Cryptocurrencies Could Be Right for Your Retirement

Many individual investors face conflicting advice about their retirement accounts. They are told, in at least some ways, to be both conservative and aggressive in their approach to investing in these accounts. Conservative and aggressive investing seem to be polar opposites.

First, they are advised to remember that this money is for the long term so they should contribute as much as possible and avoid withdrawals. This will maximize the benefits of compound interest which is the key to delivering the large gains they’ll need as they approach retirement.

Second, they are often advised to be conservative with their investments because they will depend on this money for retirement. That could mean using annuities, or other slow growth but conservative investments.

Squaring the Circle

These two conflicting philosophies may leave investors feeling as if selecting the right investment opportunity for their retirement account is similar to squaring a circle, a phrase used to describe a task that is almost impossible.

Well, in the investing community, it is actually possible to remain true to these two pieces of conflicting advice and, in effect, square the circle. Cryptocurrencies, or cryptos, could be the key to solving this problem.

Cryptos are volatile, which seemingly classifies them as an aggressive investment strategy and many advisers would recommend against placing these assets in a retirement account. But, of course, stocks are also volatile and small cap stocks are more volatile than large cap stocks.

Yet, small cap stocks are an appropriate investment in a retirement account as long as the assets are just one part of a diversified asset allocation plan. Diversification could be the very reason that it makes sense to include cryptos in a retirement account.

The goal of all investing is to buy assets that accumulate in value. Stocks deliver gains, according to many experts, averaging about 10% a year. But they are risky and have fallen as much as 90%, as an asset class, during the Great Depression, and more than 50% twice since 1999.

Bonds are safer, but they offer smaller returns. This explains why many investors tilt their retirement accounts towards stocks, including large institutional pension plans.

It is possible to add more assets to the retirement account, a process followed by many of those large institutional pension plans. Additional assets typically include commodities including gold, private equity stakes and real estate, as well as raw timber land.

These additional assets carry risk because they might not be easy to sell. Therefore, they are necessarily long term investments.

A small allocation to cryptos could provide the performance kick to an individual’s retirement account that nontraditional assets are expected to deliver for large institutional pension plans.

Large Gains Are Possible in Cryptos

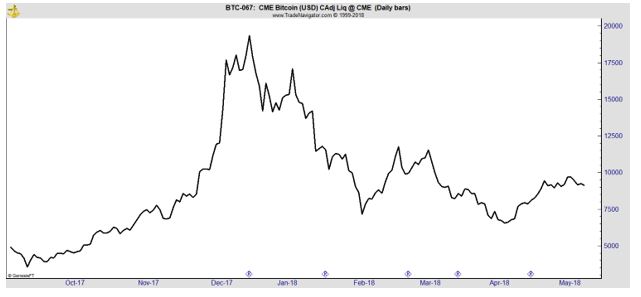

Anyone following the crypto markets has most likely noticed the large gains that cryptos, including Bitcoin, have delivered. The gains are often shown in the form of a chart like the one below.

Here, the size of the gains is evident, but difficult to quantify. The risks are also evident. But, a long term view could minimize the risks as we detail in a moment. But, before that, it could be helpful to take a look at the prices of Bitcoin in a different format.

Source: BitcoinIRA.com

Here, the gains are more easily understood. These gains also ignore the large run up that occurred in late 2017 and show the more reasonable gains that are possible in the asset class.

Now, the risks are real. But, if crypto gain acceptance over time, the long term results will be meaningful to an investor’s wealth.

The Long Term Views of Experts

In the long term, many well known experts are bullish. This includes Eric Schmidt, CEO of Google, who noted, “Bitcoin is a remarkable cryptographic achievement and the ability to create something that is not duplicable in the digital world has enormous value.”

Another tech guru, Paypal founder Peter Thiel, said, “I do think Bitcoin is the first encrypted money that has the potential to do something like changing the world.”

Even conservative analysts like Campbell Harvey, Professor of Finance at Duke University, see long term potential:

“For me, though, I look at Bitcoin not just as a currency, but what it could do in the future in other applications. Think of the Bitcoin technology as a way to exchange and verify ownership. It’s like getting into your car with your smartphone. You present cryptographic proof of ownership. You’re the owner and it’s verified through this common ledger. The car is able to identify that it is your car, and so the car starts. You’re done.”

Even Ben Bernanke, a former chairman of the Federal Reserve is cautiously optimist, stating, “[Virtual Currencies] may hold long-term promise, particularly if the innovations promote a faster, more secure and more efficient payment system.”

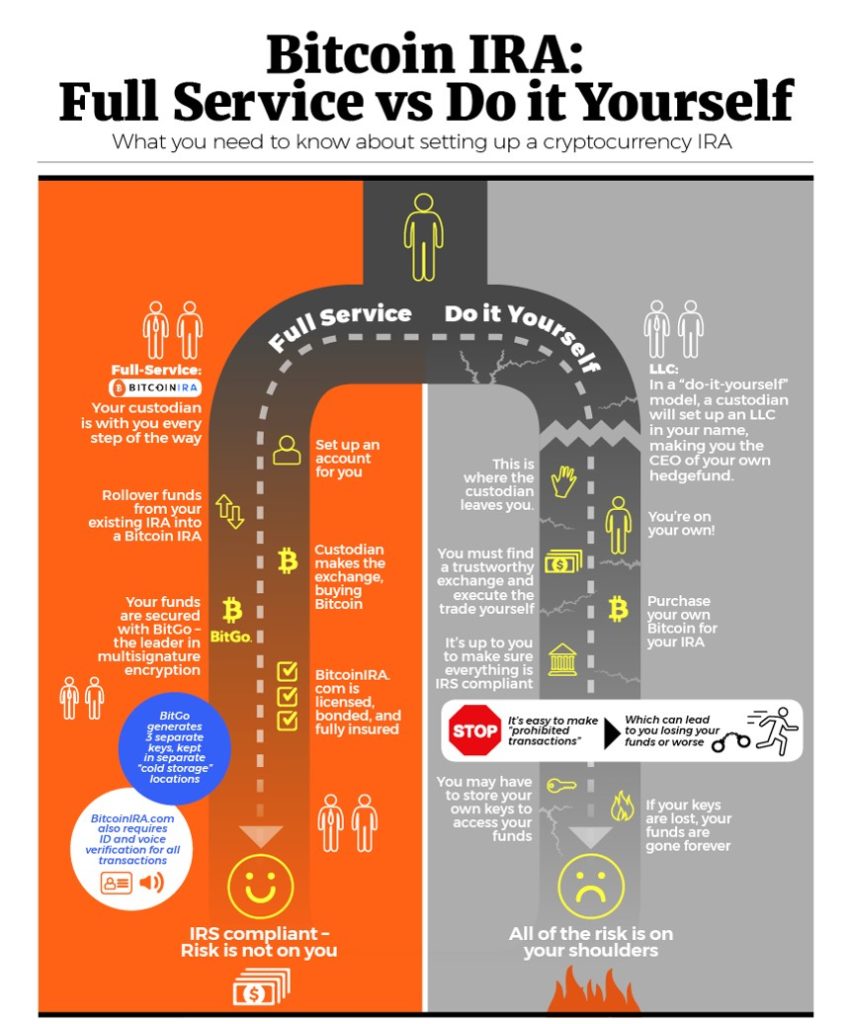

As a long term asset, cryptos could be useful in retirement accounts. However, they are a new asset class and it could be best to consider using a full service custodian to minimize the risks of making a mistake in the account. Some risks are shown below.

Source: BitcoinIRA.com

Among the benefits of a higher cost, full service company is that they will walk you through the entire process of setting up a Bitcoin IRA from start to finish and ensure total IRS compliance for the transaction.

A firm like BitcoinIRA.com makes it possible to roll over funds from an existing IRA custodian (e.g Fidelity) which is a process that can incur significant penalties if mistakes are made. The same is true if adding new funds to a retirement account. IRS penalties can be significant.

A full service firm makes it possible to trade cryptos and move funds into a secured digital wallet while ensuring IRS compliance.

Other firms, like BitIRA.com, will have smaller fees but will shift many of the compliance issues to the investor. This might not be a concern for some but it could be to others.

While bitcoin retirement accounts have appeal, they need to be researched to ensure compliance with all applicable laws and regulations.