Demographics Highlight an Income Opportunity

Demographics are destiny, according to some analysts. This idea extends far beyond the stock market. Politicians follow demographic trends and some cynics might say they pander to those trends. Other analysts might argue politicians are forced to tailor policies to demographics.

For example, Social Security is an important issue because it involves a large group of citizens who vote and because it impacts the budget. A politician, who is also a policy maker, cannot ignore either of those factors. Voters do affect the budget and the budget affects voters. The two are inseparable.

This means we can take the emotions out of demographics and consider the economic implications of shifts in the population. Economic factors are often linked to the financial world and income opportunities are available to investors understanding demographics.

Housing Shifts Create Opportunities

Investors should consider many of the demographic shifts that are underway. Among those are young people burdened with student debt, older people seeking smaller homes to reduce their tax burdens and cost of living, and families forced to share space with other family members because of low wages.

The picture can seem discouraging. But, it also presents opportunities. Many situations involve smaller living spaces than desired. Young people burdened by student debt may be forced to live in a small apartment, for example.

This can lead to placing items in storage and that means using local self storage facilities.

There is an asset class for these facilities known as self storage REITs.

A REIT is a real estate investment trust. A REIT will trade like a stock on an exchange but the underlying asset is a trust rather than an operating company.

REITs own real estate in the trust and are obligated to pass substantially all of their cash flow to investors. The REIT itself is tax advantaged and the cash flow is subject to taxes at the individual’s rate, after substantial accounting adjustments that often reduce the tax burden.

From an investor’s perspective, a REIT is an income investment. The underlying value of the real estate may appreciate and that would add to the potential returns, but REITs are valued for their steady and relatively high levels of income.

Self Storage REITs

The class of self storage REITs allows investors to target their investments towards storage facilities. These are different than many other kinds of real estate.

Apartment complexes are also available through REIT structures. Investors receive substantially all of the REIT’s cash flow as they do with any REIT. But, an apartment complex will require maintenance. And, evicting nonpaying clients could take time and carry high costs.

These costs, and many other costs for repairs and upkeep, reduce the amount of cash flow available for distribution to investors. Self storage facilities have low costs.

Many self storage facilities are inexpensive construction projects. They are generally windowless buildings based on rather large open frame construction designs that are then divided into individual storage spaces.

Many are unheated. Some even lack electricity with all unit doors opening to the outside to eliminate the need for hallway lighting. Doors with locks are the only parts of the buildings that could require repair in the normal course of operations.

Another advantage of these facilities is that they often have lower tax bills than other properties. Self storage facilities can be located in areas with less stringent zoning requirements and therefore have lower tax bills, at times.

However, that advantage may only extend to current assets. As local communities face increasing financial stress, many have limited construction of low cost facilities.

A visible example in many communities is trailer parks which offer affordable, high density housing but face numerous zoning restrictions. Self storage facilities are, in some areas, facing similar restrictions as communities seek to develop a higher tax base with more housing and office space.

This adds to the attractiveness of current self storage REITs.

Specific Strategies

One way to obtain a low cost exposure to the REIT sector is with exchange traded funds. Vanguard Real Estate Index Fund (NYSE: VNQ) is a $56 billion ETF with broad holdings including self storage REITs along with apartment and office complexes and other types of real estate.

Among the largest self storage REITs are CubeSmart (NYSE: CUBE) Extra Space Storage (NYSE: EXR), and Public Storage (NYSE: PSA).

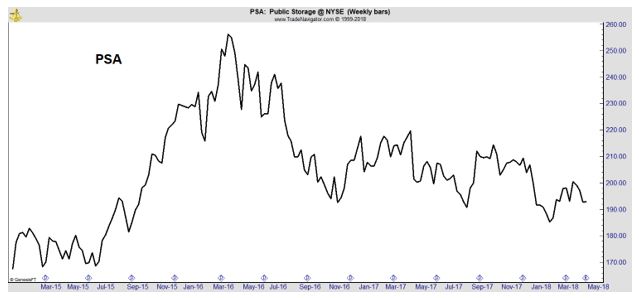

PSA is among the largest REITs with a $33 billion market cap. It offers a dividend yield of about 4%. The stock price has been in an extended trading range.

The stock price is relatively high, near $200 a share, and that could make this REIT less attractive to smaller investors. Buying several shares of a high priced stock can reduce a small investor’s ability to diversify their portfolio.

To reduce the impact of this problem, some smaller investors use options. Buying call options, for example, would allow an investor to potentially participate in upside gains in price, but that may not be a prudent choice for REIT investors.

REITs are largely considered to be income investments and the owner of an option does not receive income on their investment. Additionally, an income investment will generally not make large price moves and that will limit the up side potential of options.

For self storage REITs, it could be best to simply look at smaller offerings with stable income that offers above average yields.

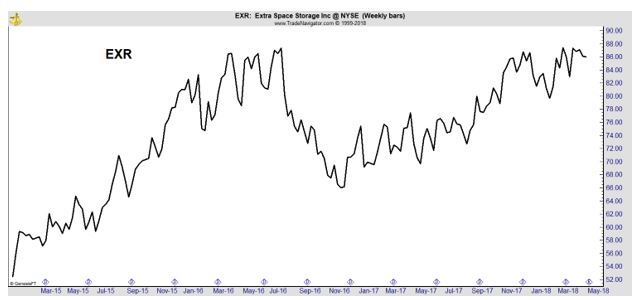

ESR has a market cap of more than $11 billion and a yield of about 3.6%. The price has been in a steady uptrend and could be positioned to challenge its all time highs.

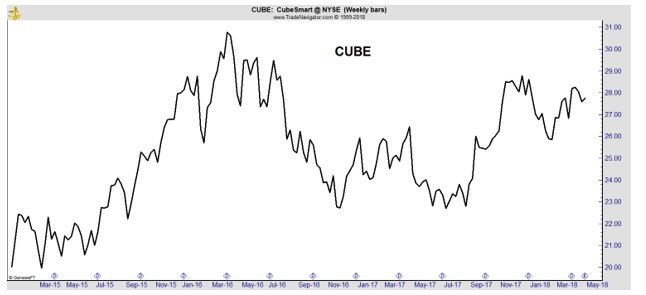

CUBE has a market cap of more than $5 billion and a yield of more than 4%. The share price has been in a trading range for more than two years.

Downside risks are most likely limited to the lower edge of the trading range where support is likely to hold prices.

There are other self storage REITs but several are not very liquid. Liquidity is a measure of trading volume and shows how easy it might be to sell. Low liquidity means it could be difficult to sell in a market decline and should generally be avoided by income investors.

The REITs highlighted above offer income opportunities with relative safety and could be an excellent opportunity for income investors.

To learn more about other market related investments and products, Click Here.