A Possible Alternative to Funding College

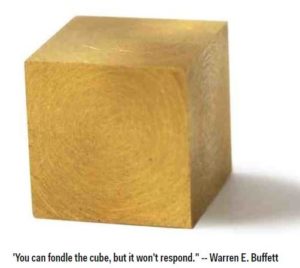

College is becoming more and more expensive. Over the past thirty years, the cost has more than doubled. This is an average annual gain of about 2.8% a year in the long run.

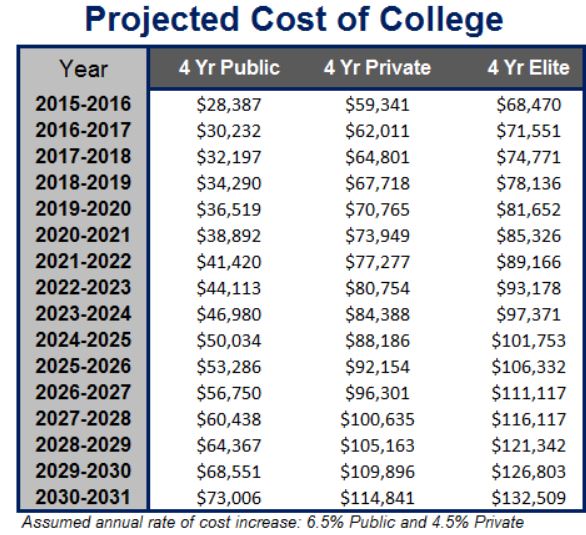

Source: The College Board

There are many different sources of data and the precise details of the costs and the increases vary by sources. The data shown above is from The College Board, a not-for-profit organization that connects students to college success and opportunity.

The College Board was created to expand access to higher education. Today, the membership association is made up of over 6,000 of the world’s leading educational institutions and is dedicated to promoting excellence and equity in education.

The College Board also helps more than seven million students prepare for a successful transition to college through programs and services in college readiness and college success — including the SAT and the Advanced Placement Program.

It’s data comes from its members and could be among the most accurate sources of data.

While that data is reassuring, showing price increases roughly inline with inflation, other sources paint a different picture. And, it’s important to remember that it is historic data. If you are thinking about college in the future, you need to consider future costs.

Here, the picture is hardly calming. Children will be ready to enter college after high school and parents or grandparents will want to ensure they have the money needed then. A shortfall could mean a child doesn’t get attend the right school, or even any school.

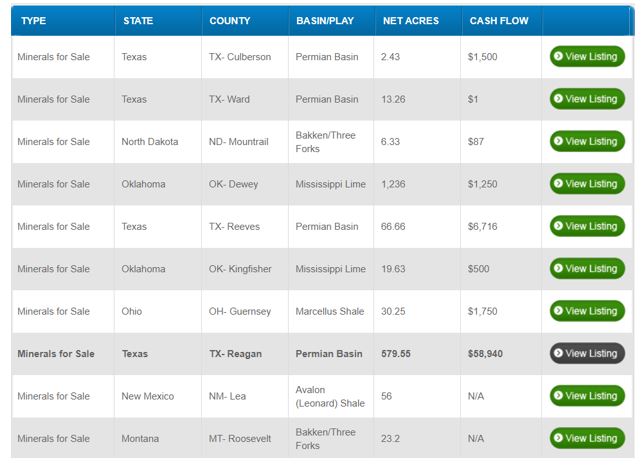

Given the high risks of a shortfall in funding, when deciding how much is needed, it is best to be aggressive in making assumptions about future costs. The table below shows the projected using cost increases that are higher than the average of the past.

Source: CollegeFinancingGroup.com

It will require a great deal of money to put a child through college ten years or more from now. But, families will make that sacrifice because education can bring rewards to the children throughout their lives.

Benefiting From College

We know that college is expensive, and we know that many families will make the necessary sacrifices to send children to college. This implies there will be a steady stream of new students into schools, especially the large schools with reputations for excellence.

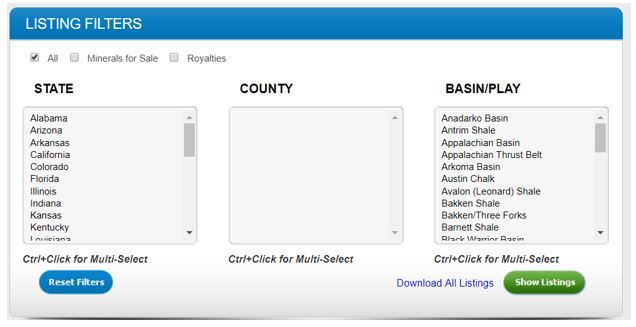

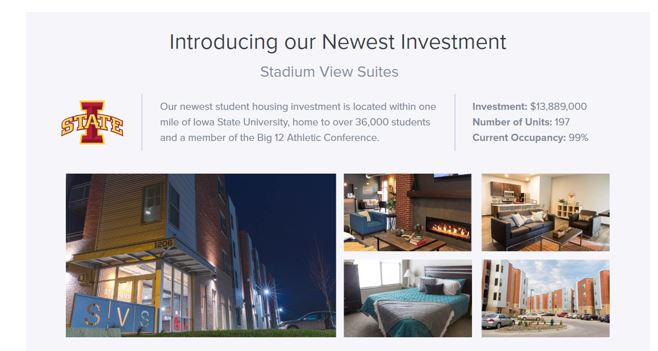

One company, RichUncles.com, is offering an investment opportunity based on that implication. The company’s business plan is to purchase modern properties that were purpose-built for university student living environments

The desired student housing properties will be located within a one mile walking distance of major NCAA Division I universities that have over 15,000 students enrolled. The Division I schools are the largest schools which participate in intercollegiate athletics, programs that enhance the school’s reputation.

The company notes that the acquisition strategy for student housing will focus on attractive operating histories and building construction designed to achieve management efficiency:

- 150-bed minimum capacities

- 90%+ rental occupancy rates

- Broad geographic diversification

This opportunity is available to individual investors with a minimum initial investment of as little as $5. The latest opportunity meets those criteria with a student housing project a mile away from Iowa State University.

Source: RichUncles.com

The per unit cost of $70,502 seems to be reasonable for investment properties near a college. The shares represent an ownership stake and offer both the potential for income and capital appreciation. Since capital appreciation depends on an increase in price, your analysis should consider the per unit pricing of any investment.

A Well Known Strategy for the Well Heeled Investors

The strategy of investing in student housing is one many high net worth individuals have pursued for years. One way to do this is by buying a residence for a student when they attend the college as an investment property and selling when the student graduates.

While that strategy is a desirable one, the investment requirement is significant. Rental properties have strict financing standards and generally require large down payments. RichUncles.com is opening that strategy to anyone with a willingness to invest at least $5.

The company describes itself, “Rich Uncles is a technology platform that allows people of all income levels to invest in companies called real estate investment trusts, or REITs. These companies select, buy, and manage commercial and residential real estate.”

Your investment buys you shares of a company that owns revenue-producing student housing. The tenants in the buildings pay the investment company rent every month, and the income generated by those rent payments is distributed back to investors.

Considering the Risks

There is no guarantee this investment, or any other investment in this category, won’t lose money. That’s especially true if the investor needs to sell quickly. This company does offer a liquidity provision that addresses that risk factor.

Rich Uncles Student Housing REIT offers a share redemption program, which allows investors the opportunity to sell their shares back to the company once each month.

Further details are in the Offering Circular, but, in general terms:

“Repurchases are made pursuant to an established share repurchase program and are subject to limitations more fully described in the offering circular, including, but not limited to the following:

- the repurchase price depends on the holding period of shares and ranges from 97% of the most recently published net asset value (NAV) or in the absence of a published NAV, $4.85 per share (which is equal to 97% of the $5.00 per share price in this offering) for shares held less than one year to 100% of the most recently published NAV, or in the absence of a published NAV, then $5.00 per share for shares held for at least three years;

- repurchases are limited to 5% of the weighted-average number of outstanding shares during the prior 12-month period; and

- the repurchase program can be terminated or amended at any time.”

While it’s restricted, the liquidity provision does exist. And, that is one of the factors that should be considered before making any type of investment.