Income Investors Need to Evaluate Reverse Mortgages

Money is an emotional topic at times. Among the most emotional topics can be reverse mortgages. But, before jumping to a conclusion, investors need to remember there are two sides to every story. In the case of reverse mortgages, there are good and bad sides of the story to consider.

First, let’s define the terms. Then, we will look at a recent study that shows the reverse mortgage could be an important tool for income investors. Finally, we want to highlight a few of the risks.

The Definition of a Reverse Mortgage

In simple terms, according to Hull Financial Planning, “a reverse mortgage is where the bank slowly pays you for the rights to own your home. The bank gives you a stream of payments for as long as you’re living in the home, and after each payment, interest accrues.

At the end, when you’re no longer living in the home – whether because you had to move to an assisted living facility or you peeled the garlic – the bank can use the home as the collateral against the loan and claim it unless you or your estate pays the balance on the mortgage.

The term that the government uses is a Home Equity Conversion Mortgage (HECM)… To qualify, you need to be living in a single family home, condo, or mobile home, or you need to be the owner-occupant of a 2-4 unit home.

You also need to have little to no mortgage on the home, since the idea is that you’re using the equity built up in your home in order to fund cash flow requirements. If you’re using the reverse mortgage to pay off your existing mortgage, then you’re not going to get as good of a deal out of the reverse mortgage.

You also need to continue to maintain the house, keep insurance on it, and pay your property taxes. This helps to ensure that there’s a worthwhile house available for the bank when you’re no longer occupying it. Finally…[y]ou have to be at least 62 years old to qualify for one.”

The risks jump out in general terms. You will be using your home for income and this could be a problem in some ways. But, before assessing the risks, let’s look at the study.

A Reverse Mortgage as a Financial Planning Tool

Two Ph.Ds, Barry H. Sacks, J.D., Ph.D. and Stephen R. Sacks, Ph.D., published “Reversing the Conventional Wisdom: Using Home Equity to Supplement Retirement Income” in the Journal of Financial Planning. From the title, we see they are viewing their argument that the products are useful as an uphill fight.

The executive summary of their paper tells us the most important points:

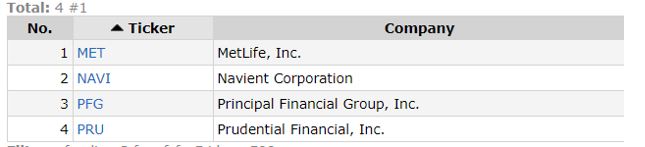

- This paper examines three strategies for using home equity, in the form of a reverse mortgage credit line, to increase the safe maximum initial rate of retirement income withdrawals.

- These strategies are:

(1) the conventional, passive strategy of using the reverse mortgage as a last resort after exhausting the securities portfolio; and two active strategies:

(2) a coordinated strategy under which the credit line is drawn upon according to an algorithm designed to maximize portfolio recovery after negative investment returns, and

(3) drawing upon the reverse mortgage credit line first, until exhausted.

- A three-spreadsheet stochastic model is described, with one spreadsheet incorporating each strategy. The three spreadsheets are run simultaneously, with the same investment performance and withdrawal amounts in each.

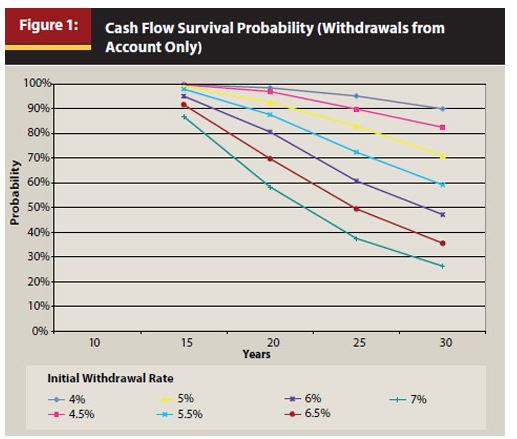

- The cash flow survival probability over 30 years is determined for each strategy, and the comparisons are presented graphically for a range of initial withdrawal rates.

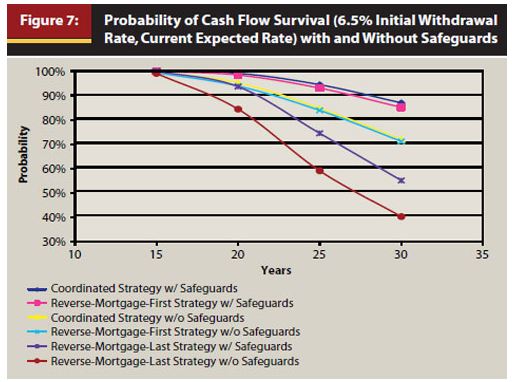

- We find substantial increases in the cash flow survival probability when the active strategies are used as compared with the results when the conventional strategy is used. For example, the 30-year cash flow survival probability for an initial withdrawal rate of 6 percent is only 55 percent when the conventional strategy is used but is close to 90 percent when the coordinated strategy is used.

- The model also shows that the retiree’s residual net worth (portfolio plus home equity) after 30 years is about twice as likely to be greater when an active strategy is used than when the conventional strategy is used.

The highlights are apparent. Retirees using a coordinated strategy that funds living expenses with a reverse mortgage when the stock market declines have a greater likelihood of meeting their retirement goals.

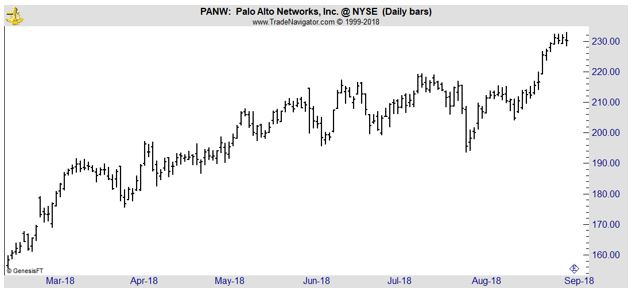

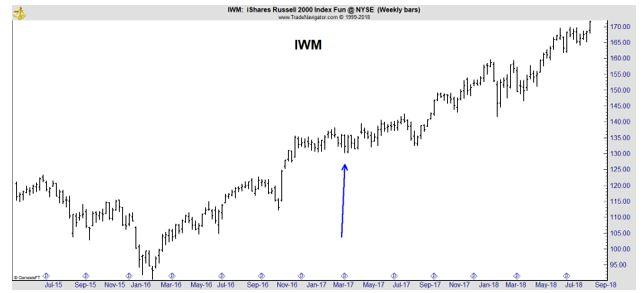

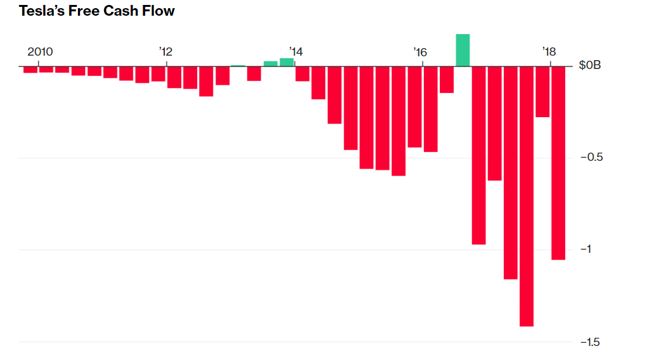

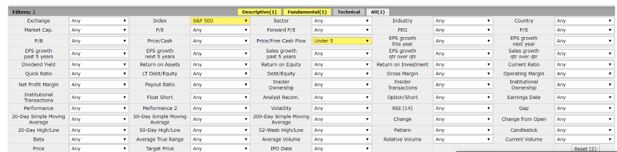

Two charts can help illustrate this point. The first shows that the probability of having enough money for retirement with a conventional approach may be lower than many investors believe.

Source: Journal of Financial Planning

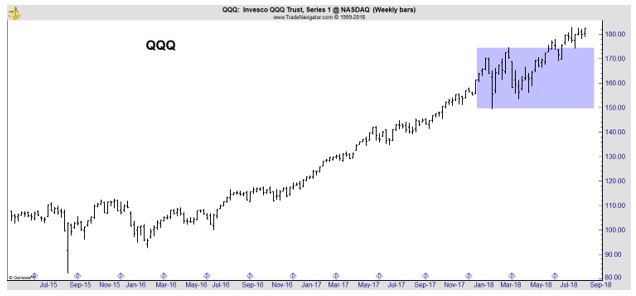

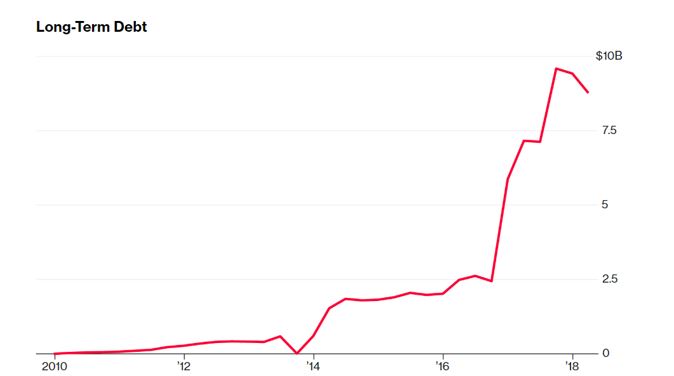

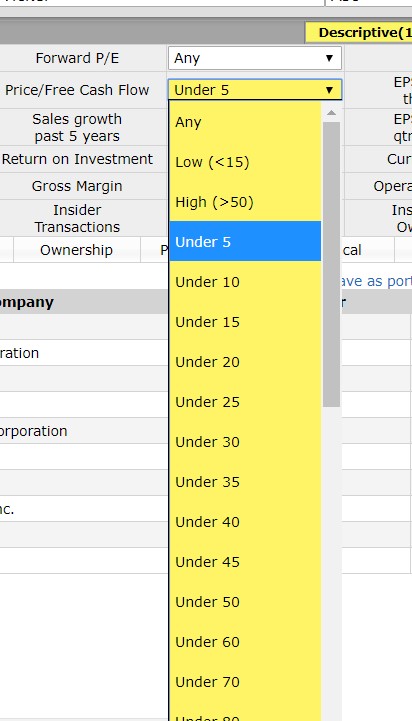

The next chart shows the probability of success when the reverse mortgage is used.

Source: Journal of Financial Planning

Risks Are Important to Consider

AARP notes that there are important risks to consider.

“You can keep the house only as long as you can pay your property taxes and homeowners insurance. If you run out of money and let these bills slide, you’re in default, and the bank can foreclose on your house.

About 46,000 reverse mortgages are in default — 8 percent of the total, says the U.S. Department of Housing and Urban Development. So far, 61 percent of the troubled borrowers are in repayment plans. Still, lenders won’t let defaults accumulate indefinitely. You’ll likely see foreclosures rise toward the end of this year.

If married couples decide to take a reverse mortgage, be sure you’re both on the loan. That way, either one of you can remain in the house without repaying the loan if the other spouse dies or enters assisted care.

Under current HUD policy, spouses who aren’t on the loan are forced to repay if they want to keep the house. If they don’t have the necessary assets, the home is sold out from under them. AARP considers this a misreading of the law and has filed a lawsuit, according to AARP senior attorney Jean Constantine-Davis.

If the spouse or other heirs do want to buy the house, they owe the lesser of either the total loan amount or 95 percent of the home’s current market value. Some lenders have tried to charge relatives the full amount of the mortgage balance, including all fees and even if it’s more than the house is worth. So know your rights.”

In other words, there is a risk you can lose your house or you may not be able to leave your home to your heirs. These risks need to be considered but even with the risks, the reverse mortgage could be worth discussing with a financial planner.