Earnings Peaked, And This Is Important, But Overlooked, News

Earnings season is underway. With about half of the companies in the S&P 500 having delivered their results for the fourth quarter, the results are mixed. There’s just no clear conclusion to draw from the news, but there is a clear pattern to the trading and to the future.

Let’s start with a look at what has been reported so far.

Earnings Summary

- Of the companies in the S&P 500 that have reported, 70% beat analysts’ estimates for earnings per share (EPS). This is below the one-year (77%) and five-year average (71%).

- EPS reports are 3.5% above expectations, on average. This is below the one-year (6.0%) and five-year average (4.8%).

- Of the companies that have reported so far, 62% beat analysts’ expectations for revenue. This is below the one-year average (72%) and above the five-year average (60%).

- Sales are 0.8% above expectations. This is below the one-year average (1.4%) and above the five-year average (0.7%).

But, beat or miss, stocks are rallying on the news.

Market Reaction

According to FactSet,

“Market Rewarding Positive and Negative Earnings Surprises

To date, the market is rewarding both positive and negative earnings surprises. Companies that have reported positive earnings surprises for Q4 2018 have seen an average price increase of +2.3% two days before the earnings release through two days after the earnings release.

This percentage increase larger than the 5-year average price increase of +1.0% during this same window for companies reporting positive earnings surprises.

Companies that have reported negative earnings surprises for Q4 2018 have seen an average price increase of +0.8% two days before the earnings release through two days after the earnings release.

This percentage increase is an improvement relative to the 5-year average price decrease of -2.6% during this same window for companies reporting negative earnings surprises.”

In other words, traders seem to be buying anything. That is a potential indicator of exuberance and could show that the bounce in the S&P 500 index since the end of December has gone too far. This would be especially true if earnings growth is to slow.

Looking Ahead

Overall, FactSet notes the last quarter of 2018 is looking like a strong quarter for earnings. “For Q4 2018, the blended earnings growth rate for the S&P 500 is 12.4%. If 12.4% is the actual growth

rate for the quarter, it will mark the fifth straight quarter of double-digit earnings growth for the index.”

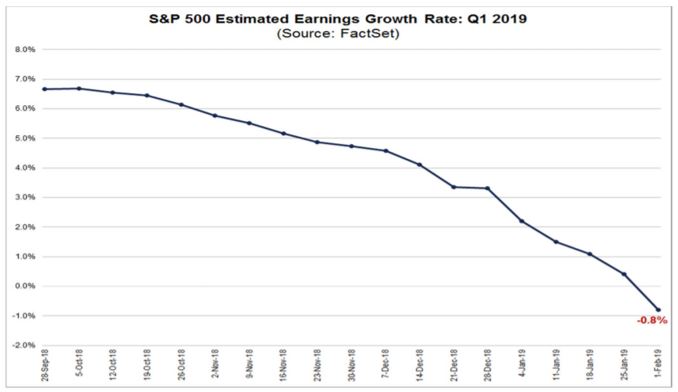

But, FactSet reports that the outlook for the current quarter is less promising. Analysts now expect a decrease in earnings for the first quarter of 2019.

Because of the downward revisions to EPS estimates during the month, the S&P 500 is now projected to report a small year-over-year decline in earnings (-0.8%) for the first quarter. However, earnings estimates for the first quarter have been falling for the past few months.

On September 30, the estimated earnings growth rate for Q1 2019 was 6.7%. On December 31, the estimated earnings growth rate for Q1 2019 was 3.3%.

Source: FactSet

“During the month of January, analysts lowered earnings estimates for companies in the S&P 500 for the first quarter.

The Q1 bottom-up EPS estimate (which is an aggregation of the median EPS estimates for all the companies in the index) dropped by 4.1% (to $38.55 from $40.21) during this period. How significant is a 4.1% decline in the bottom-up EPS estimate during the first month of a quarter?

How does this decrease compare to recent quarters?

During the past five years (20 quarters), the average decline in the bottom-up EPS estimate during the first month of a quarter has been 1.6%. During the past ten years, (40 quarters), the average decline in the bottom-up EPS estimate during the first month of a quarter has been 1.8%.

During the past fifteen years, (60 quarters), the average decline in the bottom-up EPS estimate during the first month of a quarter has been 1.7%. Thus, the decline in the bottom-up EPS estimate recorded during the first month of the first quarter was larger than the 5-year, 10-year, and 15-year averages.

In fact, the first quarter marked the largest decline in the bottom-up EPS estimate during the first month of a quarter since Q1 2016 (-5.5%).

If the index reports an actual decline in earnings for the first quarter, it will mark the first year-over-year decline in earnings since Q2 2016 (-3.1%)

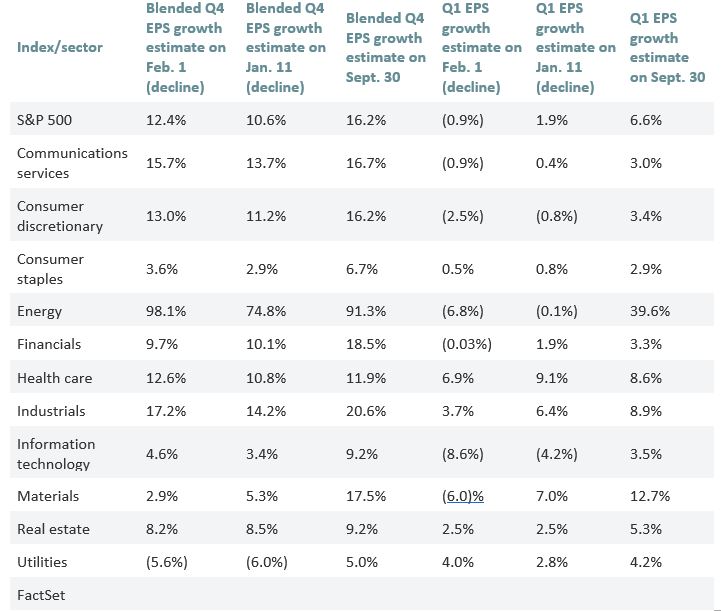

MarketWatch noted the changes have carried by sector. “The following table shows what analysts expected through Friday in terms of year-over-year EPS growth for the S&P 500 and each of the S&P 500’s 11 sectors for the fourth and first quarters, as well as the change in estimates since Jan. 11 and Sept. 30.”

This is all an indication that caution is warranted in the current market. Indiscriminate buying is unlikely to be rewarded in an environment when earnings growth is slowing and, in fact, many companies are likely to report year over year declines in earnings in the current quarter.

Some of the decline can most likely be attributed to robust earnings in 2018 due to the passage of tax reform that changed a number of accounting factors. Those were, in effect, one-time gains. Now, there is a reversion to normalcy and that comes at potentially a bad time for investors.

Did you know that dividends have rewarded investors for at least 100 years, at least since John D. Rockefeller said, “Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.”

We have prepared a special report about dividends that you can access right here.