Investing in high quality preferred stocks

Source: Nasdaq.com

Learn about Investing in high quality preferred stocks and get passive income. Preferred stocks are an often overlooked asset class. Preferred stocks are assets that combine some of the features of stocks with some of the features of bonds.

Shares of preferred stock are a claim on the company’s assets, just like common shares which are the class of stock that is more commonly traded. However, preferred shares have a higher claim on the company’s assets and earnings than common stock.

Preferred shares generally have a dividend that must be paid out before dividends to common share holders can be paid. Unlike common stock, preferred shares usually do not have voting rights that provide share holders with a say in the company’s operations.

One benefit of preferred stock is that although it pays a fixed level of dividends, like common shares the market price of the security can go up.

Preferred Share Prices Correlate With Interest Rates

The amount of the dividend is fixed when a company issues preferred shares. That amount will often be expressed as a percentage because the par value of the shares.

The par value is the face value of the shares. This is a concept that is usually applied to bonds. The par value of a bond is the amount that will be paid when the bond matures. It is typically $1,000. The market price of a bond may be above or below par, depending on factors such as the level of interest rates and the bond’s credit status.

Par value for preferred shares is usually $25 or $100 and the market price will be determined by the current level of interest rates and the financial health of the issuer.

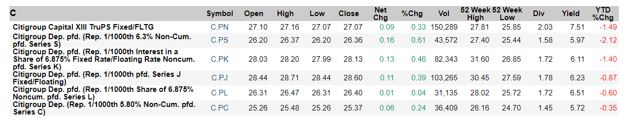

Many well known companies issue preferred shares. Below are recent price quotes for preferred shares issued by Citigroup.

Source: The Wall Street Journal

The symbol usually includes the stock’s symbol (C in this case) and the series of the preferred C.PC, at the bottom of the listings, is the C-series issue and carries an interest rate of 5.8%. The shares par value is $25, and the current price is slightly above that at $25.26.

The quotes will be familiar to stock market investors who see the open, high, low and closing prices for common shares of stocks they follow. Notice that the volume on the preferred shares is sufficient to provide liquidity to individual investors.

The 52 week high and 52 week low columns show that these investments are not very volatile. This is because Citigroup is a financially stable company and the preferred shares move in line with changes in interest rates.

The dividend is expressed in dollar terms and as a percentage of the current price of the preferred shares. Dividends are usually paid quarterly but could be paid more or less often, depending upon the terms of the individual security. The amount shown in the table is the annual payment, not the quarterly payment.

The YTD change, or the year to date change in the price in percentage terms, confirms the low volatility in the issuers.

The Long Term View of Price Volatility

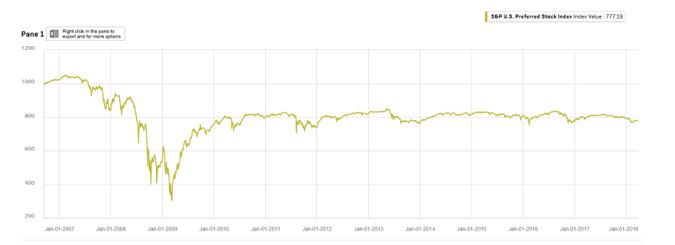

While preferred shares generally track interest rates, their prices are not immune to bear markets. The next chart shows the S&P U.S. Preferred Stock Index, a broad index that tracks the securities. Notice the steep decline in 2008 and then the lack of volatility in the bull market.

Source: Standard & Poor’s

This chart demonstrates that these securities could be best for income investors with a long term horizon. The long term outlook is needed to accept the risk of the steep drawdown that is possible in a bear market.

There are many individual issues available, or an investor could choose to invest in an index of preferred securities. Several exchange traded funds, or ETFs, make it possible to conveniently invest in a diversified basket of preferred shares at a low cost.

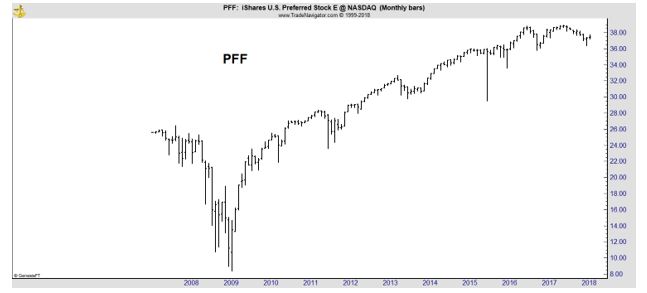

One ETF is iShares US Preferred Stock ETF (NYSE: PFF). The next chart shows the price action in this ETF is similar to the movements seen in the broad index above.

The drawdown in the bear market was more than 68% but investors who held through that decline did recover their losses, just as investors in the broad stock market indexes did.

Given the risks related to a price decline in the ETF, investors need to be comfortable with the level of income provided. The yield on PFF was recently 5.7%.

Who Should Consider Investing in Preferred Stocks

There are many investors who could benefit from this asset class. Long term investors may find the yields to be suitable in the current market conditions.

Small investors can target specific yields in specific issues. Many of these securities have a par value of $25 and trade near $25 a share. As the table above showed, it is possible to buy securities yielding more than 7% at a price of less than $30 a share.

Preferred dividends are not subject to being reduced like dividends of common stocks are and the dividends of cumulative issues will always be paid even if they are omitted for a period of time.

This means a company could skip one or two payments in a time of distress but will make the payments when funds are available, assuming the company is not headed towards bankruptcy.

Preferred shares can also be noncumulative (or non. cum as shown in the price table above). In that case, the company would not make up any missed payments. Because of that, cumulative shares which have more safety will usually trade at prices that are lower than similar noncumulative shares.

Investors could also consider using margin, especially if they maintain a long term outlook. Buying securities on margin could boost income but it carries the cost of margin interest. However, at discount brokers, many investors may find the yield on the preferred shares or on PFF exceed the cost of a margin loan.

When the risks and potential rewards of the preferred stocks are considered, many investors will discover that this overlooked asset class is an ideal source of passive income.