput and consistency. Increasing access and awareness is the strategy to identify new guest and target current customers.”

“Despite high expectations, sell-side sentiment and fundamentals are not aligned,” wrote Regan. “We suppose this could always lead to an upgrade cycle as the turnaround continues to unfold, which could benefit the stock down the road.”

The case for the bulls is a strong one as is the case for the bears. It could be best to use a strategy that limits risk, such as one that relies on options and can benefit from whichever scenario you believe is most likely.