Cybersecurity Could Be the Next Big Thing for Investors

No matter what your political opinion is, if you follow politics you understand there is a potential threat to the election process. The degree of the threat isn’t secure, and the potential source is also unclear. But, as local election boards move to voting machines instead of paper ballots, the threat of hacking those machines becomes real.

While elections are a threat that is in the headlines, the reality is that almost everything in modern society is at risk of hacking. Every corporate server is a potential target of hackers and home networks can be a target.

But, less understood is the fact that other targets exist. Many cars are connected to networks that push upgrades to systems and correct errors in previous versions of software. Even systems within the car are connected via network connections.

Fears of hacking even extend into our bodies. Last year, “The Food and Drug Administration (FDA) recalled 465,000 pacemakers after discovering security flaws that could allow hackers to reprogram the devices to run the batteries down or even modify the patient’s heartbeat, potentially putting half a million patients lives at risk.”

An Industry to Fight the Cyber Threats

As networks become increasingly important, a new industry has grown up to combat the threats. Stocks in the cybersecurity sector could be excellent long term investments since these threats will not subside in the future. In fact, cyber threats are likely to increase.

Leading stocks in the industry include:

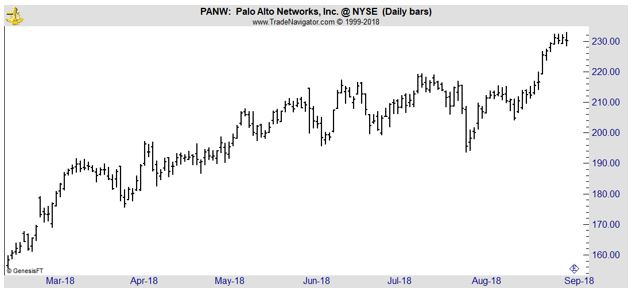

Palo Alto Networks, Inc. (NYSE: PANW)

PANW provides firewall appliances and software; Panorama, a security management solution for the control of appliances deployed on an end-customer’s network as a virtual or a physical appliance; and Virtual System Upgrades, which are available as extensions to the virtual system capacity that ships with physical appliances.

It also offers subscription services covering the areas of threat prevention, uniform resource locator filtering, malware and persistent threat, laptop and mobile device protection, and firewall, as well as cyber-attack, threat intelligence, and content control.

In addition, the company provides support services; and professional services, including application traffic management, solution design and planning, configuration, and firewall migration, as well as online and classroom-style education training services.

The stock has been a market leader for some time.

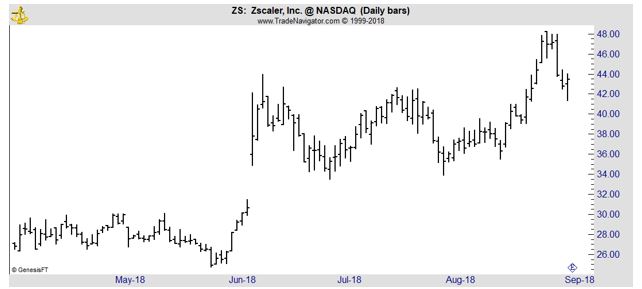

Zscaler, Inc. (Nasdaq: ZS)

ZS operates as a cloud security company worldwide. The company develops a software-as-a-service based security platform that secures access for users and devices to applications and services.

It serves airline and transportation, conglomerate, consumer good and retail, financial service, healthcare, manufacturing, media and communication, public sector and education, technology, and telecommunications service industries.

SailPoint Technologies Holdings, Inc. (NYSE: SAIL)

SAIL designs, develops, and markets identity governance software solutions in North America, Europe, and the Asia Pacific. The company offers on-premises software and cloud-based solutions, which empower organizations to govern the digital identities of employees, contractors, business partners, and other users, as well as manage their constantly changing access rights to enterprise applications and data across hybrid IT environments.

Its solutions include IdentityIQ, an on-premises identity governance solution; IdentityNow, a cloud-based multi-tenant governance suite; SecurityIQ, an on-premises identity governance for files solution that secures access to data stored in file servers, collaboration portals, mailboxes, and cloud storage systems; and IdentityAI, a cloud-based identity analytics solution for organizations to detect potential threats before they turn into security breaches.

This stock has also been a market leader.

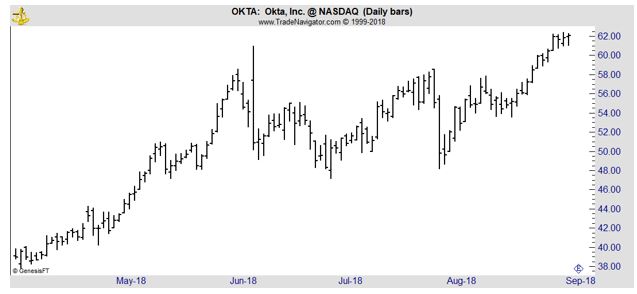

Okta, Inc. (Nasdaq: OKTA)

OKTA provides identity solutions for enterprises, small and medium-sized businesses, universities, non-profits, and government agencies in the United States and internationally. The company offers Okta Identity Cloud, a platform that offers a suite of products to manage and secure identities, such as Universal Directory, a cloud-based system of record to store and secure user, application, and device profiles for an organization; Single Sign-On that enables users to access their applications in the cloud or on-premise from various devices with a single entry of their user credentials.

The stock price is breaking resistance and could be set for a significant move.

Fortinet, Inc. (Nasdaq: FTNT)

FTNT provides broad, automated, and integrated cybersecurity solutions worldwide. It offers FortiGate hardware and software licenses that provide various security and networking functions, including firewall, intrusion prevention, anti-malware, virtual private network, application control, Web filtering, anti-spam, and WAN acceleration; and FortiSandbox technology that delivers proactive detection and mitigation services; and FortiSIEM family of products, which offers a cloud-ready security information and event management solution for enterprises and service providers.

The stock has been in a strong up trend and a pull back is possible after the sharp gain.

Any of these stocks could be a winner. But, there is no guarantee any stock will increase in value. Therefore, it is important to consider diversifying which could require owning several of these companies.

Investors who want a diversified exposure to the industry can consider the ETFMG Prime Cyber Security ETF (NYSE: HACK). This exchange traded fund offers a way to benefit from the growth of cyber security without needing to pick the potential winners in the sector.

It is also important to have a risk management strategy for all investments. Some investors manage risk with stop loss orders. This strategy requires placing sell orders below the entry price of a position. For example, an investor could place an order to sell if prices fall by 10% or 20%.

In a fast moving market, stop loss orders could be executed significantly below the desired price level. To avoid that risk, some investors manage risk by position sizing.

For a position sizing strategy, the investor allocates a set percentage of the account to each position and accepts the fact they could lose the entire amount. This could be implemented by allocating 2% or 5% of the account to each position. Position sizing may require a large account.

Investors could also consider using call options. These are available at prices significantly below the price of the stock and could deliver large gains if the stock moves higher before the option expires. Call options could be used by long term investors by simply purchasing new calls whenever one expires.

These strategies could help investors benefit from the cyber security sector without suffering excessively large losses if the sector crashes.