Cats Are Pets, and Potentially an Important Investment Theme

There are more than 74 million cats in over 36 million American households according to estimates from the American Veterinary Medical Association. On average, pet owners spend about $91 a year on vet bills for each cat, a potential market of $6.6 billion.

Of course, cat owners spend money on more than just vet bills. They buy food, toys, kitty litter and various other things for their pets, which are often treated as part of the family. That place in the family means many owners will spend what’s needed for health care and that creates potential investment opportunities.

Cat Medicine Could Be a Unique Niche

Barron’s recently noted,

“…diseases in cats are considered harder to diagnose than in dogs. “Cats, unlike most dogs, can tolerate severe orthopedic disease due to their small size and natural agility,” says Carmela Stamper, a veterinarian with the Food and Drug Administration’s Center for Veterinary Medicine.

And cats don’t like taking chewable pills, an increasingly popular option for dogs.

“When a typical vet says to a cat owner that you have to give this pill once or twice a day, most people know in the back of their mind that the cat’s probably not getting that pill,” says Marc Levine, a longtime veterinarian who runs a practice in South Orange, N.J.

While few pain drugs are available for cats, “there are a slew of nonsteroid anti-inflammatories” for dogs, he says.

They include Galliprant, which Elanco Animal Health (MYSE: ELAN) introduced in 2017, and Rimadyl, a Zoetis (NYSE: ZTS) drug that was rolled out in 1997. A pain reliever and anti-inflammatory for cats and dogs is Elanco’s Onsior.

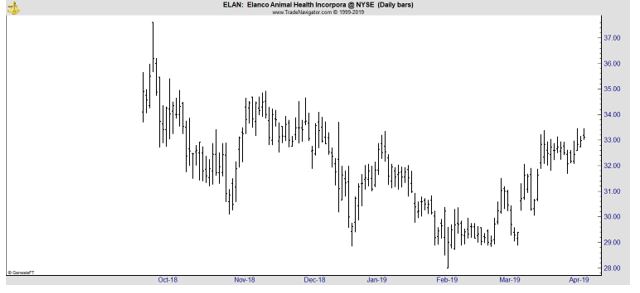

ELAN began trading late last year and the stock has struggled since its initial public offering, reaching its high in the first week and currently trading more than 10% below that high.

The pattern could be considered bullish as the recent price action could be considered a short term consolidation within a longer term bottoming pattern. With that interpretation, the stock could have a price target of about $38, just above the previous highs.

Fundamentals could, on the other hand, provide a reason for concern. Analysts expect the company to report earnings per share (EPS) of $1.08 this year and $1.28 next year. Fourteen analysts have published estimates for 2019 and 2020.

For 2021, ten analysts have published EPS forecasts and the consensus estimate is $1.48. These forecasts indicate annual EPS growth of about 15% a year while in the long run, EPS growth is expected to average about 12.4% a year.

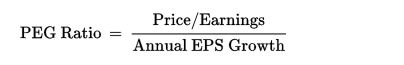

Using that level of estimated growth, the stock could be overvalued when the PEG ratio is applied.

Specifically, the formula for the PEG ratio is the P/E ratio divided by the EPS growth rate. The PEG ratio assumes a stock is fairly valued when the P/E ratio is equal to the estimates growth rate of EPS.

When using the PEG ratio, a ratio below 1 indicates a stock is potentially undervalued. Higher PEG ratios indicate stocks are overvalued.

This formula can be rearranged with simple algebra to find the target price (P in the P/E ratio). Fair value for a stock would be the product of the EPS growth rate and EPS. For ELAN, we can use the PEG ratio and multiply next year’s expected EPS of $1.28 by the expected EPS growth rate of 12.4%.

This provides a price target of $15.87. Using a higher P/E ratio of 18 provides a price target for the stock of about $23. Both price targets are well below the current price of the stock and could indicate ELAN is overvalued.

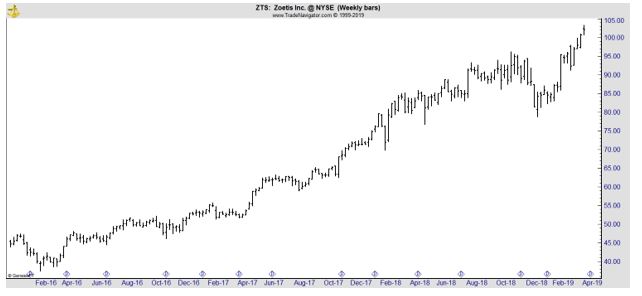

The same math argues that ZTS could also be overvalued. Analysts expect EPS of about $3.88 in 2020 and the growth rate of future earnings is expected to average about 14.6%. The PEG ratio points to a price target of about $57.

However, the stock is trading at new all time highs and the chart is bullish. That could make ZTS attractive to short term traders as a potential momentum trade.

This is likely to be a long term investment theme since pets are likely to remain important to families. And, of course, it’s not just cats.

Barron’s continued, “Cats offer a big opportunity for new products and sales. John Kreger, an analyst at William Blair, estimates that dogs account for 75% of all veterinary visits.”

The AMVA estimates there are nearly 70 million in American households.

But, dogs in some ways, are easier for owners to care for, as Barron’s noted.

Because it’s harder to get cats to swallow pills, “injectables in cats is the holy grail,” says Kristin Peck, head of U.S. operations at Zoetis. Pet owners “would find a way to bring their cat in if they thought it would be something that would truly make a difference in their cat’s life.”

Injectable drugs aren’t the only solution for cats, and there is plenty of research and development focused on the species.

Kindred Biosciences (Nasdaq: KIN), an animal-health biotechnology company, has one product on the market, Mirataz, whose sales totaled about $2 million last year following its launch in July of 2018. It treats cats with unintended weight loss, and it’s applied topically to the cat’s inner ear.

Levine, the veterinarian, says he would like to see more medicines for cats that can be applied to the skin or injected.

One is Convenia, an anti-infective launched by Zoetis in 2006 that treats common bacterial skin infections in dogs and cats. It’s injected, and it lasts for up to two weeks.

For the industry, developing more feline drugs would be the “cat’s meow.”

KIN could be testing support and could be attractive to technical traders. But there is risk. The company reported just $2 million in sales last year and is expected to report losses for at least the next few years.

While the fundamentals are bearish on the industry, for now, this is a long term trend and could be worth placing on a watch list of potential buys since the stocks could be more attractive in the next market downturn.