If You Follow Buffett, You Might Have This Problem In Your Portfolio

Warren Buffett is widely followed because he has delivered a long record of successful investments. Not all of Buffett’s investments work but he often exits a position before there is a large loss. Of course, Buffett is not perfect, and he does occasionally suffer through large losses.

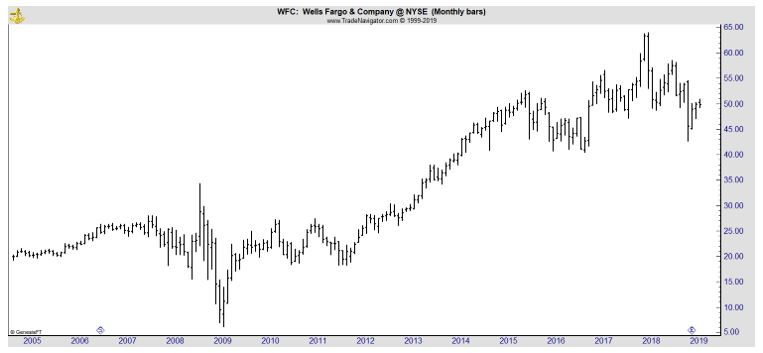

One example is Wells Fargo & Company (NYSE: WFC). The bank lost more than 80% of its value in the bear market that began in 2008 and then lost more than 20% of its value after reports that the bank was creating fake accounts for customers.

In the long run, Buffett does appear to have done fine with WFC. But that is an opinion based on hindsight. A more challenging question could be what to do if your stock suffers a steep sell off? Buffett is forced to address that question based on his investments in Kraft Heinz stock (Nasdaq: KHC).

Confronting Bad News

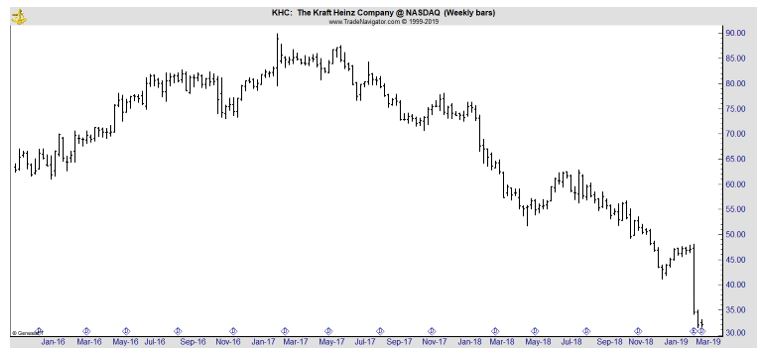

KHC has sold off sharply in recent weeks.

Barron’s summarized the problems that have pushed the stock price lower, noting that the company “isn’t catching any breaks—Bernstein has joined the numerous analysts who have downgraded the shares.

… Kraft hasn’t been having a great year to begin with. The stock tumbled more than 8% after its previous earnings report in November fell short of expectations. Kraft’s bottom-line results not only missed, but the results showed it had sacrificed pricing for growth, and investors reacted negatively.

The quarter showed that what used to be considered safe stocks just aren’t so safe anymore.

[More recently], it became clear that Kraft’s problems ran deeper than the staples slump.

Not only did its fourth quarter and guidance disappoint, but the company also cut its dividend, took a $15.4 billion asset write-down related to its Kraft and Oscar Mayer brands, and disclosed that the Securities and Exchange Commission has been investigating its procurement division’s accounting practices since October 2018.

…Not surprisingly, Kraft’s trouble led to steep stock declines and plenty of analyst downgrades for the shares. … Bernstein’s Alexia Howard added her voice to the chorus of caution, downgrading the stock to Market Perform and cutting $11 from her price target, to $50.

She wrote that her bull thesis was undercut by high cost pressures in the fourth quarter, a problem Kraft warns will persist this year.

Howard was disappointed not only with the downbeat earnings and guidance, along with other problems, but worries that issues don’t bode well for Kraft’s ability to raise prices later this quarter—something investors clearly want to see.

She also warns there is a lack of catalysts that can boost the stock’s valuation, despite how far it has fallen. (Likewise, Warren Buffett, who owns Kraft, said he doesn’t think the shares look particularly cheap despite their plunge.)

…Howard writes that “the company’s visibility into future financial performance is limited,” and without some bottom-line improvement, Kraft’s multiple will have little fuel to expand. Perhaps an even bigger issue: “It will take quite some time for management to rebuild credibility with investors.”

That seems to be an understatement.

It isn’t that Kraft doesn’t have a valuable portfolio of brands—after all Heinz ketchup is so dominant it has spawned listicles testifying to its irreplaceable taste.

But consumer brands are being squeezed—both by changing tastes that favor fresh, organic alternatives to shelf-stable packaged goods and by shoppers choosing lower margin-store brand alternatives.

Kraft may have the quality products to weather the storm, but management hasn’t done much to demonstrate it has the ability to navigate the new normal.”

Possible Actions for Investors

“We know that Buffett’s purchases are widely copied, which means many people own Kraft Heinz,” according a recent Barron’s story. The news site also offered some insights on what to do next.

“An investor fearing such a selloff, or someone who wants to earn some money from a dead-money stock, should consider selling upside call options against stock to shrink the unrealized loss. The strategy, known as “overwriting,” is a classic stock-management tool.

On any given day, fund managers overwrite positions with calls that have strike prices that reflect their stock-target prices. If they think a stock is fully valued at $45, they sell $45 calls at various expirations and pay themselves to wait.

With Kraft Heinz at $32.71, investors can sell the January $37.50 call for $2. If the stock remains below $37.50, investors keep the premium. Should the stock be at the strike price at expiration, investors must sell the stock at $37.50 or cover the call.

The risk to overwriting is that investors miss any rallies above $37.50. Kraft Heinz stock has ranged from $32.05 to $68.59 over the past 52 weeks.

The overwrite can be enhanced with a short put to create a “short strangle,” or “combo.” This is for investors who want to buy Kraft Heinz, but at a lower price. The January $30 put was recently bid around $2.40.

Selling puts on damaged stocks that are hard to evaluate is like dancing on the roof. If the roof gives way, you’re in trouble—or stuck, in this case, having to buy the stock at $30, even if it is trading at $20. Or you could pay top dollar to cover the put.

It can be difficult to repair damaged stocks, especially after a company’s management has violated investors’ trust.

Many investors say it is better to realize losses than wait for a recovery. But maintaining a sell discipline can be difficult. Besides, many investors likely own Kraft Heinz at sharply lower prices, due to historical spinoffs, and they likely reason that they can wait for the stock to recover.

We have no idea if Buffett is using options to manage his Kraft Heinz position, although he is no stranger to the options market. He has used options in the past to control stocks around corporate mergers.

He also sells options that expire in more than 10 years on major stock indexes, often committing billions of dollars in an over-the-counter market that insurance companies use to hedge the guaranteed returns of variable annuity contracts.

Our approach is less majestic. It simply expresses a view that a little life can be breathed into wounded stocks, one trading breath at a time, in the options market.”

Even if you don’t own Kraft, these strategies could be useful the next time one of your stocks drops sharply, an event that is possible even for the greatest investors.

Did you know that dividends have rewarded investors for at least 100 years, at least since John D. Rockefeller said, “Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.”

We have prepared a special report about dividends that you can access right here.