Your Best Investment Options for Retirement Planning in 2018

As the end of the year approaches, many investors are reviewing their portfolios. They are deciding how to allocate their funds in the year ahead and where new investment funds should be placed. This is especially important at this time of year as many retirement accounts should be assessed at least annually.

While investors should review their investment options from time to time, at least some fail to do so. This can create large risks when it is time to retire. Failing to plan for retirement as it approaches could lead to working longer, a penalty no investor wants to pay.

First, Determine Risk Tolerance

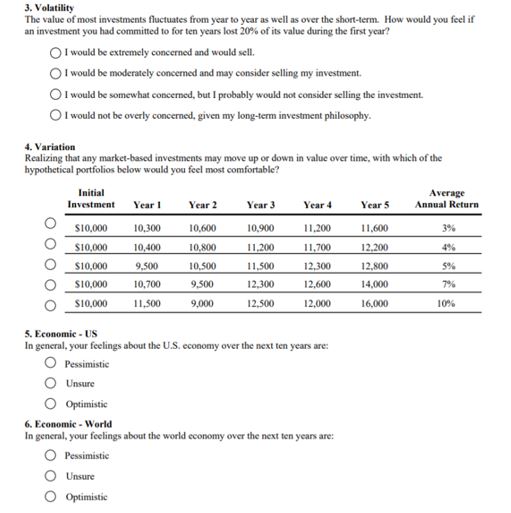

Many investment advisers use standardized risk assessment forms to identify the tolerance of their clients. An example of part of one firm’s questionnaire is shown below.

Source: Raymond James

These questions are useful and firms have developed algorithms to interpret the answers. But, the forms have an important limitation in that the questions are theoretical. Investors are asked to assess how they would feel about certain events.

In reality, when the events occur, investors have different feelings than they expected. This leads to problems and could lead to decisions that act against their long term interests.

One way to think of risk is to consider the time left to retirement. This could be the most important factor in determining the best investment options for you as an individual.

Time to Recovery Could Be a Tool to Manage Risk

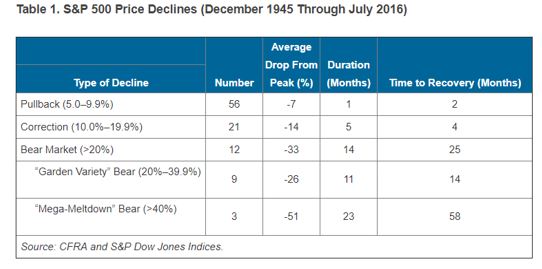

One recent research report considered how often market declines of various depth occurred and, perhaps more importantly how long it takes, on average, to recover from the decline. Average recovery times are shown in the next chart.

Source: AAII.com

Recovery times provide a different and important way to look at the risk of the stock market. Usually, risk is reduced to numbers like the standard of volatility of returns or the largest historic loss in percentage terms. These are important values but difficult to use when planning your best investment options.

Time to recovery shows the length of time it took, on average, for the stock market to recover after making a low.

The author of this research, the noted analyst Sam Stovall, explained:

“The 56 pullbacks since December 31, 1945, dragged down the market by an average of 7%, taking about one month to go from peak to trough. However, the S&P 500 then took an average of only two months to recover all that was lost during these declines.

What’s more, the market took only about four months to recover fully from declines of 10.0% to 19.9%. So in greater than 85% of all declines of 5% or more since World War II, the market got back to breakeven in an average of only four months or fewer!

Finally, the S&P 500 took an average of only 14 months to recover from the more typical “garden-variety” bear market (declines of 20% to 39.9%), causing one to conclude that if an investor can’t wait a year, then they probably have no business investing in equities!”

His last point is emphasized because of its importance. If an investor can’t wait a year for a recovery, they should not accept the risk of a decline. The cost is just too high.

Now, this way of thinking offers information related to your best investment options as you approach retirement. Notice that the steepest bear markets last an average of 23 months and require an additional 58 months to recover.

In total, this time period covers 81 months, or just under 7 years.

If you are within 7 years of retirement, you need to be less risk tolerant. Prior to that time, on average, you have time to recover from a bear market. After that time, the risks could exceed the potential best return on investments.

Your Best Investment Options for Next Year

Assuming you can tolerate the risk of the stock market, your best investment options in 2018 most likely lie in the stock markets.

But, consider looking outside the United States in the next year. Many investors in the US dedicate an excessive allocation to their home country. This isn’t a concern limited to US investors.

According to data from the IMF’s Coordinated Portfolio Investment Survey, US investors allocated over 70% of their equity assets to the US even though based on market capitalization the US represents less than 50% of the opportunity set.

Canadian and Australian investors exhibit similar levels of concentration of equity exposures (60%-70%) in their domestic markets despite these markets representing only 3.3% and 2.4% of the global opportunity set based on their respective weights in the MSCI ACWI index.

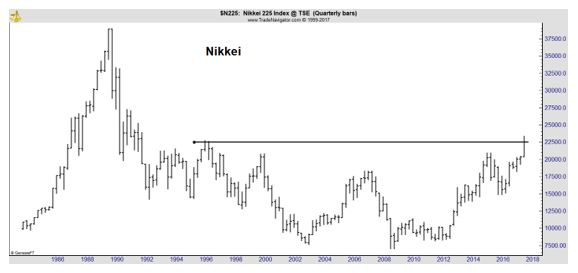

Looking ahead, long term charts indicate Japan could be among the best investment options in the future.

The Nikkei 225 Index, a benchmark index for the stock market in Japan, peaked in 1989. The index recently broke above its 1996 high. This is a bullish indicator for technical analysts.

Based solely on chart analysis, the Nikkei could gain more than 20% in the next year. This is based on the measured move from the breakout point, a common technique applied in technical analysis.

Outside of the stock markets, there are many investment options available although few are screaming buys as we enter 2018.

Bonds and Commodities Raise Caution Flags

Bonds have been in an extended bull market for more than 35 years. But, the Federal Reserve has now been raising rates for two years. This could be a problem for the bond markets.

Bond prices fall as interest rates rise. This means bonds may fall as central banks around the world raise rates or pursue quantitative tightening policies. Quantitative easing, the central bank policy of buying other asserts rather than changing interest rates to effect policy changes, has been an experiment.

By many measures quantitative policies have been successful. However, there is no precedent for how markets or the economies of different nations will react to an end of these policies. There are theories and there are risks. Investors looking to avoid risk may find short term fixed income instruments are their best investment options.

Short term instruments will offer low yields. This may be disappointing but for investors approaching retirement, return of capital may be more important than return on capital.

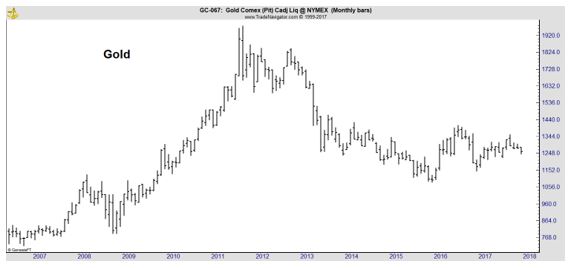

Risks related to loss of capital also extend to commodity markets. The chart of gold is shown below.

This is also a long term chart and shows a multiyear trading range for the metal. Many commodities show similar chart patterns. One problem for these markets is bitcoin.

While bitcoin is a new investment, it appears to be perceived as, at least in part, a store of value. This is one of the functions of gold, and by extension, other commodities or commodity indexes held. For now, bitcoin represents a threat to that role and could be weighing down the price of gold and commodities.

Avoiding the risks of bonds and commodities reinforces the emphasis on the equity markets as the best investment option.

However, there are concerns that stocks, particularly in the US, are overvalued. That indicates now is an ideal time to consider overcoming the home country bias and increasing the amount of investment allocations to overseas markets.

Looking abroad, Japan could be one of the best investment options in 2018. The country appears to be breaking out of a multiyear bear market that dates back to 1989 and could be among the best performing markets for years to come.

For more investing tips, you can follow our weekly blog here.