How to Spot the Next GE

General Electric (NYSE: GE) has left some investors reeling. If you’re reading this and you own individual stocks, there is a high probability you own GE.

According to The Wall Street Journal, “about 43% of GE shareholders are retail investors, people who own stock in their personal accounts, according to S&P Global Market Intelligence. That compares with 32% at Johnson & Johnson and 21% at Boeing Co.”

This is, in part, due to the company’s generous employee ownership program. For decades, the company has had a program that encourages employees to buy GE shares by offering to match 50% of worker contributions, which were taken directly from paychecks.

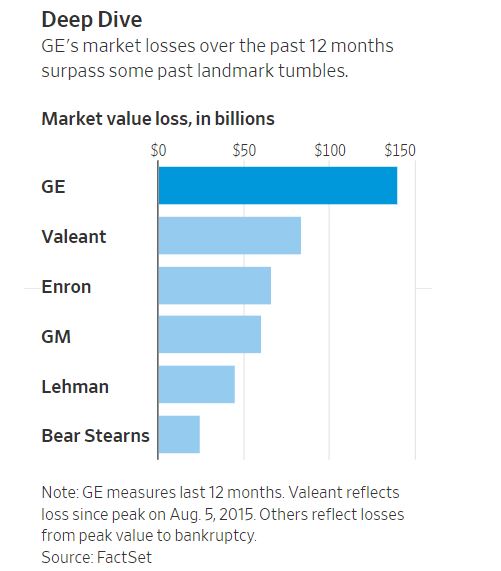

Now, the stock has lost more in value than some of the largest disasters in Wall Street history and those employees are shocked.

Source: The Wall Street Journal

That total loss of $140 billion of the stock’s value in the past twelve months is spread among employees, former employees, individual investors who believed a company with an operating history spanning more than 125 years couldn’t fail, and large institutional investors.

There is little those investors can do now. The stock’s decline has been so steep that many experts believe the stock will bounce back, to some degree, and insist the potential up side in GE now outweighs the potential risks.

Avoiding the Next GE

All of the disasters shown in the chart above cost individual investors dearly. After each Wall Street flop, the question of how to avoid the next disaster comes up. While it seems hopeless, it is not. There are some steps investors can take to preserve their wealth.

The first lesson for investors is never to believe any investment is 100% safe. GM is another big name on that list of largest all time losers. The company went through bankruptcy and left its original investors with little. Lehman and Bear Stearns also had storied histories.

Investors are familiar with the warning that past performance is not a guarantee to future performance. They apply that advice to mutual funds or the performance of an investment adviser. But, they may not apply that advice to large cap companies with long operating histories.

The Second Lesson: Cash Flow From Operations

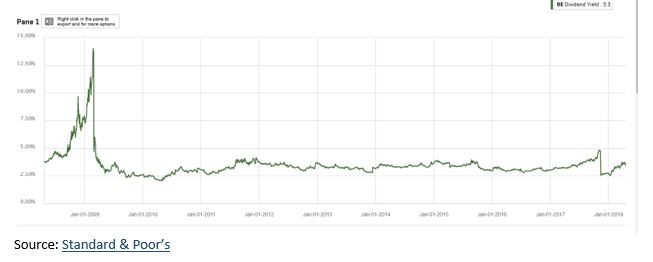

GE offered a generous dividend. But, that dividend was cut, one of the reasons for the stock’s sell off. The chart below shows the dividend yield of GE.

Source: Standard & Poor’s

GE’s dividend was also cut in the 2008 financial crisis. But, that time, the market was telegraphing the cut because the yield had become unsustainably high. This time, the dividend yield peaked at about 4.7%, high for the current market but not a red flag like the double digit yield of a decade ago.

While the yield seemed to be reasonable when considered in absolute terms, in fact, it was unsustainably high for GE given its financials.

Companies pay dividends with cash. This seems obvious, but it demonstrates the importance of researching stocks that you may own or are considering buying. A more detailed analysis of cash flow could help investors avoid dividend cuts and large losses in some stocks, including GE, Enron and others on the list shown above.

After reviewing valuation ratios, dividend yields or other important metrics that assist you in your investment decisions, open the company’s statement of cash flows. This could be the most important financial statement and it may very well be the one that gets the least amount of attention.

Cash flow can be confusing, and fortunately we don’t need to be accountants to complete a safety check. We simply need to review two lines on the statement.

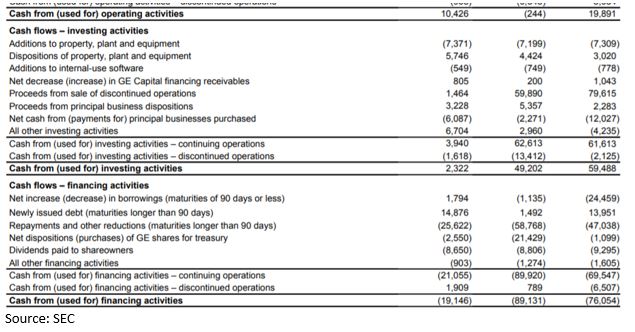

Companies need to generate cash from operations to fund their financing activities. In the statement of cash flows shown above, the dividend payments and other expenditures of cash used in financing are enclosed in parentheses indicating they are negative numbers or cash outflows.

In the financing activities shown above, notice that GE was spending billions of dollars buying back its shares. The company was also repaying debt, which is often required under a company’s debt obligations.

In each of the past three years, the amount of cash that GE used for financing activities exceeded the amount of cash flow that the company generated through operating activities. This is an unsustainable situation.

It’s that simple. A company must generate sufficient cash flow from its operations in the long run to finance its dividend and other financing activities.

As a stopgap measure, the company can raise funds through its investing activities, information which can also be found in the statement of cash flows. In this case, GE sold off a large amount of assets and used cash from those sales to finance its operations and dividend payments in the previous two years.

Cash Flow Avoids Value Traps

As we noted, many investors fail to consider cash flows when they are making investment decisions. But, value traps, stocks which appear to offer value but tend to trap an investor into losses, will usually have warnings in their statement of cash flows.

Ideally, the cash flow from operations will exceed the cash flow from investing activities. This indicates the dividend is more than likely safe. Cutting a dividend will, of course, result in less income for share holders and almost always result in a sell off in the stock.

The dual effects of lower income and loss of capital could leave an investor feeling trapped and will result in an investor showing real losses in their account.

There is no way to guarantee that a value stock truly offers value to investors. However, a quick check of cash flows will reduce that risk. This is a step that few investors will take and that means this information could help you beat the market by avoiding the largest losses in history.

We do know that there will be other stocks like GE, Enron and the others on that list of the all time biggest losers. It makes sense to check your holdings at least once a year to minimize owning the next one.