Gold’s Pullback Could Show It’s Time to Buy

Investors know that price trends are interrupted by countertrend moves. In other words, prices move neither straight up nor straight down. Up moves will include down moves and vice versa. This is true in all time frames whether investors focus on the long term or short term.

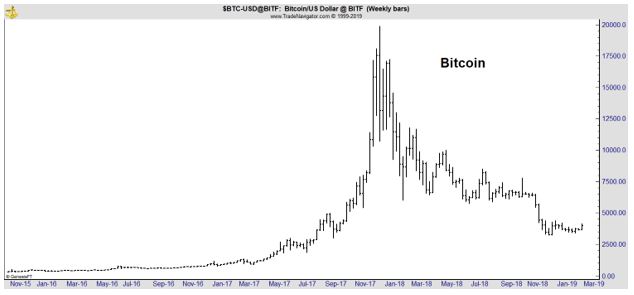

Barron’s recently highlighted the bullish trend that appears to be developing in gold and reminded investors of the risks as they consider buying the metal. The weekly chart of SPDR Gold Trust (NYSE: GLD) is shown below.

In the article, Barron’s noted, “Gold prices have pulled back from a 10-month high in recent sessions, leaving investors wondering why the many geopolitical and economic issues plaguing the market haven’t been able to fully support the metal’s haven appeal.

Gold notched that multi-month peak just over a week ago on the back of uncertainty linked to Brexit, the U.S.-China trade dispute, and global economic growth. But prices on Wednesday were in jeopardy of suffering a loss for the month on the heels of four monthly gains—the longest upward streak since 2016.

“Prices have run up to the top end of the trading range they have held for the past five years,” says Rob Haworth, senior investment strategist at U.S. Bank Wealth Management, pegging the “top end” at $1,350 to $1,400.

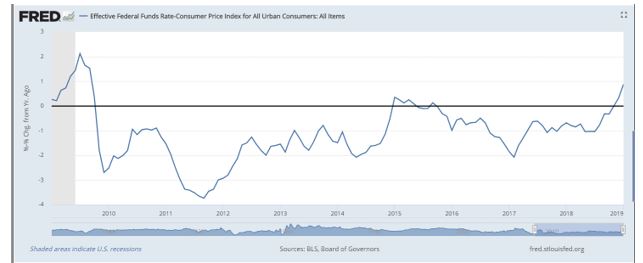

“Without further easing in financial conditions, ramping inflation or stock market volatility, gold prices are likely to struggle at the top end of this five-year trading range,” he says.

Gold still faces supply challenges and any uptick in demand would tighten inventories.

The gold-mining sector has seen a spate of merger and acquisition activity, most recently with Barrick Gold ’s (Canada.TSX: ABX) unsolicited proposal to buy Newmont Mining (NYSE: NEM) in a deal that values Newmont at nearly $18 billion.

“The M&A activity is reflective of the increasing difficulty [in] finding and mining gold reserves,” says Will Rhind, chief executive officer at exchange-traded fund issuer GraniteShares.

“The consolidation of the gold-mining sector…highlights existing gold supply difficulties and shortages, which is supportive of gold prices,” he says.

On the demand side, central banks have been on a gold buying spree, lifting 2018 net purchases of the metal to 651.5 metric tons—their highest in more than 50 years, as geopolitical uncertainty and economic worries prompted national banks to diversify their reserves, according to the World Gold Council.

“Central bank choices about composition of their reserves send important signals to financial markets about relative safety of currency alternatives,” says Trey Reik from Sprott, which manages the Sprott Physical Gold Trust (PHYS). “Whenever gold allocations are on the rise, central bank authority is augmenting the [money-like qualities] of gold.”

Carlos Artigas, WGC director of investment research, says that on an annual basis, central banks have been net buyers of gold since 2010. A recent WGC survey also revealed that almost a fifth of central banks signaled their intention to raise gold purchases over the next 12 months.

“Central bank buying is quite bullish as they are massive institutional players…and even a small allocation to gold can be quite significant in terms of additional physical demand,” says Mark O’Byrne, research director at precious metal brokerage GoldCore.

“Official sector gold buying does not imply necessarily that [central banks] are bullish on gold, per se….It likely means that they are concerned regarding the outlook for the dollar and are reducing and hedging exposures in this regard.”

“Trillion-dollar deficits in the U.S. under [President Donald] Trump and growing fiscal imprudence will be making central banks with large dollar reserves increasingly nervous about the outlook for the dollar,” says O’Byrne.

“A $22 trillion national debt and the lack of any will to rein in massive spending is making America’s creditors nervous and…the ‘risk free’ status of U.S. Treasuries will come into question.” That may lead to higher demand for haven gold.

“Given the scale of the risks,” O’Byrne believes gold is “more than likely” to climb to a record high of $2,000 within the next 24 months.

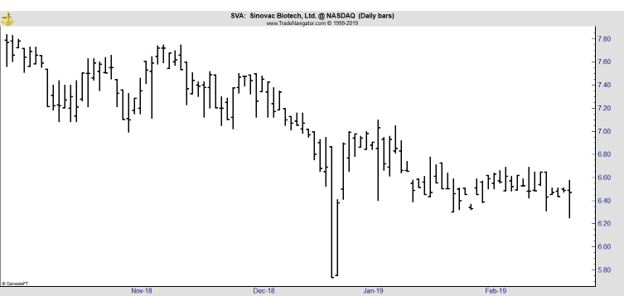

The longer term chart of gold (GLD) is shown next. At $2,000 an ounce, this ETF would be expected to trade at $200.

That is a significant potential gain and the chart shows the potential rewards could outweigh the risks of the trade.

GLD has traded in a narrow range for some time. The downside risk is, under technical analysis, the lows of the range or about $100 a share. The upside is about three times larger than the downside which makes buying gold favorable from a risk and reward perspective.

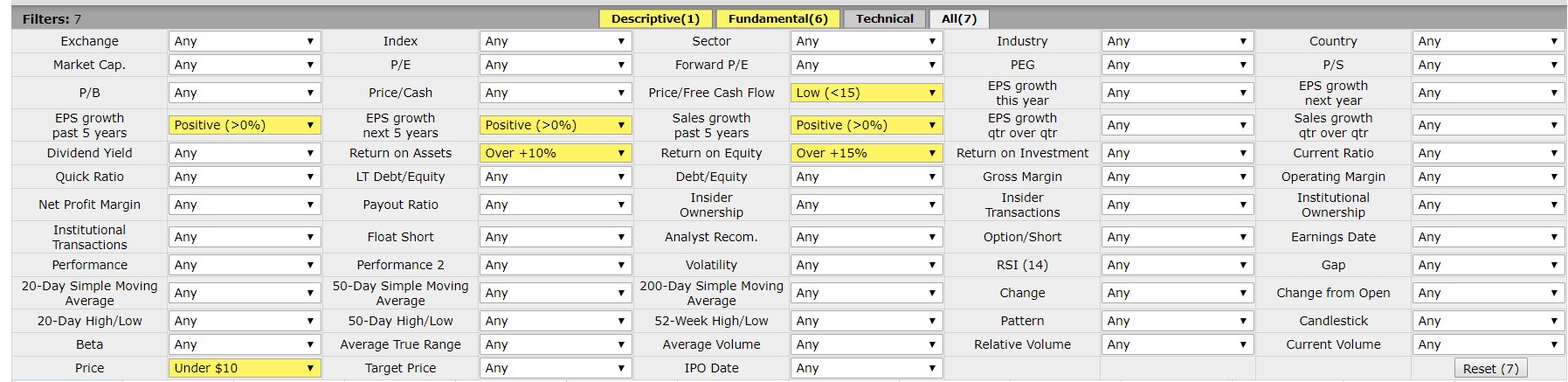

Gold Miners Could Be A Better Trade

It’s possible to directly trade gold. This can be done with coins, ETFs or futures. Coins are collectibles and can have tax consequences that are different than investments in stocks. Of course, popular ETFs that back their shares with physical holdings of precious metals face taxes at the higher rate for collectibles.

Futures carry their own tax consequences and risks and many individual investors avoid these markets.

It is important to consult your tax adviser to learn how this could affect you.

Publicly- traded stocks of gold miners offer an indirect way to invest in gold. Mining companies are taxed at the same rate as stocks which can be lower than the rate for gains in GLD or other ETFs.

In addition to offering tax benefits, gold miners also offer the benefit of leverage. An example might be the best way to explain the leverage miners offer.

Let’s assume it costs a miner about $800 an ounce to produce gold and they mine 1 million ounces a year. If gold is at $1,000 an ounce, the company should generate a profit of about $200 an ounce or $200 million.

This is a simplified example so we will assume the company has no other costs and no additional revenue.

If the price of gold increase by 30%, to $1,300 an ounce, assuming the costs of production stayed the same, the miner’s profits would increase to $500 an ounce or $500 million for the company, an increase of 150%.

The miner is leveraged, in this example, 5 to 1, and benefits immensely from higher gold prices. Even smaller gains in the price of gold have a large impact on earnings. A 1% increase in gold prices (to $1,010 an ounce) results in a 5% jump in the earnings of this hypothetical mining company.

Remember, leverage can help increase investment returns on the upside but can cause significant losses on the downside.

A 1% decline in the price of gold could result in a 5% drop in earnings for this gold miner and we would expect the stock price to reflect the diminished earnings potential of the company. A 20% decline in gold would push the miner from a profit to a loss.

This leverage makes gold miners an excellent way to invest in gold. Buying miners while uncertainty is high could lead to gains in the short run and in the long term.

Did you know that dividends have rewarded investors for at least 100 years, at least since John D. Rockefeller said, “Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.”

We have prepared a special report about dividends that you can access right here.