2019’s Best Bet In Stocks

The end of the year is often a time for reflection. It is a time to look ahead. Both of those exercises can have value for investors. Reflection allows them to see what worked in the past year while looking ahead is an opportunity to develop a strategy.

For investors, the exercise can be especially useful if they apply momentum strategies in their portfolio.

Momentum investing, according to Investopedia, “involves a strategy to capitalize on the continuance of an existing market trend. It involves going long stocks, futures, or market ETFs showing upward-trending prices and short the respective assets with downward-trending prices.

Momentum investing holds that trends can persist for some time, and it’s possible to profit by staying with the trend until its conclusion. For example, momentum investors that entered the U.S. stock market in 2009 generally enjoyed an uptrend through 2018.

Momentum investing usually involves a strict set of rules based on technical indicators that dictate market entry and exit points for particular securities.

Momentum investors sometimes use two longer-term moving averages, one a bit shorter than the other, for trading signals. Some use 50-day and 200-day moving averages, for example. The 50-day crossing above the 200-day creates a buy signal. A 50-day crossing back below the 200-day creates a sell signal. A few momentum investors prefer to use even longer-term moving averages for signaling purposes.

Another type of momentum investing strategy involves following price-based signals to go long sector ETFs with the strongest momentum, while shorting the sector ETFs with the weakest momentum, then rotating in an out of the sectors accordingly.”

Another way to implement a momentum strategy is simply buy last year’s best performers and hold them for a year. Studies have shown this can be a successful approach to the markets.

Looking Back

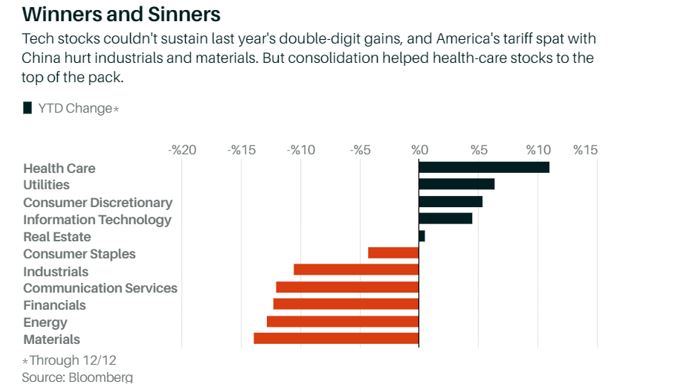

The chart below shows the performance of various sectors in the past year. The chart shows that health care and utilities have been the best performers.

Source: Barron’s

These two sectors are usually considered to be safe havens in a bear market and they have performed well in a difficult year for the stock market.

In MarketWatch.com, Mark Hulbert recently noted that the trend in utilities is not limited to the short term and the sector has been a strong performer over the long term as well:

“Over the last 20 years, for example, the Utilities Select Sector SPDR (NYSE: XLU) has beaten the S&P 500 index by an annualized margin of 6.7% to 6.0%. It’s extraordinary for stocks as conservative as utilities to nevertheless beat the broad market over the long term.”

While utilities have done well in the past, the question is how they look going forward.

A bullish analyst was recently quoted in Forbes explaining that there are misconceptions about utility stocks that investors should consider:

“Despite the persistent belief of many investors that dividend stocks are bond proxies, utility stocks over any meaningful period of time trade in line with their business prospects. And like all companies, they’re affected by the health of the economy and capital markets.

A return to rally mode for the overall stock market would therefore benefit utilities.”

While there are reasons for optimism based on the business prospects,

“Offsetting is the potential headwind of rising interest rates. Over any length of time that’s meaningful for income investors, there’s no real correlation between benchmark interest rates and utility stock returns.”

And, volatility can not be ignored in the sector:

“It also seems obvious that much of the resulting volatility is attributable to money sloshing in and out of giant ETFs, much of it in response to algorithms rather than individual human decisions. And that almost certainly means we can expect more of this kind of action.”

Overall, this analyst believes utilities should be viewed as companies rather than as a defensive asset class that moves independently of the stock market.

Putting Theory to a Test

Other analysts believe utilities are a defensive trade. A defensive investment strategy can be defined as “a conservative method of portfolio allocation and management aimed at minimizing the risk of losing principal.

A defensive investment strategy entails regular portfolio rebalancing to maintain one’s intended asset allocation; buying high-quality, short-maturity bonds and blue-chip stocks; diversifying across both sectors and countries; placing stop loss orders; and holding cash and cash equivalents in down markets.

Such strategies are meant to protect investors against significant losses from major market downturns.”

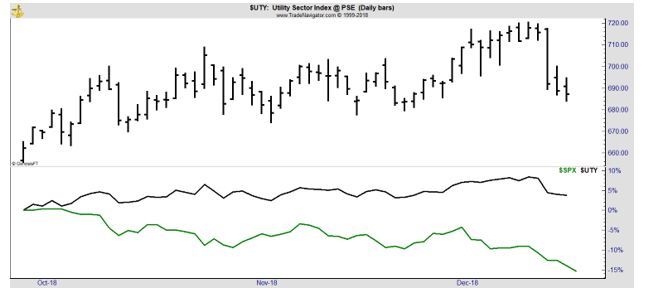

In order to be successful, a defensive strategy should deliver gains as the broad stock market falls. The next chart compares the utility sector index with the S&P 500 since the beginning of October.

This chart shows that utilities have done well since the market decline began, delivering a gain as the S&P 500 index dropped almost 15%.

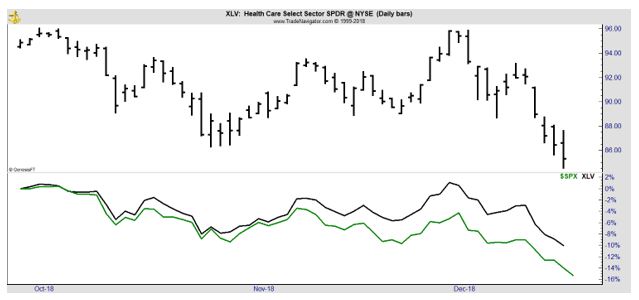

The next chart looks at health care and shows that this sector has lost less than the broad stock market but still shows a loss.

This is a short time period and the performance of the two sectors should be considered as conclusive. But the charts do demonstrate the potential value of utilities in the current stock market.

Yahoo Finance recently posted an analyst’s recommendation as to the best utility stocks. They were:

- American Electric Power (NYSEL AEP): a massive electric utility company that delivers electricity to more than 5 million customers across eleven states. Hotter than normal weather so far in 2018 has buoyed operations for the past several months, and robust economic strength in the company’s core markets has also boosted the business. Overall, sales and earnings are both trending higher at a healthy rate. And the dividend yield on AEP stock is 3.5%.

- Sempra Energy (YSE: SRE) is another one of the industry’s heavyweights is Sempra Energy (NYSE:SRE), the multi-faceted energy company that provides energy services to more than 40 million customers globally across Southern California, Texas, Chile and Peru. The company is continuing its energy diversification efforts by expanding its liquid natural gas (LNG) business, something which the company feels can help fuel sustainable long-term growth. The dividend yield on SRE stock sits right around 3%.

- Duke Energy (NYSE: DUK) also benefitted from unusually hot weather and strengthening economic conditions, Duke’s revenues and earnings are trending consistently higher at a slow and stable rate and offers a 4.5% dividend yield.

- American Water Works Company (NYSE: AWK) provides waters services to 15 million people across 46 states and Canada. That makes American Water the largest and most diverse publicly traded water company and yields 2%.

- NextEra Energy (NYSE: NEE) offers significant long term earnings growth potential based on its role as a leading player in renewable energy and battery storage and offers a 2.6% dividend yield.

Given the current market environment, these could be stocks worth considering.