Computers Might Be Making This Decline Worse, or Better

There has been a relentless shift on Wall Street ever since the first traders gathered under the buttonwood tree that grew on the spot of what is now the New York stock Exchange. That shift has been to adopt new technologies and strategies as soon as practical.

The rush to change is driven by the purpose of the gathering under the buttonwood tree. Traders were looking for a way to profit from fluctuations in business and that has been the objective of traders ever since.

But, as so many things in life have changed, the shift is towards speed and with computers, the fastest traders can make a profit. However, this shift has led to concerns that computers are driving the action on Wall Street.

In a recent article called Behind the Market Swoon: The Herdlike Behavior of Computerized Trading, The Wall Street Journal reported that,

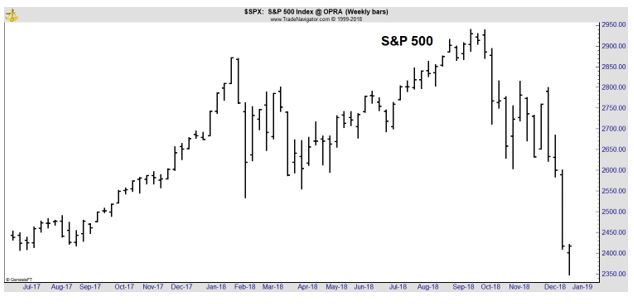

“Behind the broad, swift market slide of 2018 is an underlying new reality: Roughly 85% of all trading is on autopilot—controlled by machines, models, or passive investing formulas, creating an unprecedented trading herd that moves in unison and is blazingly fast.

To many investors, the sharp declines are symptoms of the modern market’s sensitivities. Just as cheery sentiment about the future of big technology companies drove gains through the first three-quarters of the year, so too have shifting winds brought the market low in the fourth quarter.

Source: The Wall Street Journal

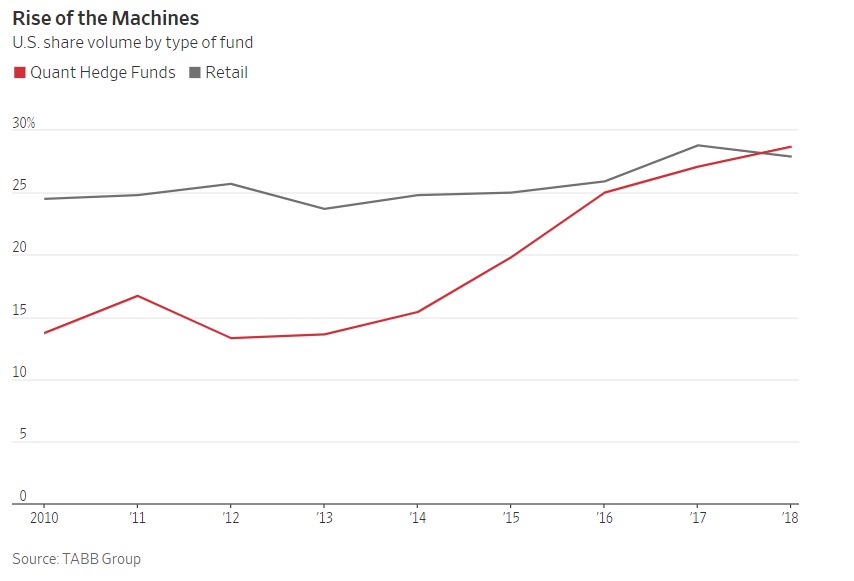

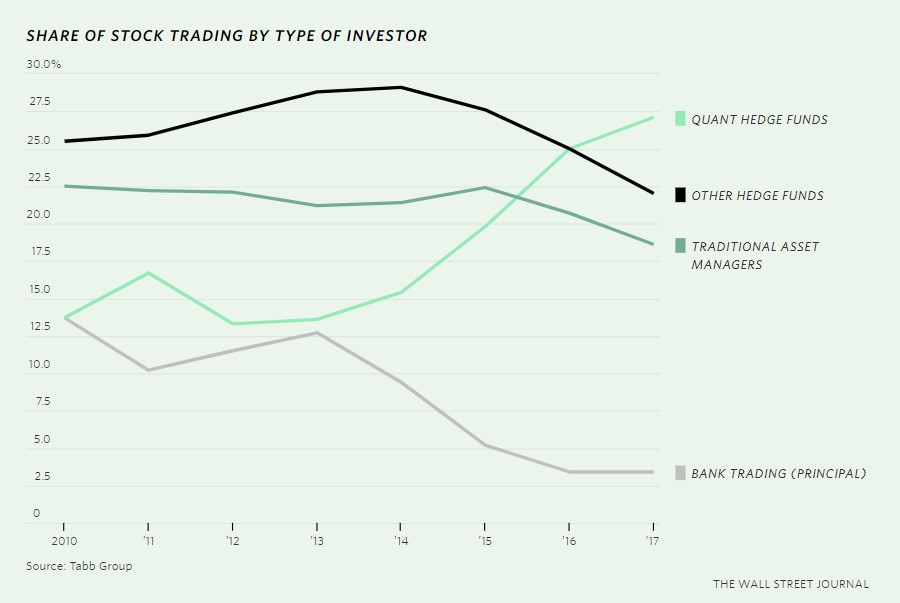

Today, quantitative hedge funds, or those that rely on computer models rather than research and intuition, account for 28.7% of trading in the stock market, according to data from Tabb Group–a share that’s more than doubled since 2013. They now trade more than retail investors, and everyone else.

Add to that passive funds, index investors, high-frequency traders, market makers, and others who aren’t buying because they have a fundamental view of a company’s prospects, and you get to around 85% of trading volume, according to Marko Kolanovic of JP Morgan .

“Electronic traders are wreaking havoc in the markets,” says Leon Cooperman, the billionaire stock picker who founded hedge fund Omega Advisors.”

It’s Been a Trend for Some Time

This is largely due to the fact, as The Wall Street Journal has previously reported, “up and down Wall Street, algorithmic-driven trading and the quants who use sophisticated statistical models to find attractive trades are taking over the investment world.

On many trading floors, quants are gaining respect, clout and money as investment firms scramble to hire mathematicians and scientists. Traditional trading strategies, such as sifting through balance sheets and talking to companies’ customers, are falling down the pecking order.

“A decade ago, the brightest graduates all wanted to be traders at Wall Street investment banks, but now they’re climbing over each other to get into quant funds,” says Anthony Lawler, who helps run quantitative investing at GAM Holding AG .

The Swiss money manager last year bought British quant firm Cantab Capital Partners for at least $217 million to help it expand into computer-powered funds.

Guggenheim Partners LLC built what it calls a “supercomputing cluster” for $1 million at the Lawrence Berkeley National Laboratory in California to help crunch numbers for Guggenheim’s quant investment funds, says Marcos Lopez de Prado, a Guggenheim senior managing director.

Electricity for the computers costs another $1 million a year.

Algorithmic trading has been around for a long time but was tiny.

An article in The Wall Street Journal in 1974 featured quant pioneer Ed Thorp. In 1988, the Journal profiled a little-known Chicago options-trading firm that had a secret computer system. Journal reporter Scott Patterson wrote a best-selling book in 2010 about the rise of quants.

Prognosticators imagined a time when data-driven traders who live by algorithms rather than instincts would become the kings of Wall Street.”

And they have, over time, been moving in that direction. Last year, quant hedge funds became the most active group on Wall Street.

Source: The Wall Street Journal

Now, “The speed and magnitude of the move probably are being exacerbated by the machines and model-driven trading,” says Neal Berger, who runs Eagle’s View Asset Management, which invests in hedge funds and other vehicles. “Human beings tend not to react this fast and violently.”

But, There are Still Trends

While computers and trading strategies make it possible for market moves to unfold in seconds, the moves are still driven by fundamental factors. Among those factors are:

- A slowdown in growth in the economies of Japan, China and Europe, and suggestions the U.S. might be moderating a little bit too.

- The end of an era of low interest rates and easy money. In late September, the Fed pushed interest rates above the rate of inflation for the first time in a decade. This month, the ECB confirmed it would end its $3 trillion bond-buying program.

- A decline in the growth of corporate profits. In each of the first three quarters of the year, profits of S&P 500 companies rose about 25% from a year earlier, helped by the corporate-tax cut. According to FactSet projections, earnings growth for the S&P 500 in the fourth quarter will be less than half what it was earlier in the year. It will fall into single digits in 2019.

- Erratic politics in large parts of the world. The U.S. and China are embroiled in a trade dispute. President Trump is openly denigrating the Federal Reserve on Twitter. Britain is fumbling through Brexit and Italy through an economic drought with consequences for its giant bond market.

So, there are reasons for the selling that has pushed major market averages significantly lower.

Computers are making the move quicker, according to some experts. However, since the computers are really executing programs written by humans, they are not the driving force behind the direction of the trend. They are merely accelerating the trend.

This is the good news. If computers accelerate the trend, that means the down trend and the bear market which seems to have hit stocks, could be over quicker than usual. Then, when news becomes bullish, prices could rebound quicker than usual.