Can This Trick Really Help Your Portfolio?

It’s often described as the “only free lunch in investing.” Diversification is defined as “a risk management strategy that mixes a wide variety of investments within a portfolio.

The rationale behind this technique is that a portfolio constructed of different kinds of assets will, on average, yield higher long-term returns and lower the risk of any individual holding or security.

Diversification strives to smooth out unsystematic risk events in a portfolio, so the positive performance of some investments neutralizes the negative performance of others. The benefits of diversification hold only if the securities in the portfolio are not perfectly correlated—that is, they respond differently, often in opposing ways, to market influences.

Studies and mathematical models have shown that maintaining a well-diversified portfolio of 25 to 30 stocks yields the most cost-effective level of risk reduction. The investing in more securities generates further diversification benefits, albeit at a drastically smaller rate.”

Rather than relying on general rules of thumb like buying 25 to 30 stocks, the American Association of Individual Investors studied the question of diversification. This is an older study but covers the question well.

The study began with “an analytical assessment of investment risk” which “begins by breaking total uncertainty into two components: the general risk of variations in the market return and the specific risk of variation in individual stock returns.

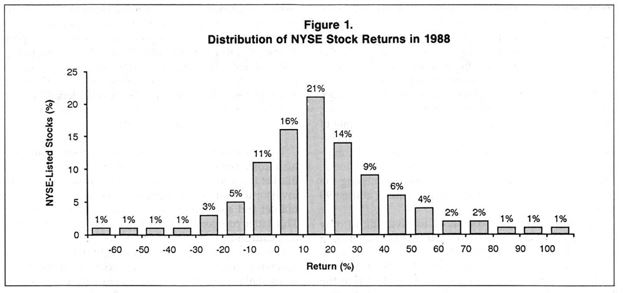

Figure 1 indicates the magnitude of this second component of risk by showing the tremendous variation in the rates of return of the 1,528 stocks listed on the New York Stock Exchange during 1988. The horizontal axis shows the rate of return consisting of dividends and capital gains, and the vertical axis reports the percentage of stocks that achieved those returns.

The graph indicates that 21% of all stocks produced returns that ranged between 10% and 20%. A 51% majority of stocks had returns between 0% and 30%. For the 1,528 stocks listed on the New York Stock Exchange for the entire year, the average return was 19%.

The graph indicates that 21% of all stocks produced returns that ranged between 10% and 20%. A 51% majority of stocks had returns between 0% and 30%. For the 1,528 stocks listed on the New York Stock Exchange for the entire year, the average return was 19%.

There is nothing that investors can do about general market uncertainty. Individual investors simply have to accept the risk associated with swings in the market if they are investing in the stock market and desire the returns related to this risk.

The specific risk of choosing particular stocks, on the other hand, can be reduced with diversification. Spreading an investment over many stocks reduces the chances of a return substantially below the market average. The probability of all the stocks doing poorly is small, and the negative effects of a few bad choices are diluted within the large portfolio.

The practical problem is simply determining how many stocks are necessary in order to achieve the benefits of diversification. The conventional wisdom based on a number of analytical studies is that investing in only 15 to 20 stocks provides the benefits of diversification.

This advice reinforces the “law of small numbers” intuition that a small sample of stocks will accurately reflect the overall result of the stock market. In fact, investing in 15 to 20 stocks does not nearly exhaust the risk-reducing advantages of diversification.

Many investors will choose to invest in far more than 20 securities in order to reduce risk to an acceptable level.

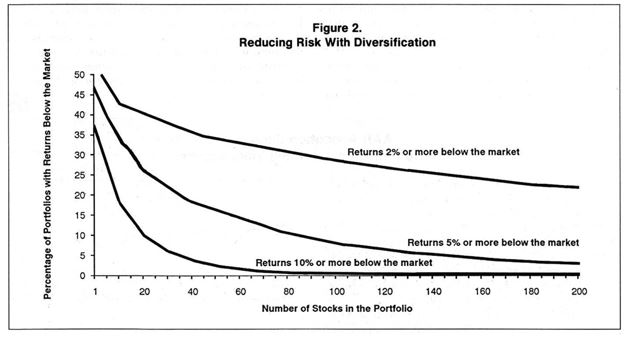

The information in Figure 2 allows an investor to make an informed choice about the appropriate level of diversification and risk.

This graph shows the returns for all possible portfolios drawn from the 1,528 securities listed on the Big Board. The horizontal axis indicates the number of stocks in the portfolio, and the vertical axis shows the percentage of these portfolios with a return substantially below the market.

How Do You Interpret These Results?

Figure 2 demonstrates that 10% of all portfolios consisting of 20 stocks had returns that were below the market average by 10% or more. Moreover, 26% of these 20-stock portfolios were under the market by 5% or more and 40% by 2% or more.

Clearly, there is a substantial amount of risk that can be avoided by diversifying beyond 20 stocks. An investor willing to accept only a 10% chance of missing the market by 5% or more needs to diversify across 80 stocks.

Put another way, the closer an investor wants to get to the market rate of return, the more diversification is necessary: An investor willing to accept a 30% chance of missing the market by 5% or more can diversify among only 18 stocks, but if the investor wants a 30% chance of missing the market by only 2%, he must diversify among at least 90 stocks.

Figure 2 shows that, compared to investing in only one stock, diversifying across 20 stocks produces a substantial reduction in risk: The chance of a return 5% below the market falls from 47% to 26%.

However, adding 20 more stocks (for a total of 40 stocks) to the portfolio only reduces the risk from 26% to 18%. The fact that reductions in risk are increasingly difficult to achieve is the source of the conventional wisdom that 20 stocks adequately provide the benefits of diversification.

Some analysts see the slow reduction of risk apparent in the graph and conclude that diversification beyond a small number of securities is not worthwhile.

A far better conclusion is that the slow rate necessitates diversification across a large number of stocks in order to eliminate the substantial amount of specific risk.

Figure 2 demonstrates that the law of small numbers is not valid; in fact, investing in a large number of stocks is necessary to approximate the performance of the market with some reasonable degree of confidence.”

But, is this practical for an individual investor? Is it really possible to invest in 80 or more individual stocks and understand the companies while having time to monitor the progress of each stock? Even with portfolio management tools, that could be a daunting task.

However, if the goal is to match the market diversification is needed. But the great investor Warren Buffett famously stated that “diversification is protection against ignorance. It makes little sense if you know what you are doing.”

If your goal is to beat the market, risk may need to be accepted and diversification may not be the best course of action.