Emerging Markets Could Be Leading Global Markets

Emerging markets, as a group, remain more than 20% below their recent peak. A decline of 20% is the commonly accepted definition of a bear market. And, now, by that measure emerging markets are in bear market mode.

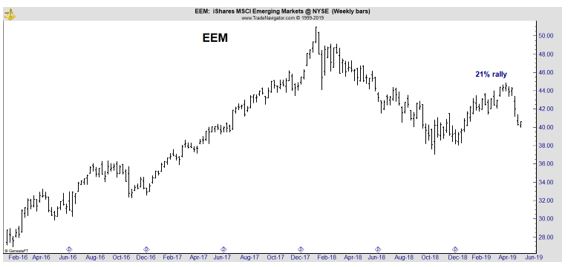

To measure emerging markets as a group, traders can turn to the iShares MSCI Emerging Markets ETF (NYSE: EEM). The chart of EEM is shown below.

After a 21% rally earlier this year that sparked hopes of a new bull market, the down turn has resumed.

Before digging into what the drop means, it could be helpful to define the terms. An emerging market is a country that has some characteristics of a developed market but does not satisfy standards to be termed a developed market.

This includes countries that may become developed markets in the future or were in the past. The economies of China and India are considered to be the largest emerging markets.

Emerging markets fit between developed markets and “frontier markets,” a term used to describe developing countries with slower economies than those that are considered to be emerging. This can all be confusing, so economists have tried to refine the definition.

Some definitions require an emerging economy to display the following characteristics:

- Intermediate income: its PPP per capita income is comprised between 10% and 75% of the average EU per capita income.

- Catching-up growth: during at least the last decade, it has experienced a brisk economic growth that has narrowed the income gap with advanced economies.

- Institutional transformations and economic opening: during the same period, it has undertaken profound institutional transformations which contributed to integrate it more deeply into the world economy. Hence, emerging economies appears to be a by-product of the current globalization.

But that definition, more than 50 countries, representing 60% of the world’s population and 45% of its GDP, are emerging. The ten largest Ems are, in alphabetical order, Argentina, Brazil, China, India, Indonesia, Mexico, Poland, South Africa, South Korea and Turkey.

Turmoil Is Spread Around the World

Often when emerging markets make a large price move, there is one region that stands out. That’s not the case right now. Problems in Turkey, Argentina and South Africa are ongoing and potentially serious.

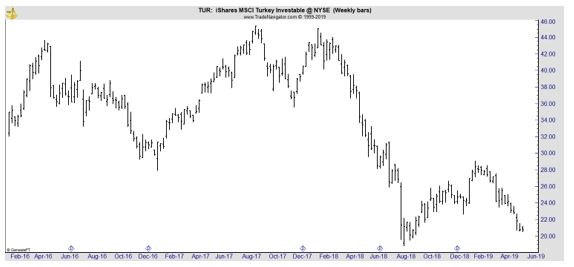

iShares MSCI Turkey ETF (NYSE: TUR) is still more than 55% below its 2017 high.

Turkey is in the midst of a little noticed financial crisis. As Al-Montor.com reports, “The two main actors in the economic crisis gripping Turkey are the central bank, which runs the state’s monetary policies, and the Treasury, which is in charge of fiscal policies.

The central bank is ostensibly independent, while the Treasury is attached to Treasury and Finance Minister Berat Albayrak, who is also President Recep Tayyip Erdogan’s son-in-law.

Those who follow how things work on the ground are well aware that the central bank does not act independently and is subject to direct and indirect government meddling. The bank has long felt compelled to seek Erdogan’s blessing in its interest rate decisions.

Recently, it has come under pressure to let the Treasury use its resources and — again, at Albayrak’s behest — do something it should never do, namely directly or indirectly intervene in the foreign exchange market.

The bank’s role in foreign currency sales by Treasury-controlled public banks, aimed at curbing the slump of the Turkish lira, is a case in point.

The central bank’s transfer of funds to the Treasury is even more intriguing. Such transfers are not something new — in fact, they are required by law, given that the bank is ultimately a state-owned company that transfers part of its profits to the Treasury.

This year, however, the transfer that was due in April was brought forward to January via a legal amendment ahead of the March 31 local polls. As a result, the Treasury — saddled with major deficits due to the government’s preelection populism — was able to get early some 34 billion liras ($5.6 billion) instead of borrowing on high interest rates.

The Treasury has now reportedly set an eye on the central bank’s legal reserves, which represent 20% of its profits and a sum the bank sets aside by law to use in extraordinary circumstances.

There are legal obstructions to the move, but given the government’s record on respect for the law, many are convinced it would not be discouraged by legal hurdles. Its only reservation seems to be that such a blood transfusion would lay bare the Treasury’s desperate situation for all to see, including the foreign money markets.”

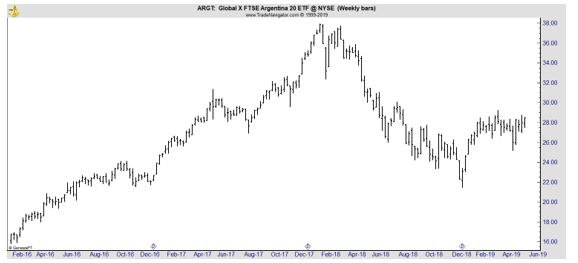

There is a more traditional crisis in Argentina. Global X FTSE Argentina 20 ETF (NYSE: ARGT) is about 25% below its 2017 highs.

Here, the IMF is trying to bail out the country and the Financial Times notes, “When the IMF completed its third review of Argentina’s economy in early April, managing director Christine Lagarde boasted that the government policies linked to the country’s record $56bn bailout from the fund were “bearing fruit”.

Less than a month later, amid darkening political prospects for incumbent president Mauricio Macri, the country’s currency crisis reignited and bond yields spiked, threatening not only the IMF’s Argentina programme but its reputation and that of its leader.”

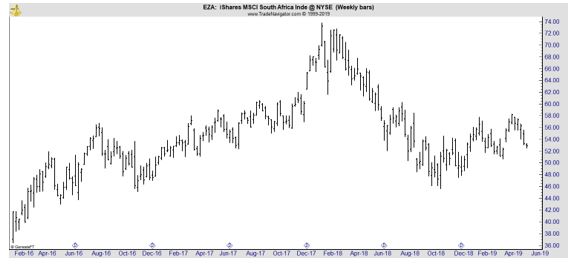

iShares MSCI South Africa Index ETF (NYSE: EZA) is almost 30% below its 2017 highs as populist policies in that country threaten economic growth.

These three countries show that this crisis is different than other crises in the past. For example, in 2008, there was a common problem in emerging markets and developed economies as a credit crisis threatened the financial system.

That’s not the case this time and that indicates there could be different factors to consider when trading.

Safety Could Become Important

Traders are generally thinking about the possible returns on their capital. In other words, they are seeking opportunities to earn rewards of perhaps 10% a year on their investment accounts. In times of crisis, they often start to consider the importance of return of their capital.

When crises and bear markets hit, traders become increasingly concerned about losses of capital. They can react by putting their capital into investment opportunities that appear to be the safest. This explains why Treasury securities often rise in price when the stock market crashes.

In the current market environment, the crises are geographically diversified. Few stock markets around the world are in decisive bull markets with major stock market indexes at or near new all time highs. One market trading near new highs is the US stock market.

That means the US could offer safety to traders and markets in the country could benefit from a flight to safety trade. This could benefit large cap US stocks, the ones included in the S&P 500 index, for example, and US Treasury securities.

Treasuries could be beneficiaries of increased cash flow since they offer safety and the Federal Reserve is one of the few central banks in the world raising rates. That could make the market attractive to overseas investors.

In fact, that is what happened in the previous two emerging market bears. This is the third time EEM has fallen by at least 20% in the past ten years. Neither of the previous bears resulted in a bear market for US stocks.

In 2011, the S&P 500 Index fell 17.8% during the emerging market bear market. In hindsight, that was a buying opportunity for US investors.

The next emerging market bear developed in 2014. That time, the S&P 500 fell less than 7%. US stocks then rallied 12% before selling off by 12% as the emerging market continued for 16 months.

This time is probably the same as the other two times. US stocks could pull back but a bear market in the US won’t start until the US economy contracts. For now, there’s no sign of that.