Cash Points to Value in These Stocks

Value investors often look at earnings. Stocks with low price to earnings (P/E) ratios can be favorites of value investors. Other metrics including the price to sales (P/S) ratio, the price to book (P/B) ratio and dividend yields, each focus on an important aspect of value.

Finding Value in Financial Statements

The P/E ratio identifies companies that have reported earnings, an indicator of profitability. The P/S ratio focuses in the top line of the income statement. Some investors believe sales are more stable than earnings and provide a better indicator of value.

Book value is also generally considered to be a more stable metric than earnings. In addition to being slow changing, the book value provides a measure of how much investors could expect to receive in a worst case scenario if the company enters bankruptcy.

Dividend yields offer investors return on their investment. Rather than having to wait for capital gains, the investor receives dividends which can provide steady income as long as they are maintained.

While each of these metrics measures something different, none of them will work under all market circumstances. That’s why some investors combine multiple indicators.

Cash as a Value Indicator

Cash might be among the most important indicators of value. A firm with cash is capable of meeting its operating expenses and paying required interest on loan obligations. Cash also allows a firm to invest in its future by funding research and development, acquisition of other companies or expansion in addition to maintaining current operations.

When a company has more cash than it needs, management can decide to reward investors with dividends or with share buy backs. By buying its own shares, the company can increase its own stock price in the short run by creating demand for the shares.

Buy backs can also increase the value of the stock in the long run by decreasing the number of outstanding shares which can increase the reported earnings per share in the future.

Because of its importance to operations and value creation, cash can be an important factor in finding value.

A Screen For Cash Rich Firms

Specifically, we looked for companies with lower than average price to cash (P/C) ratios. But, for added safety, we also required companies to have debt levels that were lower than its peers and we also required the company to have reported earnings in the past year.

Finally, we restricted our list of potential buys to low priced stocks. One study looked at how low priced, or cheap, stocks performed relative to more expensive stocks. The study found that cheap stocks delivered more than six times the average return of the more expensive stocks in a typical quarter.

Just five low priced stocks passed our screen.

Global Cord Blood Corporation (NYSE: CO)

Global Cord Blood Corporation, together with its subsidiaries, provides umbilical cord blood storage and ancillary services in the People’s Republic of China.

The company offers cord blood testing, processing, and storage services under the direction of subscribers; and tests, processes, and stores donated cord blood, as well as provides matching services. It does this through three operating cord blood banks in the Beijing municipality, the Guangdong province, and the Zhejiang province.

The stock appears to be forming a base after an extended decline.

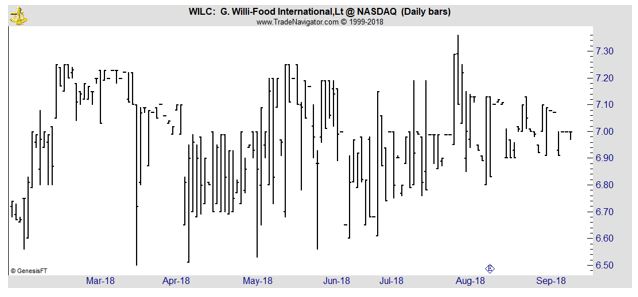

Willi-Food International Ltd. (Nasdaq: WILC)

Willi-Food International Ltd. develops, imports, exports, markets, and distributes various food products worldwide.

It offers canned vegetables and pickles, an assortment of olives, garlic, roasted eggplant, and sun and dried tomatoes; and canned fish comprising tuna, sardines, anchovies, smoked and pressed cod liver, herring, fish paste, and salmon.

The company also provides canned fruits that include pineapple, peaches and fruit cocktail; edible oils comprising olive, sunflower, soybean, corn, and rapeseed oil; dairy and dairy substitutes consisting of cheese, feta, Bulgarian cubes, goat cheese, butter spreads and other products; and dried fruits, nuts, and beans, such as figs, apricots and organic apricots, organic chestnuts, sunflower and sesame seeds, walnuts, pine nuts, cashews, banana chips, pistachios, and peanuts.

In addition, it offers instant noodle soups, frozen edamame soybeans, freeze dried instant coffee, bagels, breadstick, other food and light and alcoholic beverages under the Willi-Food, Donna Rozza, Manchow, Gold Frost, Tifeeret, Say cheese, and Emma brand names.

The stock is relatively illiquid and limit orders should be considered to enter and exit positions in WILC.

BBX Capital Corporation (NYSE: BBX)

BBX Capital Corporation is a private equity and venture capital firm specializing in investments and acquisitions of middle market companies.

The firm also invests in mergers and acquisition, add-on acquisitions, divestiture, taking public companies private and private companies public, leveraged buyout, partnership, recapitalization, and restructuring. It typically does not invest in industries or companies whose ultimate returns are event driven.

The firm seeks to invest across a broad range of industries ranging from service to manufacturing businesses. The firm prefers to acquire controlling interests in its portfolio companies and can also consider minority investments.

This stock also appears to be forming a base after an extended decline.

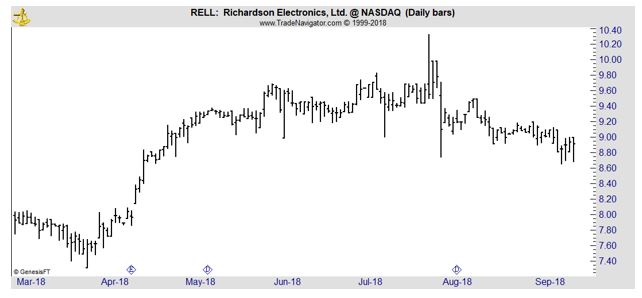

Richardson Electronics, Ltd. (Nasdaq: RELL)

Richardson Electronics, Ltd. engages in power and microwave technologies, customized display solutions, and healthcare equipment businesses in North America, the Asia Pacific, Europe, and Latin America.

The company’s Power and Microwave Technologies Group segment provides engineered solutions, power grid and microwave tubes, and related consumables; high value flat panel detector solutions, replacement parts, tubes and service training for diagnostic imaging equipment; and customized display solutions, as well as power conversion and RF and microwave components for broadcast transmission, CO2 laser cutting, diagnostic imaging, dielectric and induction heating, high energy transfer, high voltage switching, plasma, power conversion, radar, and radiation oncology applications.

Its products are used to control, switch, or amplify electrical power signals, as well as are used as display devices in alternative energy, healthcare, aviation, broadcast, communications, industrial, marine, medical, military, scientific, and semiconductor markets.

The company’s Canvys segment provides custom display solutions, such as touch screens, protective panels, custom enclosures, specialized cabinet finishes, application specific software packages, and certification services to corporate enterprise, financial, healthcare, industrial, and medical original equipment manufacturer markets.

Its Healthcare segment manufactures, refurbishes, and distributes diagnostic imaging replacement parts, including CT and MRI systems and tubes, hydrogen thyratrons, klystrons, and magnetrons; flat panel detector upgrades; and additional replacement solutions. This segment serves hospitals, medical centers, asset management companies, independent service organizations, and multi-vendor service providers.

This stock appears to be either forming a base or a rounding top and traders should consider risk management strategies including stop loss orders if they trade this stock.

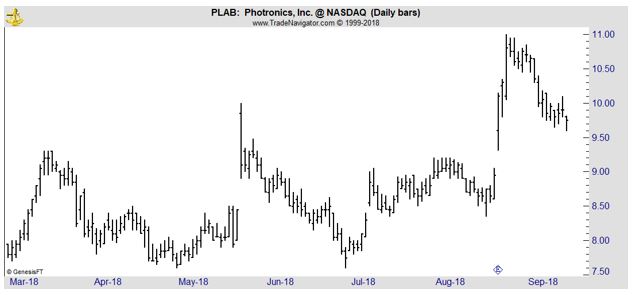

Photronics, Inc. (Nasdaq: PLAB)

Photronics, Inc. manufactures and sells photomasks in Taiwan, Korea, the United States, Europe, and internationally.

It sells its products to semiconductor or FPD designers, manufacturers, and foundries, as well as to other high-performance electronics manufacturers through its sales personnel and customer service representatives.

PLAB appears to be pulling back within an up trend.

Remember, there is no guarantee any stock will increase in value. Also, it is important to remember when we search for stocks using quantitative measures, our goal is to identify stocks that meet those criteria.