Income and an Inflation Hedge, In an Obvious and Overlooked Area

Inflation is a growing concern. The truth is that inflation has been a concern for decades. One of the most significant differences between a typical bout of inflation concerns and the current round is that inflation pressures are building.

The chart below shows the year over year change in the producer price index (PPI) over the past five years. The trend is now clearly up.

Source: Federal Reserve

The PPI measures the average change over time in the selling prices received by domestic producers for their output. The prices included in the PPI are from the first commercial transaction for many products and some services. It’s designed to measure inflationary pressures that are in the pipeline.

With inflation pressures building, many income investors should be increasingly concerned. As inflation rises, interest rates should rise. Higher interest rates should lead to declines in the prices of fixed income investments.

This means investors could be left with the low income associated with investments in low interest rate instruments and declines in the prices of those assets. It’s a significant problem with a loss of both income and principal threatening the portfolios of fixed income investors.

Inflation Hedges Could Benefit Income Investors

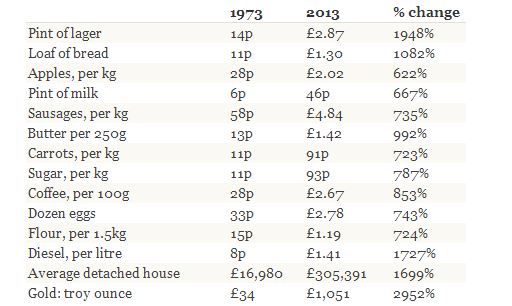

Inflation hedges are generally considered to be assets that can move higher in value as inflation rises. Historically, gold has served as an inflation hedge. That means gains in the price of gold should keep up with the prices of everyday items in the long run. This idea is supported by at least one study.

Source: ZeroHedge

But, gold is speculative in nature in the eyes of many investors. Warren Buffett has been in that camp and made several comments on gold as an investment in his annual letter.

What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis. As “bandwagon” investors join any party, they create their own truth – for a while.” Berkshire Hathaway 2011 Shareholder Letter, p. 18.

Is Buffett right, as he so frequently is? The answer depends on the investor’s perspective. Because gold has little use in industry, there is a speculative component to its price. If an investor is concerned that speculators might abandon gold, they could consider other potential inflation hedges.

Among the potential hedges to consider could be a home. Home prices tend to appreciate about 1% a year, in the long run, after inflation. Home prices also tend to hold up well in stock market downturns.

According to Barron’s, “During the Great Recession, of course, the real estate market collapsed along with stocks. But residential real estate’s performance during the 2007-2009 bear market was anomalous, according to data from Yale University’s Robert Shiller, winner of last year’s Nobel Prize in economics and the co-creator of the Case-Shiller Home-Price Index.

In 14 of the 15 previous U.S. equity bear markets, going back to 1956, the home-price index rose. And in that lone bear market prior to 2007 in which home prices did fall, they did so by just 0.4%.”

However, homes might not be a reasonable investment option for many investors. Many will already own their own home and be reluctant to take on additional costs of home ownership. That doesn’t mean there are no options available to them. They could look at a component of the home.

Lumber is a commodity that is used in home construction. Investors could gain direct exposure to lumber through the futures market. However, futures are a risky investment that many individual investors may not be well suited to trade.

Individual investors could also gain exposure to lumber through real estate investment trusts, or REITs. The investment management firm Invesco recent commented on timer REITs, or REITs that own timber land:

“Timber REITs are currently experiencing strong rates of cash flow acceleration thanks to a strong US economy, improving housing starts and the surging price for timber. Each of the above companies has between 2 million and 12 million acres of working forests across many states, and they can provide wood for use in a variety of markets including lumber, pulp, paper and other wood-based products.4

Bottom line: On the lumber and panel front, we expect housing starts to continue to rise in the next several years as more millennials form new households. This should continue to be supportive of timber REITs.”

A Specific Strategy

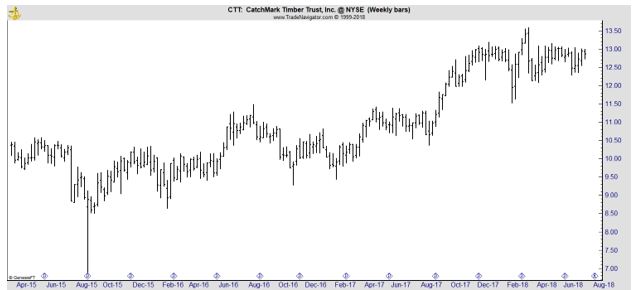

CatchMark Timber Trust, Inc. (NYSE: CTT) is an example of a timberland REIT. This REIT currently yields about 4.2%.

CTT is a self-administered and self-managed real estate company investing in timberlands. The company is engaged in the ownership, management, acquisition and disposition of timberland properties located in the United States.

CTT owns interests in approximately 499,600 acres of timberlands in the United States. Its timberlands included approximately 74% pine stands and 26% hardwood stands. This property generates income which supports the yield.

The stock chart of CTT shows little volatility, meaning the REIT could protect capital in a market downturn. It should deliver gains if lumber rallies as it has recently.

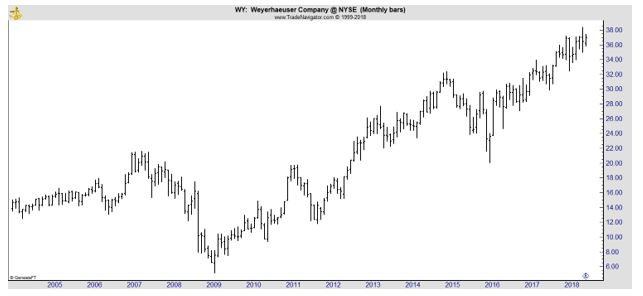

Another alternative to gain access to timber is with an operating company, Weyerhaeuser Company (NYSE: WY), a timber, land and forest products company. WY owns or controls 13.1 million acres of timberlands, primarily in the United States, and manages additional timberlands under long-term licenses in Canada.

The company manages these properties and also manufactures and distributes wood products, including softwood lumber, engineered wood products, structural panels, medium density fiberboard and building materials distribution.

The stock has been among the market leaders since bottoming in 2009.

Rising rates will almost certainly have an impact on income investors. While some may welcome the higher income rising rates will bring, other investors will suffer losses on fixed income investments they already own. Inflation hedges, like timber, could provide wealth protection and income in this environment.

For additional investing tips and products, click here.