Four Warren Buffett Stocks Trading Under $10

Like many investors, we spend a great deal of time studying Warren Buffett. In our research, we concluded that there are several steps to finding Buffett-style stocks:

- Find strong management teams by focusing on companies with higher than average return on equity (ROE).

- Find companies that show growth in earnings and sales to benefit from the expected growth.

- Ensure the company has an adequate return on assets (ROA).

- Ensure valuation is reasonable using metrics like the price to earnings (P/E) ratio or the price top cash flow (P/CF) ratio.

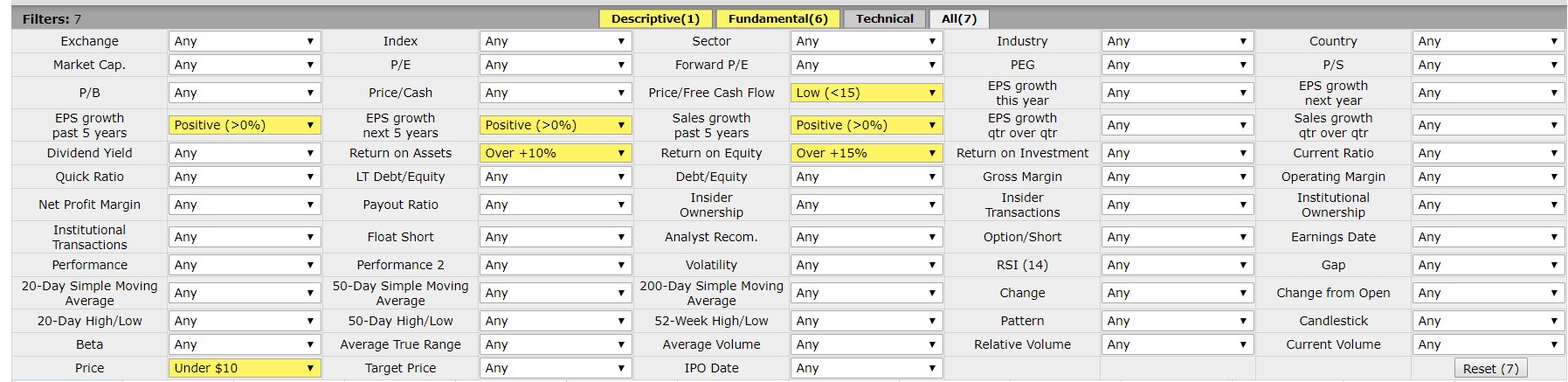

There are other ways to search for Buffett stocks. This is just one possibility and we used the free screening tool at the FinViz web site and applied the setting shown below.

Source: FinViz.com

As we noted, our screen serves as a reasonable starting point for additional research. One avenue for research is in stocks Buffett cannot buy. These include smaller companies and in our screen we found companies that have market caps of less than $10 billion.

He runs a big company, Berkshire Hathaway (NYSE: BRK-A), with a market cap of almost $500 billion Berkshire owns more than $100 billion worth of publicly traded stocks and has billions in cash on its balance sheet.

Buffett considers himself to be an elephant hunter. He is forced to focus on large cap stocks because his portfolio and company are so large.

Let’s imagine Buffett discovered a small cap stock he likes, and he invests $5 million in the company. Once he reported his ownership through Securities and Exchange Commission filings, it would be difficult to get out of the stock.

Some buyers would rush in to follow in his footsteps, decreasing the liquidity of the stock since they would be investors planning to hold for the long term. Without liquidity, Buffett would move the market against his position when he tried to exit, costing him money and taking time away from more promising investments.

Ignoring the mechanics of trading small cap stocks, Buffett faces another problem. These investments simply won’t matter to his performance.

Let’s assume the stock doubles in value and Buffett makes $5 million on his investment. This would amount to less than 0.001% of the amount of capital he manages. The gain would increase the value of his portfolio by a trivial amount. He would need to find hundreds of these investments to add 10% to the value of his stock market portfolio.

Given the small impact small investments would have on his wealth, Buffett is likely to ignore small investments.

As individual investors, we do not have this problem. A small investment can have a large impact on our personal wealth and we can invest in the smallest companies in pursuit of wealth.

To take advantage of this flexibility, we added filters to our screen to hunt for low priced stocks and we found four.

Laredo Petroleum, Inc. (NYSE: LPI) is an independent energy company. The company is focused on the acquisition, exploration and development of oil and natural gas properties, and the transportation of oil and natural gas from such properties primarily in the Permian Basin in West Texas.

Recent filings indicate LPI had assembled 127,847 net acres in the Permian Basin and had total proved reserves, presented on a three-stream basis, of 167,100 thousand of barrels of oil equivalent (MBOE).

The stock is in a persistent down trend but could be bottoming.

SRC Energy Inc (NYSE: SRCI) is also an independent oil and natural gas company. The company is engaged in the acquisition, development and production of crude oil and natural gas in and around the Denver-Julesburg Basin (D-J Basin) of Colorado.

The D-J Basin generally extends from the Denver metropolitan area throughout northeast Colorado into Wyoming, Nebraska, and Kansas. The D-J Basin contains hydrocarbon-bearing deposits in various formations, including the Niobrara, Codell, Greenhorn, Shannon, Sussex, J-Sand and D-Sand.

Filings indicate the company was the operator of 324 gross (288 net) producing wells and participated as non-operators in 307 gross (65 net) producing wells.

This stock could also be bottoming.

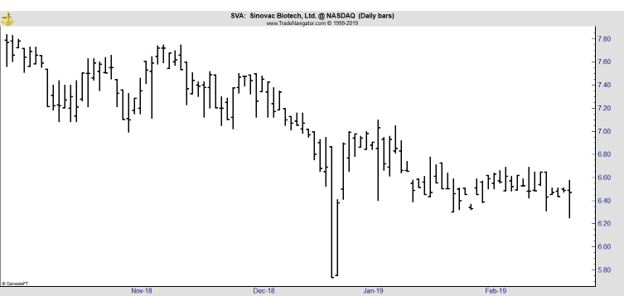

Sinovac Biotech Ltd. (Nasdaq: SVA) is a biopharmaceutical company that focuses on the research, development, manufacturing and commercialization of vaccines that protect against human infectious diseases, including hepatitis A, hepatitis B, seasonal influenza, Haemagglutinase5 Neuraminidase1 (H5N1) and Influenza A (H1N1) pandemic influenza and mumps.

The company’s pipeline consists of vaccine candidates in the clinical and pre-clinical development Phases in China. SVA is engaged in the sales, marketing, manufacturing and development of vaccines for infectious disease.

Sinovac develops various products, including Healive, Bilive, Anflu, Panflu Whole Viron Pandemic Influenza Vaccine, Split Viron Pandemic Influenza Vaccine, Panflu.1, RabEnd, Mumps Vaccine, Enterovirus 71 (EV71) Vaccine, Pneumococcal Polysaccharide Vaccine, Pneumococcal Conjugate Vaccine, Rubella Vaccine, Varicella Vaccine and Sabin Inactivated Polio Vaccine.

SVA can be a volatile stock.

180 Degree Capital Corp., (Nasdaq: TURN) is a non-diversified management investment company operating as a business development company. The company’s investment objective is to achieve long-term capital appreciation by making venture capital investments.

TURN specializes in making investments in companies commercializing and integrating products enabled by disruptive technologies mainly in the life sciences industry. The company provides operational and management resources, and financial solutions to such companies.

Its investment portfolio includes publicly traded and privately held companies and its investments are focused on transformative companies in precision health and medicine

This stock is also volatile.

These are just the companies that made it through our initial, quantitative screen as ideas that are worth additional research. Any one of these stocks could be considered a buy in the current stock market but all have risk and there is no guarantee any of them can deliver Buffett-like returns.

However, it could be useful to think like Buffett and to focus on aspects of a company’s valuation that Buffett has written about. These include the importance of cash flow since a company needs cash flow in order to reinvest in its operations and growth. Focusing solely on the P/E ratio as some investors do could miss companies like the ones we identified above.

Did you know that dividends have rewarded investors for at least 100 years, at least since John D. Rockefeller said, “Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.”

We have prepared a special report about dividends that you can access right here.