Income with Inflation Protection

Income investors face a number of risks. One of the greatest risks is that inflation will increase before their investment matures. This is especially true right now.

Now, a US Treasury note maturing in ten years offers a yield of about 3%. Let’s say an investor buys a bond with a face value of $1,000. Every year, for the next ten years, they will receive $30, the interest payment on a 3% yield. They will also receive their $1,000 back in ten years when the note matures.

What Could Go Wrong?

Since this is a US Treasury, we assume that the investor’s principal, their $1,000 investment, is safe and will be returned in 10 years. We also assume the Treasury will make all interest payments. These assumptions do not apply to corporate where there is a credit risk but we will address other risks in future articles.

In this article, we are only considering the inflation risk and that is the biggest thing that could go wrong for the investor.

Interest payments compensate the investor for the use of their money. Ideally, the interest rate also protects the investor against inflation. For most of the past ten years, inflation has been below 3% so the 3% yield on ten year notes might protect against inflation.

Source: Federal Reserve

If inflation rises above 3%, the investor in the ten year note will not keep up with inflation. In other words, they will lose money after inflation is considered. This is an important risk to consider.

Given the risk, it is reasonable to ask why investors would consider accepting a low and fixed return on their investment. Well, there is no choice. Interest rates are low and to boost income in dollar terms the investor must buy investments with a longer time to maturity.

There is, however, an important investment to consider that, like the Treasury note, carries no credit risk but also includes a guaranteed return after inflation is factored in. These investments are called Treasury Inflation-Protected Securities, or TIPS.

As their name clearly states, they provide protection against inflation. The principal of a TIPS (the amount of the face value of the investment, or $1,000 in the example above) increases with inflation and decreases with deflation, as measured by the Consumer Price Index (CPI).

When a TIPS matures, you are paid the adjusted principal or original principal, whichever is greater. So, even if deflation brings the face value of the security lower, you receive your original investment amount back. This is a strong hedge against inflation.

TIPS pay interest twice a year, at a fixed rate. The rate is applied to the adjusted principal; so, like the principal, interest payments rise with inflation and fall with deflation.

You can buy TIPS through TreasuryDirect, the government’s web site that charges no commissions. You also can buy TIPS through a bank or broker. You can hold a TIPS until it matures or sell it before it matures.

How TIPS Work

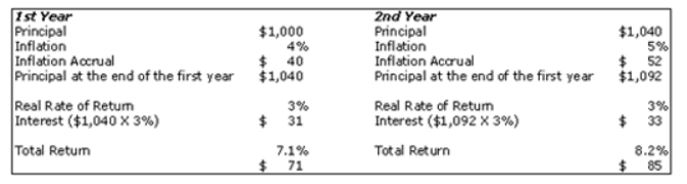

TIPS sound like an ideal income investment in theory. But, an example can help explain exactly how they work. The chart below shows an example that is hypothetical.

Source: Investopedia

Notice how the principal rises along with inflation. This is important because that could be where the gains in the investment come from. The yield on TIPS is usually lower than the yield available on Treasury securities that are not protected by inflation.

This is shown in the next chart which shows the yield based on Federal Reserve data.

Source: Federal Reserve

Notice that the yield turned negative for a time. Remember that the principal paid at maturity is always equal to the original face value so the negative yield does not imply a certain loss. Of course, it might not make sense to buy when the yield is negative, but it could make sense to buy when the yield is low.

The current yield is near 0.8%. This is after inflation yield. In effect, if inflation is 2%, the yield would be 2.8% since the principal is increased by 2%. This is below the yield on the noninflation protected Treasury which is 3%, In that case, it might seem better to buy the noninflation protected Treasury.

That ignores the risk of future inflation. If inflation rises to 4%, the TIPS would pay 4.8% and the noninflation protected security would still pay 3%. With the inflation protection, a fixed income investor could fall behind.

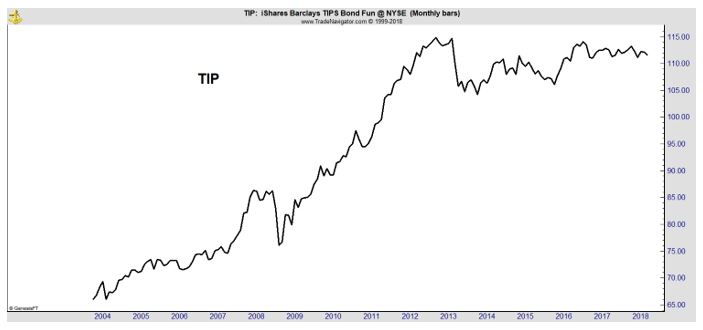

TIPS can be bought directly or they can be added to a portfolio with an exchange traded fund, or ETF. The iShares Barclay’s TIPS Bond Fund (NYSE: TIP) is one ETF that could be used. This ETF holds government issued securities. It’s long term performance is shown in the next chart.

TIPS might sound like the ideal income investment but there are some risks to consider.

These should be considered as long term investments. As the chart of TIP shows, the price of the ETF and of the securities themselves will fluctuate. In the bear market that began in 2008, the TIP ETF lost about 12% of its value on a total return basis.

However, if you buy individual TIPs and hold them to maturity, you are guaranteed to receive 100% of your investment back with all interest payments and with inflation protection. If you invest $1,000 now, you will receive at least $1,000 back at maturity.

If inflation rises, you will receive more than $1,000 but the higher amount will have the same buying power that $1,000 has today. For example, you might receive $1,500 but in theory that would buy the same amount of goods you could buy for $1,000 today.

There could also be some tax considerations with TIPS as there are with many fixed income investments. For that reason, you should consider consulting a tax professional before investing in these securities.

Even with these concerns, if you are searching for protection against inflation and current income, TIPS or the TIP ETF could be worth adding to your portfolio.