Could This Be the Time to Buy Cryptocurrencies ?

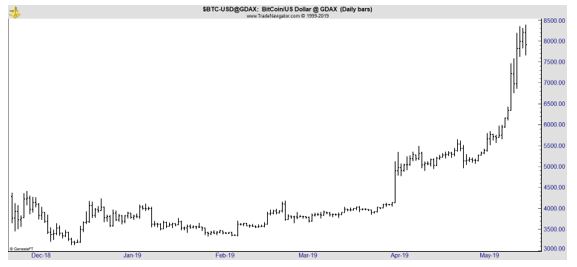

Bitcoin and other cryptocurrencies have enjoyed a bull market recently. As Barron’s noted,

“After trading around $4,000 for the first three months of 2019, Bitcoin took off at the beginning of April and almost doubled in a month and half, briefly trading above $8,000 [last week].

Then, Bitcoin’s price suddenly fell 9.5%, dropping from $7,720.90 to $6,985.13 in the space of 30 minutes. Bitcoin recently traded at $7,170.

“The level of the pullback is actually picture perfect. So far, the top cryptoassets have come down about 10 [percent] from their recent highs,” Mati Greenspan, an analyst at the trading company eToro, said Friday morning.

If Bitcoin’s slide “stops soon and turns around,” he said, “there is virtually no major resistance on the chart until $20,000.”

Bitcoin’s sharp rise over the last few weeks has been attributed by some analysts to the ongoing U.S.-China trade war.

Harpal Sandhu, chairman of Mint Exchange, told Barron’s earlier this week that based on the trade flows he has observed, investors in China have been selling yuan to move into bitcoin and other currencies ahead of a trade war. “This is capital flight coming out of China because of trade,” he said.

Bitstamp, a European exchange, blamed the crash on a massive, single seller. “A large sell order was executed on our BTC/USD pair today, strongly impacting the order book,” the company tweeted. “Our system behaved as designed, processing and fulfilling the client’s order as it was received.”

Another factor that Bitcoin analysts think helped to drive up the price is the charges filed by the New York State Attorney General Tish James against the owners of Bitfinex, a cryptocurrency exchange.

James said that Bitfinex executives raided the reserve fund of Tether, a so-called stable coin that is designed to trade at a constant value, of $850 million. Those charges, the theory goes, caused a flight out of Tether and into Bitcoin in a sort-of intra-crypto flight to safety.”

Another reason could be the possibility of a recession.

With concerns of recession mounting, now could be an ideal time to buy into the market.

Cryptocurrencies haven’t really seen a recession. Barron’s reported, “This new, decentralized asset class was born at the tail end of the housing crisis, and has yet to experience the full force of a recession or even lengthy bear market.

For years, digital assets have existed in a period of market expansion in the United States. Gross Domestic Product (GDP) has increased significantly, bringing total average GDP growth from -1.73% in 2009 to 3.138% in 2017; and unemployment has dropped from 10% to 4%, with more than two million jobs created each year for the past eight years.

Unfortunately, what’s been a positive sign for upward trends in traditional markets has had an adverse impact on the mainstream appeal of digital assets.

Because the economy has steadily improved throughout the industry’s life-span, some more casual observers have failed to fully appreciate how the intrinsic qualities of blockchain-based assets (e.g., decentralization, immutability, and bespoke structures) may benefit them.

As a result, many have erroneously assumed all digital assets are functionally interchangeable, and will all react the same way to economic fluctuations.

As is the case with any industry, companies weathering the impact of a severe market correction are, understandably, going to react differently based on their business models, leverage, and market capitalization.

That’s not to say we’ll know exactly what will happen during a recession—it’s perfectly plausible, if not likely, that there will be at least some material degree of performance correlation between various digital assets.

However, what’s more likely is that we’ll begin to see certain digital assets, each equipped with their own unique value proposition, begin to separate themselves from the pack and gain momentum as a result of their inherent structural value, not merely from speculation or the rising tide of a bullish cryptocurrencies market.

Faced with a recession, Bitcoin may serve a market function similar to that of a safe-haven commodity, rather than an equity, due to its inherent scarcity and decentrality. Bitcoin, by design, is not intended to be used as a foundation on which developers could build a platform or enterprise.

Because its supply is not controlled by any one person or entity, it’s more likely that Bitcoin will perform independently of broad market pressures (akin to how one would expect gold to react)—potentially even appreciating in value should demand for alternative forms of dependable value storage arise.

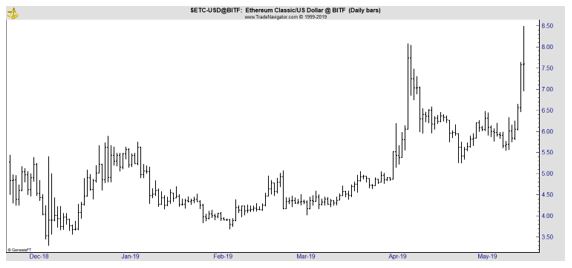

By contrast, Ethereum is far more likely to follow market trends. That’s because its platform allows other companies to build products on top of the Ethereum protocol, putting significant onus on mainstream investors to keep products afloat.

If the investors suffer, the companies suffer, which causes Ethereum to suffer as a result. Because Ethereum is a developer-focused blockchain, it’s very much dependent on how many companies use the Ethereum platform to build their projects.

If those companies were to go out of business, Ethereum’s relevance and, subsequently, its price, would undoubtedly be affected. That’s not to say Ethereum is structured similarly to equity markets by any means, but it’s more closely entangled with equity markets than most other digital assets.

Ripple’s XRP is a payments-focused digital asset that currently has the third largest capitalization in the crypto industry. Unlike Bitcoin and Ethereum, Ripple digital currency is frequently used for frictionless financial asset transfers, functioning more as a medium of exchange than other digital assets.

Because XRP functions outside the purview of mainstream markets, it’s certainly reasonable to believe that XRP would act independently in the event of a recession. On the other hand, however, XRP’s price is also highly dependent on issuance and adoption.

If Ripple loses usership—either because its issuance was mismanaged or because other projects (such as J.P. Morgan ’s proposed coin JPM) became more popular—XRP’s value would almost surely go with it.

This all indicates that cryptocurrencies could be worth considering. Even if the economy grows, the assets could be bargains after their extended bear market. If the recession does strike, cryptocurrencies could bounce as investors seek safe havens. That could deliver significant gains to traders in the asset class.

The bottom line is that cryptocurrencies are worth considering for both long term investors and short term traders.