This Group of Stocks Could Help Income Investors Ride Out a Bear Market

As stocks sold off, almost all stocks declined. That is truly the way prices move in a sell off and almost all stocks should be expected to decline but some will decline less than others. In the recent sell off, preferred stocks sold off less than the S&P 500 index.

A preferred stock, is defined by Investopedia as, “a class of ownership in a corporation that has a higher claim on its assets and earnings than common stock.

Preferred shares generally have a dividend that must be paid out before dividends to common shareholders, and the shares usually do not carry voting rights.

Preferred stock combines features of debt, in that it pays fixed dividends, and equity, in that it has the potential to appreciate in price. The details of each preferred stock depend on the issue.”

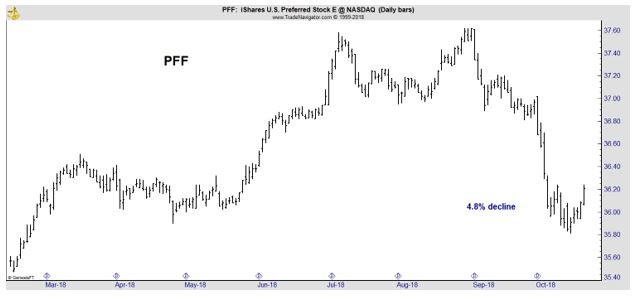

Investors looking at preferred stock could consider iShares U. S. Preferred Stock ETF (NYSE: PFF). PFF is the largest preferred stock ETF with assets of about $15 billion. At the recent price, the yield was about 5.7%.

The chart above shows that PFF did sell off in the recent market decline, but it fell just 4.8%, less than the 7.8% decline in the S&P 500.

Analysts Are Bullish on Preferred

Barron’s recently highlighted the fact that yields on many preferred issues have risen a half percentage point or more in the past month, as investors have sold off Treasuries.

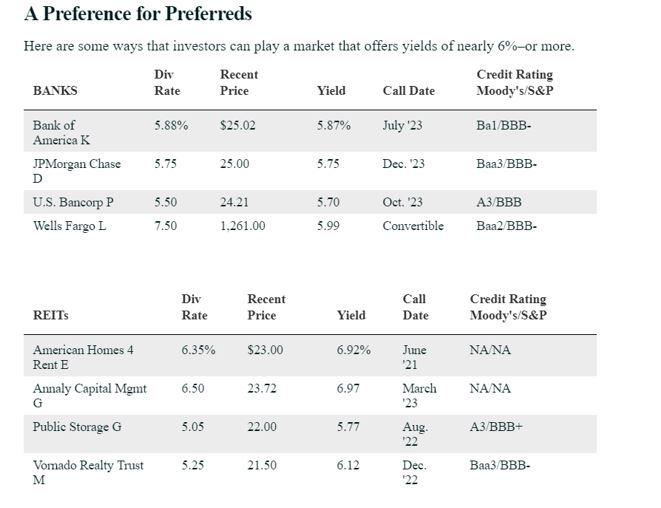

Preferreds from bank issuers like Bank of America (NYSE: BAC) and JPMorgan Case (NYSE: JPM) are yielding close to 6%. The preferred stock of some real estate investment trusts have yields of around 7%.

These yields have caught the attention of some analysts. “We’re incredibly constructive on the market now,” says Doug Baker, head of the preferred sector group at Nuveen, which runs about $8 billion of preferred investments.

One reason for Baker’s optimism is a widening yield gap between bank preferred and Treasury securities this year even as bank credit-quality improves. Banks account for more than half the $350 billion domestic preferred market.

Credit quality is important because preferred stock is a senior form of equity and thus is more vulnerable than debt to financial stress. Companies can decide not to pay preferred dividends without the actions treated as defaults.

Because of that flexibility to skip payments, credit ratings on preferreds are usually several notches below those on bonds.

Among the specific ideas for investors interested in income are the preferred shares listed in the table below.

Source: Barron’s

Barton’s also cited one bond in particular.

One large and unusual preferred issue is the $4 billion Wells Fargo series L. It carries a lofty dividend rate of 7.5%, trades around $1,260, a big premium to face value of $1,000, and yields about 6%.

It’s a favorite of David King, co-manager of the Columbia Flexible Capital Income fund (CFIAX). “I can see why it confuses people but it’s a better instrument to own than traditional preferred.”

This convertible issue can be called only if Wells Fargo (NYSE: WFC) common stock, now around $53, hits $156 and then at an effective 30% premium to its face value. This gives the issue considerable call protection. Bank of America has a preferred with a similar structure, its series L.

Important Investment Considerations

Analysts generally believe preferred shares of high quality companies are safe. Even though corporations have the legal ability to skip dividends, they will rarely do so. One reason is the fact that companies generally can’t pay common stock dividends without paying preferred dividends.

There are some important tax considerations investors might need to consider. These are just general points. For specific information, before investing in these type of securities, you should consider consulting your personal tax professional.

Most preferred dividends are treated like common stock dividends and are subject to the preferential 20% top tax rate. This could be beneficial to some investors.

But, REIT preferreds don’t benefit from the preferential dividend tax rate and usually are subject to a top rate of 29.6%. Investors pay their marginal income-tax rate, but they may be able to deduct 20% of their REIT dividends from their taxes.

“Thus, only 80% of the dividends derived from a REIT are taxable,” says New York tax expert Robert Willens. “Using a maximum rate of 37%, this translates into an ‘effective’ tax rate imposed on REIT dividends of 29.6%.”

Compared to bonds, liquidity is also better with preferred since most trade on the NYSE compared with the more opaque market for corporate bonds. Many preferreds are sold at a $25 face value to appeal to retail buyers. Those aimed at institutions usually have a face value of $1,000.

Preferreds generally carry fixed dividends and no or very long maturity dates. This makes preferred equivalent to an ultralong-term bond and therefore sensitive to changes in long-term rates.

One potential problem for investors is that issuers typically can redeem, or call, preferreds five years after issuance, resulting in limited upside and considerable downside.

Risks Are Significant

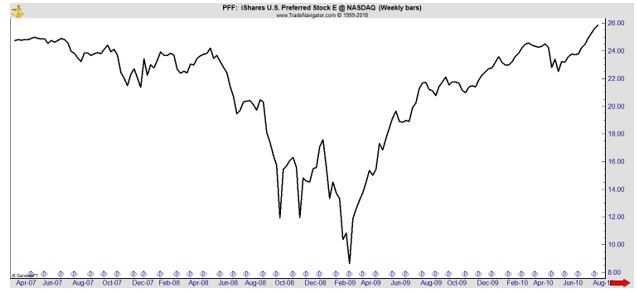

Before leaving an impression that there are many upsides and limited downsides to preferred stock, it can be useful to consider how the asset class performed in 2008 and 2009, what was in effect a significant stress test for many investments.

The chart below shows the performance of PFF and is adjusted to account for dividend income since income is an important factor in this type of investment.

PFF sold off more than 60%, after adding in the dividend income, during the bear market. This was more than the S&P 500 and was most likely due to the fact that financials account for a significant share of the funds holdings and this sector was hit especially hard in the crisis.

If financials are not sold off as steeply in the next bear market, it is possible that PFF could outperform the S&P 500 and other broad stock market benchmarks. But, the risks should not be ignored.

Another risk is the fact that higher interest rates could make preferred stock less attractive.

As always in investing, consider risks and rewards when making your decisions.