You Probably Can’t Invest In the Best Performing Hedge Funds are Minimum Investment, But That’s Okay

Best Performing Hedge Funds are Minimum mysterious Investment for many investors. They are open to select investors, those who meet the legal requirements as accredited investors, can meet minimum investment amounts that can top $5 million at the best fund and agree to lock up periods that can run for years

If you qualify to invest in the fund, you will then pay for the privilege. Many fund managers charge a management fee of 2% a year and then take 20% of the profits. This incentive fee can be structured in different ways and might not be as bad as it sounds.

Most funds only charge the incentive fee when they are making new highs. If a fund loses 10% in a year, for example, they would need to recover those losses before they could take a percentage of the profits.

Other funds only take a share of the profits that exceed a benchmark. If a fund, for example, gained 30% in a year when the S&P gained 5%, the manager would make 20% on the 25% of gains that beat the benchmark.

The largest funds and those with the best track records could take even more in fees. One fund manager, Renaissance Technologies, is rumored to charge 5% in annual management fees and an incentive fee of more than 40%. But, the fund is closed to new investors.

Performance Drives the Fees

Accredited investors are sophisticated investors. The meaning of this phrase is defined by the Securities and Exchange Commission which says, “An accredited investor, in the context of a natural person,

includes anyone who:

- earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expects the same for the current year,

OR

- has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person’s primary residence).”

Based on these tests, it’s reasonable to assume that accredited investors have access to good financial planning advice. While individual investors avoid funds with high expenses, these investors are at times encouraged to pay the high fees.

One reason to pay so much is for performance

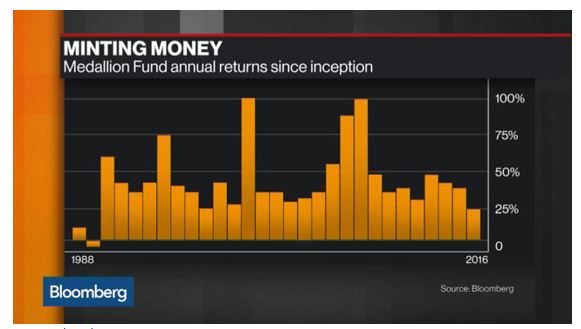

According to Bloomberg, the fund “has become probably the world’s most successful money machine. According to Bloomberg, the fund “has become probably the world’s most successful money machine. Powered by millions of lines of computer code, it has made about $55 billion over the past 29 years, thanks to average returns after fees of an astounding 40 percent.”

Source: Bloomberg

A $1,000 investment in the fund at inception would be worth more than $13.8 million at that rate of return.

Not all hedge funds perform like Medallion but investors in this arena are always looking for the next great fund.

Defining a Hedge Fund

A hedge fund is considered an alternative investment that is beyond the typical investment categories of stocks, bonds, real estate and collectibles. Hedge funds can often investment in anything and they often use leverage in an effort to boost returns.

The name comes from the first funds that were formed in the late 1940s. These funds were designed to decrease the risk in holding long term stock positions by selling short stocks the managers believed were set for a decline.

Early funds, in other words, hedged the risk of the stock market by seeking to benefit from declines. They also used leverage, or borrowed money, to increase the potential returns of the funds. The early funds generally performed well in a difficult market environment.

Their success, as almost all success on Wall Street does, led to imitation and competition. Many other managers rushed into the field and they added strategies. Soon funds were available to their select group of investors offering a variety of objectives:

- Traditional hedged equity funds buy stocks they expect to outperform and short stocks expected to decline in value. This strategy is also known as a long/short strategy.

- Market neutral hedge funds use stocks to create a portfolio that is expected to deliver returns with little volatility. These strategies often use Treasury bills as their benchmark and target returns that are slightly better than that

- Arbitrage funds use different securities in different markets that are expected to converge to a similar value. Through a series of long and short trades the managers seek to capture short term pricing differences in different securities or in different markets

- Distressed investment funds are looking for companies that could fall into bankruptcy. They then use their professional and legal teams to deliver profits on those securities.

- Global macro funds look for trends driven by major news events and may invest in stocks, bonds, currencies, futures or any other investment they believe will benefit from that trend.

There are also fund of funds, or FOF, in the hedge fund world that invest in a number of other hedge funds. A FOF may invest in dozens of funds to provide diversified investments to hedge fund investors. This is useful since the minimum investments can be high and the best funds may be closed to new investors.

Accessing Hedge Funds If You Aren’t an Accredited Investor

As with any investment management activity, indexes have been developed to track the performance of hedge funds. The introduction of indexes has helped make hedge fund investments available to individual investors.

Exchange trades notes (ETNs) tracking hedge fund indexes are traded like the more common exchange traded funds (ETFs). The difference between the two is that ETFs will use the assets under management to buy shares of individual stocks while ETNs will use funds to buy derivatives. They both trade the same way.

The IQ Hedge Multi-Strategy Index Fund (NYSE: QAI) is an ETF designed to replicate the risk-adjusted return characteristics of hedge funds using multiple hedge fund investment styles, including long/short equity, global macro, market neutral, event-driven, fixed income arbitrage, and emerging markets.

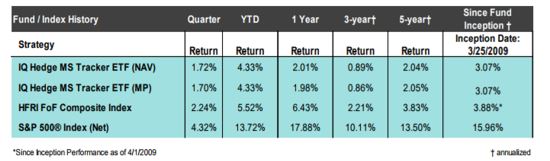

Unlike many hedge funds, individual investors can invest in QAI. The fund has more than $1 billion in assets. Its performance relative to benchmark indexes is shown in the table below.

Source: Fund Fact Sheet

This fund has underperformed the S&P 500 index since its inception on April 1, 2009. The industry standard benchmark, the HFRI FoF Composite Index, has also trailed the S&P 500 over that same time. This is actually not unexpected.

In a strong bull market like the one we have seen since March 2009, active managers are at a disadvantage. Their fees and costs contribute to underperformance as does their investment style. Active funds will seek to manage risks and in a strong bull market their defensive actions will hurt performance.

That’s why many investment managers urge investors to consider performance over a full market cycle which includes one full bull market and one full bear market. In the past two bear markets, the HFRI FoF Composite Index outperformed the stock market averages.

Between 2000 and 2002 as the stock market dropped by almost 50% as many stocks did far worse, the index delivered a gain. The index gained more than 20%. In the bear market that ended in 2009, the index declined less than half as much as the broad stock market averages.

This performance shows the value of a FoF in a portfolio. This is why large investors and institutions have owned hedge funds even through extended periods of underperformance. That is why we sought to introduce you to hedge funds in this article.

However, in future articles we will be highlighting alternative investment opportunities that have delivered strong performance.