Cheap Gold Miners

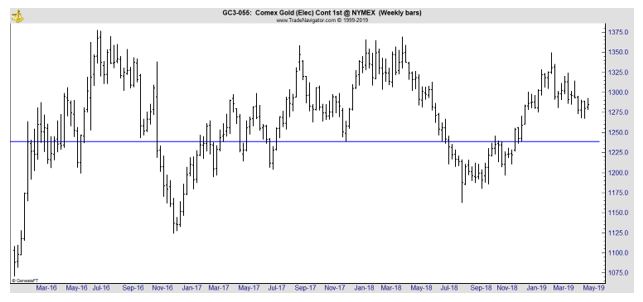

Gold prices have been in a trading range for some time and could be considered bullish based on the chart. Prices are near the upper end of the range and holding above an important support level that has been in place since late 2017.

Investors value gold for many reasons. Some see the yellow metal as protection against economic collapse. These investors tend to accumulate physical gold as coins or bars believing they will be able to use their gold to prosper under extremely adverse economic or social conditions.

Other investors believe the financial system will continue to function in the future but acknowledge gold tends to rise under adverse conditions and maintain positions in the metal through investment accounts owning ETFs, futures or gold mining stocks.

Some investors simply view gold as a trading vehicle to be bought in up trends and sold in down trends.

Of course, it is possible to directly trade gold. This can be done with coins, ETFs or futures. Coins are collectibles and can have tax consequences that are different than investments in stocks.

Many investors are surprised to learn popular ETFs that back their shares with physical holdings of precious metals face taxes at the higher rate for collectibles. This includes SPDR Gold Shares (NYSE: GLD).

Futures carry their own tax consequences and risks and many individual investors avoid these markets.

Publicly- traded stocks of gold miners offer an indirect way to invest in gold. Mining companies are taxed at the same rate as stocks which is lower than the rate for gains in GLD or other ETFs.

In addition to offering tax benefits, gold miners also offer the benefit of leverage. An example might be the best way to explain the leverage miners offer.

Let’s assume it costs a miner about $800 an ounce to produce gold and they mine 1 million ounces a year. If gold is at $1,000 an ounce, (a number used for simplicity) the company should generate a profit of about $200 an ounce or $200 million

This is a simplified example so we will assume the company has no other costs and no additional revenue. If the price of gold increase by 30%, to $1,300 an ounce, assuming the costs of production stayed the same, the miner’s profits would increase to $500 an ounce or $500 million for the company, an increase of 150%.

The miner is leveraged, in this example, 5 to 1, and benefits immensely from higher gold prices. Even smaller gains in the price of gold have a large impact on earnings. A 1% increase in gold prices (to $1,010 an ounce) results in a 5% jump in the earnings of this hypothetical mining company.

Remember, there is no free lunch in the stock market. Leverage can help increase investment returns on the upside but can cause significant losses on the downside.

A 1% decline in the price of gold could result in a 5% drop in earnings for this gold miner and we would expect the stock price to reflect the diminished earnings potential of the company. A 20% decline in gold would push the miner from a profit to a loss.

This leverage makes gold miners an excellent way to invest in gold. Buying miners when gold prices are low can lead to large gains when the price of the metal recovers.

With gold potentially poised for a breakout, now is the time to look for bargains in the mining sector.

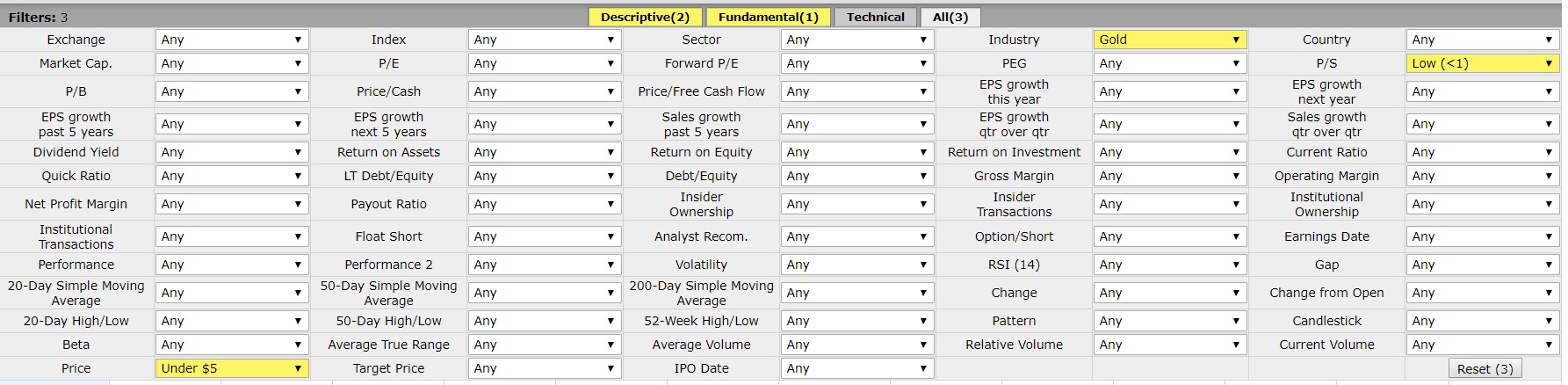

We searched for gold miners using a free screening tool to find stocks offering value and trading under $5.

Many individual investors understand that low priced stocks could be appealing for two reasons. One reason is that the low price means they have little down side risk in dollar terms. The second reason is that low priced stocks are generally the ones that deliver the largest short term gains.

One study looked at how low priced, or cheap, stocks performed relative to more expensive stocks. The study found that cheap stocks delivered more than six times the average return of the more expensive stocks in a typical quarter.

That’s why we limited our search for potential bargains by focusing on stocks priced at less than $5 per share.

Finally, we looked for stocks with a low price to sales (P/S) ratio, an indicator that the stock offers potential value.

One way to find stocks meeting these requirements is with the free stock screening tool available at FinViz.com. At this site, you could screen for a variety of fundamental factors, high levels of institutional ownership and bullish institutional transactions. An example is shown below.

Source: FinViz.com

This tool is flexible and could be applied to other industries besides gold mining. Different criteria, both fundamental and technical could also be applied.

Remember, there is no guarantee any stock will increase in value. Also, it is important to remember when we search for stocks using quantitative measures, our goal is to identify stocks that meet those criteria. The screens we develop could be used as the cornerstone of long-term investment strategies but any individual stock in the list could be a winner or loser.

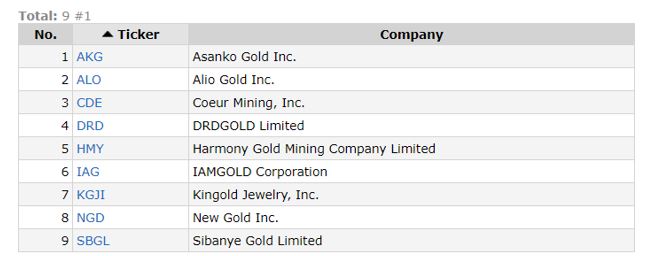

Our search identified nine miners meeting these requirements.

Source: FinViz.com

Any of these stocks could be a potential winner and all worth further research. They are cheap enough in price that an investor could consider a diversified investment in gold miners to benefit from higher prices in gold.

They are also cheap in value, at least when value is measured by the P/S ratio. However, there are still risks with any stock and traders could consider stops to protect against large losses. An initial stop is often used to mitigate the risk of the stock not moving in the intended direction.

After a time, if the stock does move higher, investors can consider a trailing stop to potentially preserve profits and offer a disciplined strategy for exiting trades to move assets into other potential investments that could offer greater potential rewards.