News Traders Can Use

White House, GOP celebrate passing sweeping tax bill

Republican lawmakers joined President Donald Trump on Wednesday afternoon to celebrate their largest legislative achievement of 2017, in a public ceremony spotlighting the most sweeping overhaul of the US tax system in more than 30 years.

“It’s always a lot of fun when you win,” Trump said at the ceremony on the White House lawn, after thanking congressional leaders including Senate Majority Leader Mitch McConnell and House Speaker Paul Ryan.

Why this news matters to traders: Many analysts attribute the market rally this year to hope of tax reform. Now that we have reform, it’s likely analysts will begin increasing estimates in companies set to benefit from lower rates.

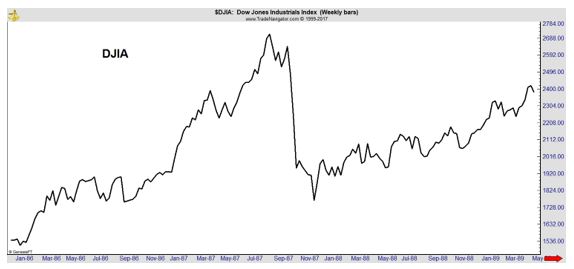

This is the largest reform package in more than 30 years and the last reform package in 1986 was followed by an extended bull market.

That rally was followed by the October 1987 crash but the crash was not related to tax reform. If history repeats, the rally following tax reform could be significant.

Airbnb Apartment Complexes Could Soon be Coming to the U.S.—Thanks to a $200 Million Investment

Airbnb has announced a $200 million investment that it says will help bring the home-sharing company’s branded apartment project to cities across the U.S. Airbnb recently teamed up with Miami-based developer Newgard Development Group to launch a brand of residential complexes called ‘Niido Powered by Airbnb’ that are specifically designed for home sharing.

Niido received the cash injection from real estate investor Brookfield Property Partners and the first $20 million is committed toward a 423-unit building in Kissimmee, Florida, which is already under construction.

“This is going to be part of the future of housing, not only in Florida, but also across the country,” Chris Lehane, Airbnb’s global head of policy and public affairs told Mercury News.

Source: Fortune

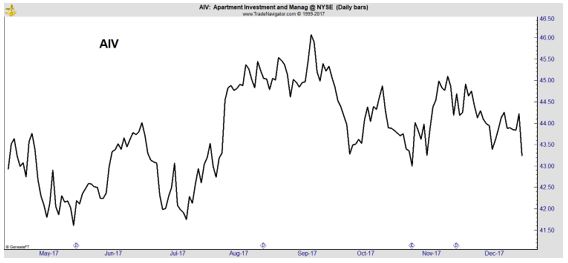

Why this news matters to traders: Airbnb is simply reacting to demand in the market place. Traders wanting to follow the company into apartments could buy Apartment Investment and Management (NYSE: AIV), a real estate investment trust or REIT.

AIV offers a yield of more than 3.2%.

SEC suspends trading of red-hot bitcoin stock

The Securities and Exchange Commission suspended trading Tuesday of The Crypto Company until January 3, citing “concerns regarding the accuracy and adequacy of information” about compensation paid to promote the firm and plans for insider sales.

Shares of The Crypto Company (CRCW) have surged nearly 160% in the past five days, more than 1,800% in the past month and 17,000% in the past three months, as investors and traders have bid up the price of bitcoin (XBT) higher and higher.

That stunning rise has lifted the company’s market value to more than $11 billion. To put that in perspective, that’s higher than the market value of well-known brand name companies like Macy’s (M), The New York Times (NYT)and Under Armour (UAA).

Source: CNN Money

Why this news matters to traders: Crypocurrencies remain a hot market but the SEC is beginning to take an interest in the industry. New regulations are a risk that investors need to consider. Penny stocks seeking to benefit from the trend could accelerate regulatory efforts.

Brexit: UK plans to soften impact on European banks

The Bank of England is to unveil plans allowing European banks to operate in the UK as normal post-Brexit. The BBC has learned that banks offering wholesale finance – money and services provided to businesses and each other – would operate under existing rules.

It means EU banks operating through branches can continue without creating subsidiaries – an expensive process. Branches offer an easy way for banks to move money around their international operations.

But they present the risk that, in the event of a financial crisis, funds are quickly repatriated to the foreign bank’s headquarters – leaving customers of the UK branch out of pocket. Subsidiaries are forced to hold their own shock-absorbing capital which can’t cut and run – they essentially become UK companies.

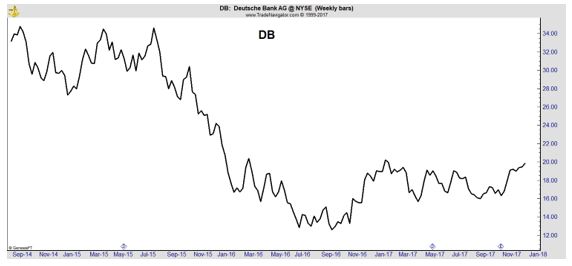

Changing from a branch to a subsidiary could cost billions for a bank like Deutsche Bank, for example, which employs 9,000 people in the UK. Currently, banks based anywhere in the EU can sell services to anywhere else in the EU thanks to an instrument known as a financial services passport. Now, that will stay the same after Brexit.

Source: BBC News

Why this news matters to traders: Lower costs could entice banks to remain in Britain. This could help boost shares of banks like Deutsche Bank (NYSE: DB) which seems to be bottoming.

As risks of Brexit diminish, new buys could emerge among banks and other sectors.

Regulators approve big banks’ living wills — with a warning

Federal regulators approved the resolution plans of the eight largest U.S. banks on Tuesday, but faulted half of them for areas that need improvement.

The Dodd-Frank Act required banks with more than $50 billion of assets to provide a detailed plan, known as a living will, of how they could be dismantled without government help if they began to fail. The plans must be signed off on by regulators.

In its latest evaluation, the regulators said the plans of the eight biggest institutions passed muster, but cited areas of improvement for Bank of America, Goldman Sachs, Morgan Stanley and Wells Fargo. All four must revise their resolution plans when they make their next submission in 2019.

Source: American Banker

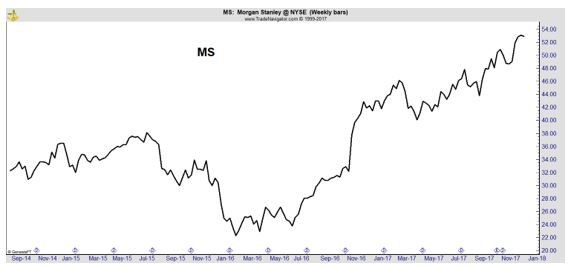

Why this news matters to traders: As the banks address the issues, their stocks could rally. For example, “the agencies criticized Morgan Stanley’s legal entity structure, which it said “contains 27 material entities,” and could increase “the inherent risk of misallocating resources.”

The agencies said that structure “raises questions about the firm’s ability to execute its strategy across a range of scenarios.” The firm was instructed to “include consideration of the risk of misallocating resources to [material entities] within its complex ownership structure and identify mitigants to that risk” in their 2019 submission.

Announcing progress related to this issue could prompt a rally in the stock.

Other banks could get similar boosts and could be considered for investment opportunities.

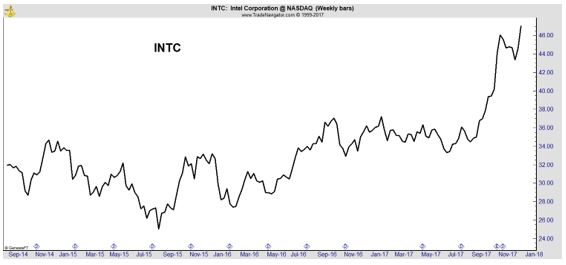

Intel CEO promises the company will ‘take more risks’ in 2018

In a year-end memo to employees this week, Intel Corp. CEO Brian Krzanich promised that 2018 would be a year of change for the company, as it aggressively explores new growth markets.

“It’s almost impossible to perfectly predict the future, but if there’s one thing about the future I am 100% sure of, it is the role of data,” Krzanich wrote, according to CNBC. “Data is becoming the most valuable asset for any company. … Anything that produces data, anything that requires a lot of computing, the vision is, we’re there.”

Intel is “just inches away” from becoming what Krzanich called a “50/50 company,” meaning that half of its revenue comes from traditional legacy products, like PC microprocessors, and the other half comes from growth markets, like artificial intelligence and self-driving cars.

“The new normal for Intel is that we are going to take more risks,” he wrote. “The new normal is that we will continue to make bold moves and try new things.”

Source: Silicon Valley Business Journal

Why this news matters to traders: Intel has been delivering gains to investors and the company’s renewed energy could allow that trend to continue.

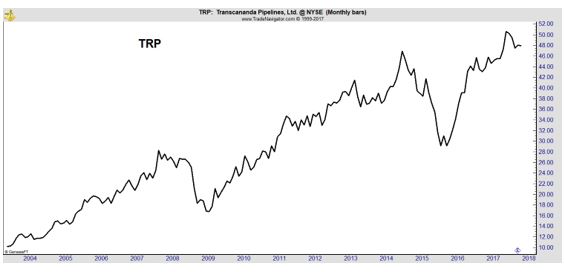

Nebraska Sticks To Keystone XL Decision

The Nebraska Public Service Commission upheld its November decision to allow the construction of the controversial Keystone XL crude oil pipeline, although it demanded a change of its route. Now the watchdog has upheld its decision in the face of opposition from the project developer, TransCanada, which wanted to build the pipeline along a shorter route.

However, Nebraska landowners who had challenged the original route considered the regulator’s decision to be a victory. Lawyers for these landowners told media after the decision was announced that it was the worst possible one for TransCanada.

Still, the Canadian company said the change of route will not have an impact on the project costs and they will remain around US$6.3 billion.

Keystone XL is planned to carry Albertan crude through Montana and South Dakota, ending in Nebraska, where it would connect to the existing pipeline network that goes on to the Gulf Coast.

The company has yet to make the final investment decision on Keystone XL, after it spent four months in open season to see if there is sufficient interest from potential buyers of the crude the pipeline will transport.

Source: OilPrice.com

Why this news matters to traders: Transcanada Pipeline is under increasing pressure to make a decision and the stock is near an important break out.

A decision would lift uncertainty from the stock and potentially spark a rally, no matter what the decision is.

Please visit our blog at InvestingSecrets.com for more stock related news and services.