Improving Value Investing

Hundreds of years ago, in medieval legend, medieval knights went on great quests in search of the Holy Grail. At least according to legends. Those legends gave rise to a phrase often used to describe a noble but difficult pursuit of something.

Investors have long sought the Holy Grail of investing. Of course, it seems unlikely one single grail will ever be found. But, researchers do keep improving their focus.

Value investing and specialties within that discipline offer a promising path to better than average profits and that is an area where time spent on a quest for knowledge is likely to deliver rewards.

Factors Segment Value

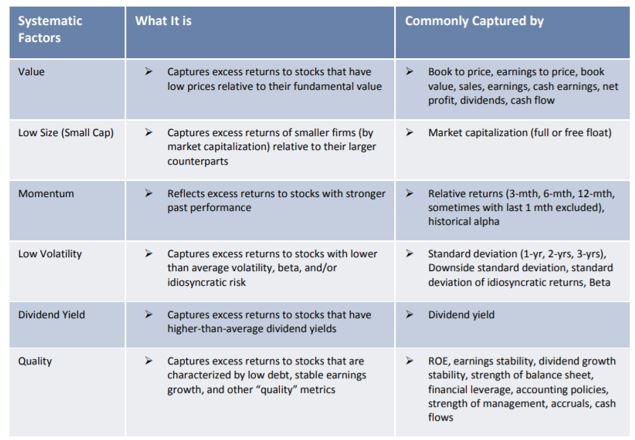

The success of value investing in the long run led to a search for what makes value investing successful. This search came to be associated with factors which “can be thought of as any characteristic relating a group of securities that is important in explaining their return and risk” according to MSCI Research.

That study explains that “a large body of academic research highlights that long term equity portfolio performance can be explained by factors. This research has been prevalent for over 40 years; Barra (now an MSCI company) for instance has undertaken the research of factors since the 1970s.

Certain factors have historically earned a long-term risk premium and represent exposure to systematic sources of risk. Factor investing is the investment process that aims to harvest these risk premia through exposure to factors.

We currently identify six equity risk premia factors: Value, Low Size, Low Volatility, High Yield, Quality and Momentum. They are grounded in academic research and have solid explanations as to why they historically have provided a premium.”

These factors are summarized in the table below.

Source: MSCI Research

The tools that are commonly used to capture the factor could each be thought of as an individual factor. This makes it important to some investors to understand whether the price to book (P/B) ratio is better to use than the price to earnings (P/E) ratio and other definitions of value.

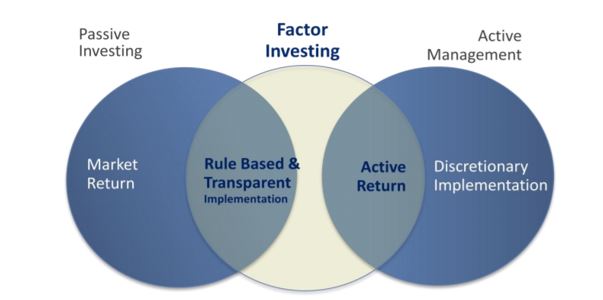

One problem with passive investing from the perspective of many investors is that it matches the market. It is designed to never beat or lag the index it tracks. This means accepting 100% of the risk of the bear markets.

Active investors seek to reduce risks in bear markets and outperform in bull markets. They do with mixed success in the long run. But the goal is certainly appealing.

Factor investing can be appealing because it is a middle ground between active and passive investing.

Source: MSCI Research

The Search for the Holy Grail of Value Can Be a Dead End

Many index funds and investment managers focus on individual factors and seek to deliver market beating returns. Over the long run, many have found success with differing factors based on value. But, the question remains as to whether or not there is a single best factor use.

Recently, Jim O’Shaughnessy addressed that question. He is the Chairman and CEO of O’Shaughnessy Asset Management and the author of four books on investing, including What Works on Wall Street, a BusinessWeek and New York Times Business bestseller.

What Works on Wall Street is an investment classic. It first appeared in 1996 and has been updated since then. As the author explains, “when the first edition of my book came out, I was super excited to be offering a compendium of the actual long-term results of all of Wall Street’s favorite measurements for determining if a stock was a good investment or not.

At the time, I only looked at individual factors and price-to-sales proved itself to be head-and-shoulders above all the others. Other than a great book by Ken Fisher called Super Stocks, which focused on how great the price-to-sales ratio was, at the time, it was a very obscure factor that wasn’t popular like PE or Price-to-book. That made me even more excited to proclaim it the “King of Value Factors.”

This was a breakthrough at the time and was well received by investors. But, O’Shaughnessy has now rethought his position and says,

“With hindsight (another nasty behavioral bias), this was a rookie mistake. Had I given it any thought, I would have remembered that you can make anything look good if you varied the amount of time in your analysis.

But I thought, gosh, this is decades of data, surely things won’t change that much going forward. But, of course, they do. Instead of focusing on how value factors in general did in identifying attractive stocks, I rushed to proclaim price-to-sales the winner.”

In subsequent editions, as O’Shaughnessy became what he “a lot more sophisticated in my analysis—thanks to criticism of my earlier work,” he realized that “everything, including factors, moves in and out of favor, depending upon the market environment.”

O’Shaughnessy’s new research drove him to the conclusion that investors would be “far better off seeing how a stock scored on a composite of value factors that took more aspects of the balance sheet into account.”

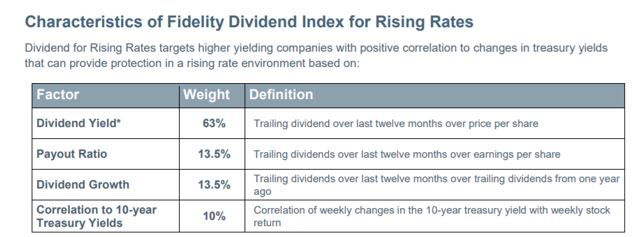

Fidelity has been doing similar research and has been introducing exchange traded funds (ETFs) that apply that research. Buying factor based ETFs could be a simple way for investors to adopt a value methodology for the long run.

Fidelity is using more sophisticated metrics to find market beating factors including the example below which explains the method used for their fund that seeks to deliver results at times when interest rates are rising as they are now.

Source: Fidelity

The Lesson For Investors

No single factor or fundamental piece of data is ever the answer or solution to the stock picking problem. In other words, there is no Holy Grail of investing.

O’Shaughnessy believes there is value in combining indicators and his current preferred metric is shareholder yield which consists of dividends and net share buy backs. This metric can be combined with other value metrics or with momentum.

Others have found success with single indicators and tests in the academic papers tend to show that any value approach can work well in the long run. So, although there is no Holy Grail there is an answer to the truth investors are searching for.

Find a valuation tool you are comfortable with and stick with it for the long run. That is the key to success in most studies.