Short Term Investment Tips for Conservative Investors

Investors are often advised to focus on the long term. This might be good advice but often it comes from a financial adviser who 1% or so of the assets they offer advice about. The adviser’s long term focus may be on maximizing the time you allow them to collect fees.

Now, there are certainly good advisers and there are certainly times when the cost of financial advice is a bargain. But, a focus on the long term might not be the only way. There are a number of investment opportunities that work well as Short Term Investment Tips for Conservative Investors.

Short Term Investment Tips for Conservative Investors

To invest for the short term, it is important to define your personal financial goal. This is a process that is no different than long term investing.

Your goal could be to ensure cash is available. This is a common short term goal of those in retirement or approaching that milestone. To meet this goal, many investors convert holdings to cash or short term fixed income exchange traded funds (ETFs).

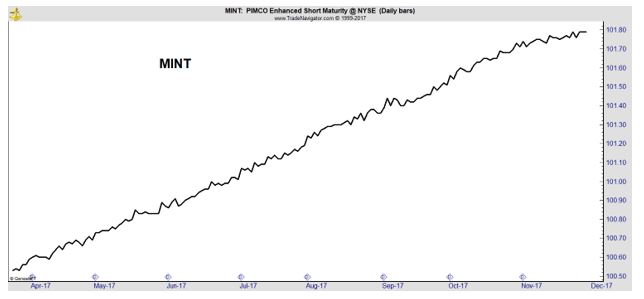

One fund to consider is PIMCO Enhanced Short Maturity Active ETF (NYSE: MINT). Its chart is shown below.

While the trend is clearly up, MINT has gained just 1.7% in the first 11 months of the year. It can be thought of as an alternative to holding cash although as an ETF, there is more risk in MINT than in cash.

Short Term Investment Tips for Aggressive Investors

Other investors may want to use short term investment strategies to harness the power of compounding. The importance of compounding returns is well known. By compounding, in the best case, you reinvest profits to maximize possible gains.

For example, with compounding, a $1,000 investment grows to $2,594 in ten years with 10% average annual gains. Without compounding, that same $1,000 investment increases to just $2,000 over 10 years at 10% simple interest.

Compounding increased the gain by nearly 60% in that example. But, it is important to consider the fact that there is no reason compounding must be measured in years. Short term investment strategies could use periods of months for compounding.

For example, if you could compound gains at a rate of 1.5% per month, $1,000 would grow to more than $2,500 in a little more than five years. This is significantly faster than compounding at an annual rate.

Many investors will question whether steady gains are possible in a short time frame. There are actually a number of ways that could be accomplished.

One short term investment tip is to consider using best investment options strategies.

Options Can Compound Wealth in the Short Term

An option gives the buyer the right, but not the obligation, to buy or sell a stock at a predetermined price at any time prior to a predetermined expiration date. Options buyers never risk more than they paid to purchase the option.

Options generally trade at low prices, often less than $100 for a contract which effectively controls 100 shares of stock. Buyers cannot lose more than the cost of the option, but sellers can lose more than their initial investment. There are some strategies where sellers face unlimited risks.

While selling options may not be the right strategy for all investors, there are some investors who use these strategies to achieve wealth. But, for now, we will focus on strategies with limited risks. Some of these strategies can involve both buying and selling options but still have limited risks.

Individual investors will generally trade call options or put options. A call option gives the buyer the right, but not the obligation, to buy shares of a stock or ETF. A put option gives the buyer the right, but not the obligation, to sell shares a stock or ETF.

A call option will generally increase in value if the price of the stock or ETF the option covers increases in value. A put option generally benefits from a decline in price.

Specific Short Term Investment Tips

Rather than explain how calls and puts can be used in theoretical terms, we will look at specific trade ideas. We will consider trading options on the SPDR S&P 500 ETF (NYSE: SPY), an ETF that tracks the S&P 500 index.

This ETF has options available that expire every week. Many stocks will have weekly options while others will only have monthly options. No matter when they expire, all options share certain characteristics and can be traded in exactly the same way.

SPY has moved an average of 1.4% in a week over the past year. With SPY trading near $265, that means the average price move per share is expected to be about $3.70.

There is a call option expiring in one week with an exercise price of $265. That means it gives the buyer the right to buy 100 shares of SPY for $265 per share. If SPY rises to $267, this option would be worth at least $2 per share, the difference between the market price of SPY and the exercise price of the option.

The call option could be worth more than that difference and often is because options are priced on various factors including market volatility, interest rates and the amount of time to expiration.

That option is trading for about $1.50. Since each contract covers 100 shares, this option would cost about $150 to buy ($1.50 * 100 shares).

If SPY makes an average move and the price action is all to the upside, this option would be worth at $3.70 and the trade would deliver a gain of more than 100% in a week. Conservatively, if the ETF makes even a small move upward, just one third of the average range, this option would most likely deliver a gain of at least 10%.

Now, 10% of $150 may not sound like much, but this is a trade that would last just one week. And, the price is low enough that many traders could buy two or three options contracts even in a small account.

But, there will also be weeks when SPY makes a relatively large move. Over the past year, the largest one week move was 2.77%. This could more than double an investor’s money, in just one week.

Of course, there will be some weeks when the trade loses money. In fact, there will be weeks when the market moves very little. The smallest move in one week over the past year was just 0.5%. That would most likely lead to a 100% loss on the trade.

Options provide a great deal of flexibility. Investors could buy put options if they expect the stock market to decline. They would then benefit from price moves to the down side. A put option with an exercise price of $265 and expiring in one week also costs about $1.50 as this is written. Th

An investor could buy a put or call every week and target a gain of 1%. At the end of one year, this rate of return would result in a gain of more than 150%, thanks to the power of compounding wealth.

Is 1% a week possible? We believe it is with options trading as long as the investor follows a disciplined approach and takes profits when they are available. This type of strategy can be difficult to follow but it could be well worth the effort since compounding does grow wealth quickly.

In the end, the best short term investment tip is the same as the best long term investment tip. Use compounding to maximize wealth.

For more investing tips, you can follow our weekly blog here.