Are Cryptos a Recession Hedge?

Recession is a word that chills investors. With good reason. The stock market often declines before the economy contracts and the declines in recessions tend to be significantly steeper than stock market sell offs that occur while the economy is expanding.

That makes recent research from the Fidelity Asset Allocation Research Team, which advises Fidelity’s fund managers, especially disturbing.

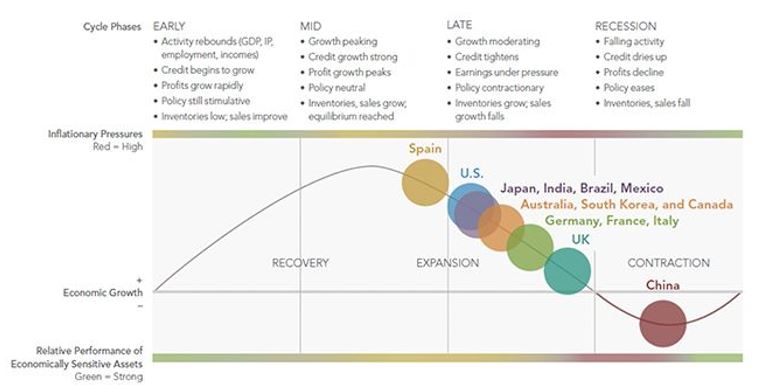

The team studies the business cycle, because they believe it helps determine the direction of stocks. In a recent report, it said the U.S. entered the late stage of the business cycle late last year.

Source: Barron’s

Barron’s summarized the research, noting, “Developed economies like Germany, France and Italy are much deeper into the late stage of the business cycle, as are Canada, South Korea and Australia. Emerging markets like Brazil, Mexico and India also just entered the late phase.

The U.K., reeling from pre-Brexit chaos, is on the cusp of recession. China, the researchers say, is already there, although they define it as a “growth recession” because the Chinese economy has marked slowdowns, not actually negative growth.”

This matters to investors because, although bear markets are only fair predictors of recessions (seven of 13 postwar bear markets were followed by economic downturns), bear markets that precede recessions tend to be longer and deeper, averaging declines of 37%.

So if the economy is indeed in the final phase of its long recovery, that’s a warning sign to investors to get more defensive.

“We’ve just been through the best parts of the cycle for risky assets,” Dirk Hofschire, Fidelity’s senior vice president of asset allocation research, told me in a phone interview.

“Late cycle is sort of the transition phase. By the end of the cycle, when we move into recession, that’s when you would want to be a little more risk-off.”

Could Cryptos Rise in a Recession?

Cryptocurrencies haven’t really seen a recession. Barron’s reported, “This new, decentralized asset class was born at the tail end of the housing crisis, and has yet to experience the full force of a recession or even lengthy bear market.

For years, digital assets have existed in a period of market expansion in the United States. Gross Domestic Product (GDP) has increased significantly, bringing total average GDP growth from -1.73% in 2009 to 3.138% in 2017; and unemployment has dropped from 10% to 4%, with more than two million jobs created each year for the past eight years.

Unfortunately, what’s been a positive sign for upward trends in traditional markets has had an adverse impact on the mainstream appeal of digital assets.

Because the economy has steadily improved throughout the industry’s life-span, some more casual observers have failed to fully appreciate how the intrinsic qualities of blockchain-based assets (e.g., decentralization, immutability, and bespoke structures) may benefit them.

As a result, many have erroneously assumed all digital assets are functionally interchangeable, and will all react the same way to economic fluctuations.

As is the case with any industry, companies weathering the impact of a severe market correction are, understandably, going to react differently based on their business models, leverage, and market capitalization.

That’s not to say we’ll know exactly what will happen during a recession—it’s perfectly plausible, if not likely, that there will be at least some material degree of performance correlation between various digital assets.

However, what’s more likely is that we’ll begin to see certain digital assets, each equipped with their own unique value proposition, begin to separate themselves from the pack and gain momentum as a result of their inherent structural value, not merely from speculation or the rising tide of a bullish crypto market.

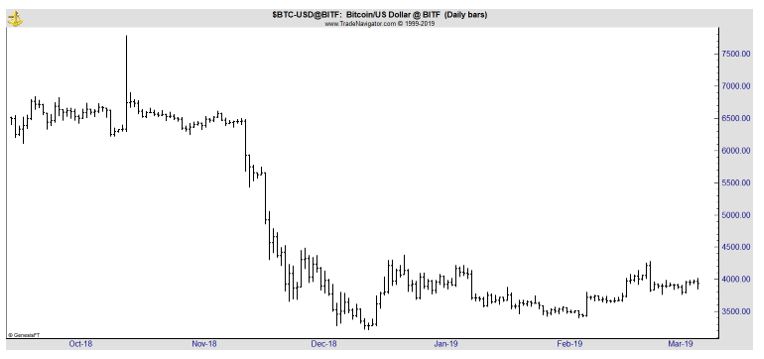

Faced with a recession, Bitcoin may serve a market function similar to that of a safe-haven commodity, rather than an equity, due to its inherent scarcity and decentrality. Bitcoin, by design, is not intended to be used as a foundation on which developers could build a platform or enterprise.

Because its supply is not controlled by any one person or entity, it’s more likely that Bitcoin will perform independently of broad market pressures (akin to how one would expect gold to react)—potentially even appreciating in value should demand for alternative forms of dependable value storage arise.”

By contrast, Ethereum is far more likely to follow market trends. That’s because its platform allows other companies to build products on top of the Ethereum protocol, putting significant onus on mainstream investors to keep products afloat.

If the investors suffer, the companies suffer, which causes Ethereum to suffer as a result. Because Ethereum is a developer-focused blockchain, it’s very much dependent on how many companies use the Ethereum platform to build their projects.

If those companies were to go out of business, Ethereum’s relevance and, subsequently, its price, would undoubtedly be affected. That’s not to say Ethereum is structured similarly to equity markets by any means, but it’s more closely entangled with equity markets than most other digital assets.

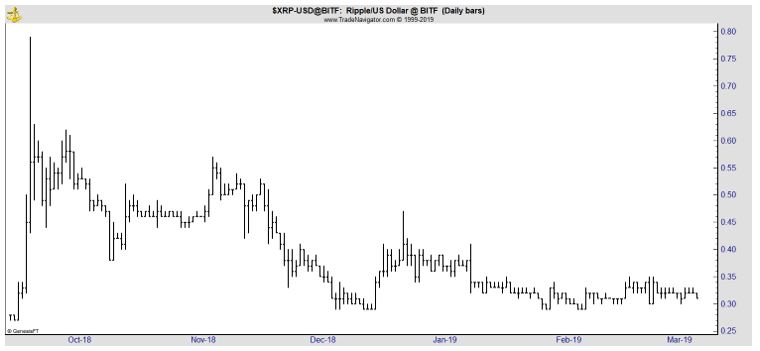

Ripple’s XRP is a payments-focused digital asset that currently has the third largest capitalization in the crypto industry. Unlike Bitcoin and Ethereum, Ripple digital currency is frequently used for frictionless financial asset transfers, functioning more as a medium of exchange than other digital assets.

Because XRP functions outside the purview of mainstream markets, it’s certainly reasonable to believe that XRP would act independently in the event of a recession. On the other hand, however, XRP’s price is also highly dependent on issuance and adoption.

If Ripple loses usership—either because its issuance was mismanaged or because other projects (such as J.P. Morgan ’s new coin JPM) became more popular—XRP’s value would almost surely go with it.

This all indicates that cryptos could be worth considering. Even if the economy grows, the assets could be bargains after their extended bear market. If the recession does strike, cryptos could bounce as investors seek safe havens. That could deliver significant gains to traders in the asset class.

The bottom line is that cryptos are worth considering for both long term investors and short term traders.

Did you know that dividends have rewarded investors for at least 100 years, at least since John D. Rockefeller said, “Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.”

We have prepared a special report about dividends that you can access right here.