Experts Say These Are the Best Income Investments

Sometimes, we all need expert advice. This is obvious, but we don’t always want to accept it. Investors may find that they can succeed in the stock market without expert advice.

That’s largely because the same information is available to all investors. In stocks, there is a level playing field to some degree, at least as far as access to information is concerned. Professionals will have some advantages as far as speed of access to information and speed of execution of trades.

But, in some other investment areas, the playing field isn’t as level. This is particularly true for income investments. Real estate, for example, is one market where experts might have access to more capital and can make better deals than many individuals.

Fixed income markets are another area where experts might have an edge related to access to capital and access to information. That means in this market it could be useful to check in with the experts from time to time.

Experts Agree That Rates Will Create Challenges

One area of agreement exists on the topic of interest rates. Rates are low.

Source: Federal Reserve

Those low rates present several potential challenges for fixed income investors.

There is widespread agreement that low rates result in low income. That means access to capital and information can be important. Individuals might be forced to accept low yields while experts might be able to structure investments that can boost their yields.

But, risks exist even with simple strategies. For example, one advisor recently told Barron’s:

“The bond math is more forgiving for low-duration funds. With short-term rates at 2%, and likely to average 2.25% through the rest of the year, investors could generate a total return of 1.25% in short-term funds if rates were to rise by a point, says Chris Zaccarelli, chief investment officer of Independent Advisor Alliance, a network of advisors with $3 billion under management.

Zaccarelli has cut his clients’ portfolio duration from seven or eight years to three to four years to protect against rate risk. “Owning bonds is a no-brainer,” he says, “but we’re doing it in a way where there’s less of a headwind from rates.””

Duration is a measure of interest-rate sensitivity; the higher a bond’s duration (measured in years), the more its price will fall as rates rise. For example, in a fund or bond with a duration of six years, investors would lose 6% in principal if rates were to rise by one percentage point.

So, although investors would welcome higher interest rates on one hand, they will suffer losses on their existing investments as rates rise.

The Best Investments, According to Experts

Many investors have moved beyond mutual funds, so to speak. They have increasingly turned to exchange traded funds (ETFs) because of the advantages of ETFs which include liquidity and low fees. However, mutual funds can still be useful to meet investor’s objectives.

One short-term fund that Zaccarelli, the investment manager cited by Barron’s, likes is Thompson Bond (ticker: THOPX), an investment-grade fund with a duration of 1.1 years and a 3.4% yield.

Zaccarelli also noted that Semper Short Duration (ticker: SEMRX), an ultrashort fund, yields 2% and has returned 1.1% this year. With a duration of three months, it has held up well, beating 93% of peers, according to Morningstar.

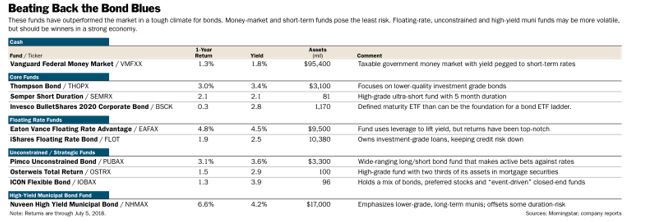

Other specific investment recommendations are summarized in the table below.

Source: Barron’s

The list includes floating rate bank loan funds. As a group, these funds have gained an average of 1% this year, “one of the few parts of the market to stay in positive territory. The loans are short-term senior secured debt with coupons that adjust at regular intervals, based on prevailing short-term rates.

Much of the floating-rate market consists of junk-rated issuers. But the debt is typically secured by assets (unlike unsecured high-yield bonds). Default rates are low and probably won’t increase for another 12 to 18 months, preceding the next recession, says O’Neil.

Eaton Vance Floating Rate Advantage (ticker: EAFAX), a top performer, is up 2.5% this year. The fund uses leverage, or borrowed money, to juice its yield, heightening risk.

But it’s run by a veteran group of analysts and managers who have delivered top-notch returns, landing in the top 1% of the category over the past decade, according to Morningstar.

Among ETFs, iShares Floating Rate Bond (FLOT) focuses on higher quality, investment-grade notes, reducing credit risk (in exchange for a lower yield).”

Another Potential Solution to the Low Yield Conundrum

Experts agree that bond ladders are a good way to create a predictable income stream from bonds (or exchange-traded funds) that mature at different intervals. This is a strategy that adapts to changes in the interest rates by allocating part of the portfolio to different maturities.

Over time, bond ladders help reduce risks. Other advantages include the fact that ladders are flexible and allow investors to take as much interest rate and credit risk as they wish, instead of leaving those decisions to a fund manager.

A bond ladder also allows investors to rapidly adjust the portfolio themselves if their income needs change or rates make a big move. Although ladders could consist of individual bonds or Treasuries, they could also be built with ETFs.

For example, analysts note that investors could place 25% in the Invesco BulletShares 2020 Corporate Bond ETF (NYSE: BSCK) and add 25% each to three more BulletShares ETFs maturing in 2021, 2022, and 2023.

This would provide the investor with a high quality, short term portfolio with a current yield of about 3.3% yield and a duration of about three years. Remember that duration describes the risk of loss so in this case, a 1% increase in interest rates should be expected to result in a 3% loss of principal.

With the bond ladder outlined above, when each ETF matures, investors could reinvest the capital, taking advantage of higher yields if market rates continue to rise. Other ETFs are also available that allow an investor to build a similar portfolio or a portfolio that meets their needs.

Fixed income investors might need to think creatively, and consider expert advice, given the current low interest rate environment and the risk that yields will rise.