Cryptos as Part of a Balanced Portfolio

Individual investors often think of a balanced portfolio as one that holds stocks and bonds. One of the most popular approaches is to allocate 60% to stock market investments and 40% of the account’s value to fixed income or bond market investments.

Investment professionals tend to think of a balanced portfolio in terms other than stocks and bonds. They may add an allocation to real estate or commodities, for example. At the extreme are funds that diversify broadly.

Yale University’s endowment fund is considered one of the best managed portfolios in the world. The fund managers invest more than $27 billion on behalf of the university. As the managers noted in their most recent performance update:

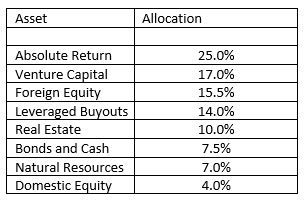

“Yale continues to maintain a well-diversified, equity-oriented portfolio, with the following asset allocation targets for fiscal 2018:

Yale targets a minimum allocation of 30% of the endowment to market-insensitive assets (cash, bonds and absolute return). The university further seeks to limit illiquid assets (venture capital, leveraged buyouts, real estate and natural resources) to 50% of the portfolio.”

Individuals Should Also Consider More Than Stocks and Bonds

Individual investors will not have access to the same investments that Yale has. Hedge funds often carry minimum investments of more than $1 million. Venture capital is an area largely out of reach of individuals. However, despite the limitations, individuals can diversify beyond equity and fixed income investments.

Individuals can invest, for example, in commodities or natural resources by owning gold. They could own gold coins or bars, shares of gold mining companies or exchange traded funds (ETFs) or mutual funds that offer exposure to the industry.

Cryptocurrencies are also an asset class and may in fact be considered the newest asset class. That makes the question of how to invest in cryptos particularly relevant.

One way to access crypto is by setting up an account at a crpto exchange such as Coinbase.

Coinbase is a digital currency wallet and platform where merchants and consumers can transact with new digital currencies like bitcoin, ethereum, and litecoin. The exchange reports that it has more than 10 million users and has completed more than $50 billion in transactions since it was founded in 2012.

There are other crypto exchanges that could meet the needs of an individual investor as well. It is important to research any exchange, and any crypto investment, to be certain the risk of the investment is in line with an investor’s personal risk tolerance.

Combining Assets in a Single Account

Crypto exchanges make it easy to gain exposure to multiple cryptos. However, the limitation of the exchange is that they limit investments to crypto. Recently, another option became available to individual investors.

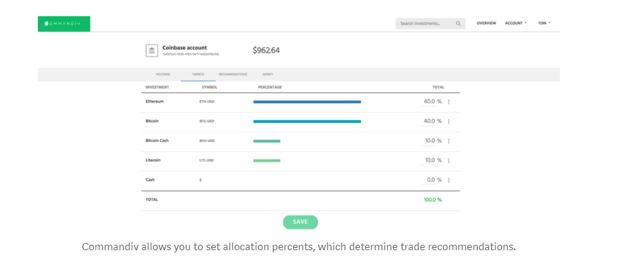

Commandiv recently announced that it is “now the first and only platform” to trade cryptocurrencies and stocks in the same account. There are likely to be more accounts at different firms soon in the rapidly advancing crypto space.

Source: Commandiv

Commandiv partnered with Coinbase so that users can manage their Bitcoin, Litecoin, and Ethereum, as well as utilize Commandiv’s personalized trade recommendations for stocks or to trade stocks or ETFs without commissions. The firm offers investors a chance to track their investments in a single account.

From the perspective of a trader in the stock market, Commdiv is like almost any other online broker. Its platform allows traders to research stocks and to enter their own trades. The securities are protected by the Securities Investor Protection Corporation, or SIPC, up to $500,000.

The SIPC is charted by the US Congress to oversees the liquidation of member broker-dealers that close when the broker-dealer is bankrupt or in financial trouble, and customer assets are missing. This is the same protection available at any broker including the largest names in the industry.

In the unlikely event of a liquidation under the Securities Investor Protection Act, SIPC and the court-appointed Trustee work to return customers’ securities and cash as quickly as possible. Within limits, SIPC expedites the return of missing customer property by protecting each customer up to $500,000 for securities and cash (including a $250,000 limit for cash only).

SIPC adds a level of security to Commandiv that is not available at all brokers. The firm also offers fiduciary advice.

According to experts, “a fiduciary’s responsibilities or duties are both ethical and legal. When a party knowingly accepts a fiduciary duty on behalf of another party, he or she is required to act in the best interest of the principal, the party whose assets they are managing.

The fiduciary is expected to manage the assets for the benefit of the other person rather than for his or her own profit, and cannot benefit personally from their management of assets.

Strict care is taken to ensure no conflict of interest arises between the fiduciary and his principal.”

Asset Allocation Options

Although asset allocation is not always something that individual investors pay a great deal of attention to, it is often an important component in the investment policy of professional investment managers. The reason for that emphasis among professionals is easy to understand.

Asset allocation is integral to long-term investment success. In fact, a landmark study cited in the Financial Analysts Journal shows that about 90% of the variability of average total returns earned by balanced mutual funds and pension plans over time was the result of asset allocation policy.

With Commandiv, asset allocation is simple and expansive. As an individual, you could expand well beyond stocks and bonds. It would even be possible to allocate assets to foreign markets and, perhaps most importantly in the current environment, to crypto currencies.

The firm’s pricing is based on the amount of assets in the account, offering investors a chance to lower their costs by adding assets. Pricing starts with an annual fee of 0.49% of assets for the smallest accounts, and there is no account minimum. However, a minimum monthly fee of $2 is assessed.

While Commandiv is unique for now, it is an interesting investment account that could be considered by investors. Long term investors in the stock market could use the account to learn about cryptos. Traders could use the account to benefit from moves in any market that is volatile at the time.

It could be important to watch for other brokers making similar offerings. This would demonstrate the financial market’s confidence in crypto currencies which are likely to expand dramatically in the coming years.