Can You Really Generate Passive Income from Your Stocks?

Many investors understand the concept of writing options as a way to generate income but wonder if the strategy is truly beneficial. There are, of course, pros and cons to this and every investment strategy. We will take a brief look at this idea, so you can determine if this passive income strategy is right for you.

A Brief Overview of the Strategy

The way the Covered Call Strategies is often presented, it sounds too good to be true. Usually, the explanation includes the facts that you keep the stock you own, you sell calls that are not exercised and generate continuous and high levels of income from the stock.

For example, say you own 100 shares of ABC Company. You bought the shares years ago at $1 and the price is now $25. You want to generate income from the shares but you don’t want to pay taxes on the large gain. So, you sell a covered call.

You believe the stock will move just a small amount over the next few months and sell a call with an exercise price of $30. The stock is trading at $28 when the call expires so you keep the premium of $100 and sell another call.

Sometimes, this happens. But, more often, there are some other outcomes to the strategy.

Let’s start with what might be the biggest problem for many individual investors. In order to sell covered calls, you will need to own at least 100 shares of the stock.

The need to own at least 100 shares is a potential problem because of the way options contracts are priced. A variety of factors go into the price of the option one of which is the value of the underlying stocks. The higher the stock price is, the more the option will be worth.

This means that a low priced stock, the kind of stock a small investor would be able to buy at least 100 shares of, will have low options premiums. In the market, a stock trading at $25 might offer short term options trading at $0.30 or less. The income on the covered call would be just $30, before commissions.

Commissions will diminish the amount of income and the commissions of options trades can be higher than the commissions on stock trades. Even some of the discount brokers will charge $7 to $10 per contract, or more, when fees are included.

This is important to remember when many options will deliver income of less than $20. Some brokers also charge a fee if the option is exercised.

The Risks of Covered Calls

Even though the costs can be considerable and the income may be small, many investors find covered calls appealing. But, there are important risks to consider. One risk is that the stock price falls and the second risk to consider is that the stock price rises.

Declining prices are a risk of owning a stock. If the stock falls, the income obtained from selling the call will offset the loss to a small degree. But, the covered call may also lead to higher costs if the stock is sold.

Before selling the stock, covered call sellers will need to close their option trade. This can result in more commissions.

Now, if the stock rises, there could also be costs. If the stock is above the exercise price of the covered call at expiration, the stock will be sold. This could result in a tax bill for the trader, in some cases triggering the taxable event the trader was trying to avoid.

Some brokers will charge an exercise fee, and in some cases that fee could be more than the commissions to close the trades would be.

An Alternative

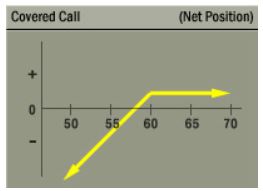

Despite the drawbacks, the idea of the covered call is attractive. It is a way to generate income. But, because of the risks, the strategy will not be right be for everyone. To consider alternatives, we can look at the risk reward payoff diagram for the covered call strategy.

Source: The Options Industry Council

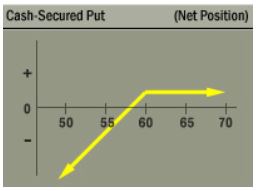

Notice in the figure above that the payoff is limited and the risk is relatively large. To find an alternative strategy, we can start by locating an options strategy that possesses a similar risk reward profile. The cash secured put, or naked put writing, strategy has the same profile as a covered call.

Source: The Options Industry Council

With a cash secured put, you will sell a put option with an exercise price below the current market price. For our purposes, the mechanics of the trade are less important than the risk reward diagram. In the chart above, you can see the reward is the same as the covered call as is the risk.

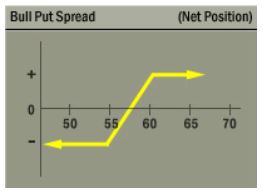

What’s appealing about the covered call is the reward, so we are happy with that. What we would like to reduce is the risk of the strategy. When selling a put or a call, options traders can always reduce the risks of the strategy by creating a spread.

A spread trade involves selling an option to generate income and then buying a lower priced option to reduce the risk. This strategy caps both the potential risks and rewards as is shown in the next risk and reward payoff diagram.

Source: The Options Industry Council

Spreads may very well accomplish the goals of the covered call seller. They generate income and reduce risk. But, they are not subject to exercise which means they will not trigger a potential tax bill. Also, spreads will not make it more expensive to sell a stock if that is the right thing to do.

Options are a versatile tool for income investors and should be considered as an alternative to covered calls by many investors.

These are the type of strategies that are explained and used in our TradingTips.com’s Options Insider service. To learn more about how options can be used to meet your income and wealth building goals, click here for details on Options Insider.