Goldman Sachs Could Be the Best Choice for Income for Small Investors

Learn about Good investment ideas / opportunities for small investors, Goldman Sachs is a Wall Street legend. The company has been completing large deals for about 149 years, since the firm was founded by Marcus Goldman and Samuel Sachs in 1869. Since then, the firm has grown and generated more than $42 billion in revenue.

In the financial crisis, under pressure because of derivatives trades that suffered large losses, Goldman became a traditional bank holding company, ending the business model of an independent securities firm. This move made the company eligible for assistance from the government under the Troubled Asset Relief Program, or TARP, as it was known.

Goldman would eventually receive a $10 billion bailout in the financial crisis. But, since then the company has moved into traditional banking and it is now the fifth largest bank in the US with assets of about $930 billion.

Much of the bank’s operations are conducted through the division known as Marcus by Goldman Sachs. Marcus personal loans and online savings accounts help people find ways to be smarter with their money.

The company explained the mission of Marcus:

We listened to 10,000 people tell us about their experiences with debt. When people tried paying off their expenses using credit cards, they often got stuck in an endless cycle of high interest rates and fees. Debt happens—and it can happen to anyone. A loan from Marcus can help you better manage it.

We understand that people want to make the most out of their money. It’s why we’ve designed our savings products to truly be on our customers’ side. Whether your savings goals are Short term investment tips or long-term, we have a savings product that fits your need.

Growth for Goldman and an Investment Opportunity for Individuals

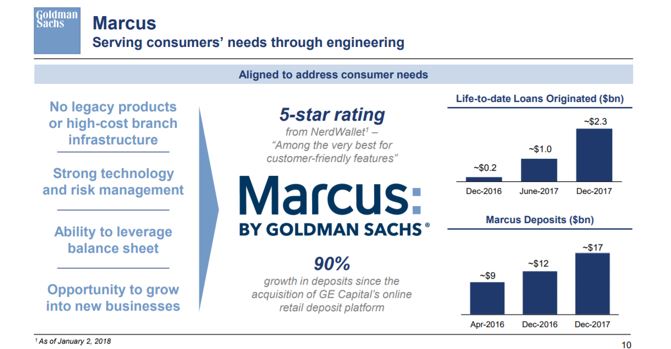

Marcus has grown rapidly. In a recent presentation to analysts, the company’s CEO Lloyd Blankfein explained that deposits have increased by 90% since April 2016.

Source: Goldman Sachs

Those deposits allow the company to fund loans and for now, Marcus has more than enough assets to cover billions in additional loans.

Loans are priced with interest rates between about 7% and 24%. The precise rate depends on a variety of factors including the applicant’s credit score and the length of the loan. But, according to Bankrate.com, an independent source of information, these rates are competitive with other lenders.

What could be most appealing about Marcus is the company’s potential as a source of passive income for smaller investors. Marcus pays above average rates of interest on its deposits.

Passive Income for Savers Remains Low

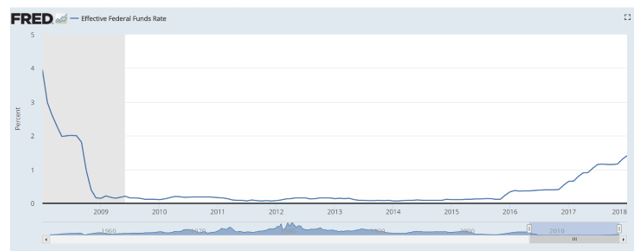

The Federal Reserve began raising short term interest rates in 2015.

Source: Federal Reserve

Since then, the Fed has boosted the target for the Federal Funds rate from a range of 0% to 0.25% to the current level of 1.25% to 1.50%.

The federal funds rate is the interest rate at which banks lend to each other overnight. Technically, the rate that the borrowing institution pays to the lending institution is determined between the two banks. The weighted average rate for all of these types of negotiations is called the effective federal funds rate.

This means that the effective federal funds rate is essentially determined by the market. However, it is influenced by the Federal Reserve through open market operations to reach the federal funds rate target.

The Fed notes that, “The federal funds rate is the central interest rate in the U.S. financial market. It influences other interest rates such as the prime rate, which is the rate banks charge their customers with higher credit ratings. Additionally, the federal funds rate indirectly influences longer- term interest rates such as mortgages, loans, and savings, all of which are very important to consumer wealth and confidence.”

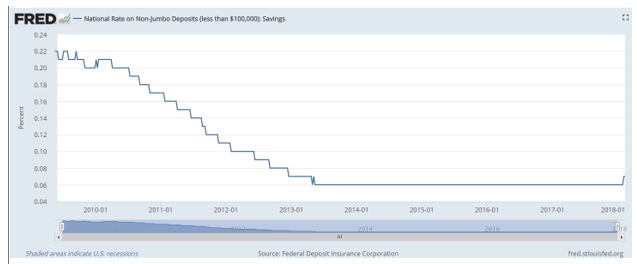

Analysts expect the Fed to push the rate higher, towards at least 2% by the end of the year. Despite the Fed’s actions, individuals are still not benefiting from higher rates. Fed data shows that banks are paying depositors an average of just 0.07% on their money.

Source: Federal Reserve

The Federal Deposit Insurance Corporation, or FDIC, confirms that individuals are securing low rates even when they are willing to commit to a five year lockup of their money in a certificate of deposit (CD).

Source: FDIC

Marcus Offers More Than 1%

Goldman’s bank is offering savers a substantial premium to the average with a savings account that pays 1.5%. In what many analysts find surprising, the accounts are targeting small investors. Goldman has traditionally focused on high net worth clients with assets of millions of dollars.

Marcus allows individuals to earn above average interest rates with a minimum deposit of just $1. There are limitations on this account that restrict the number of withdrawals per month to just six transactions.

This account would not be suitable as a substitute for a checking account but it could be useful as a source of passive income for investors looking to hold cash as an emergency reserve.

Marcus also offers CDs. Interest rates on CDs that mature in six months pay an interest rate of 0.6% while a 5 year CD pays investors 2.5%. A 3 year certificate offers investors 2%.

These are not high levels of passive income, but Marcus marks an aggressive entry into consumer finance by Goldman. The company obviously sees an opportunity to enjoy a low cost source of capital and has already obtained more than $17 billion in deposits.

Overall, the benefits to Goldman are obvious. The company is able to increase income by borrowing at low rates and lending the money at substantially higher rates. This is a proven formula for profits by banks.

This money can be used by any division of the company. Goldman’s investment bankers now have access to cheap capital for deals and its traders have access to the capital to generate profits for the parent company.

There are also obvious benefits for individual investors. The high level of passive income is important to consider. Access to Goldman is also a possible consideration. Creating an account, for as little as $1, could make the individual a client of one of the world’s largest investment banks.

For now, there is no link between the company’s research with the consumer arm of the business but if that were to change, Marcus could become a gateway to valuable information for individual investors.